Description

Vietnam Sub-bituminous Coal Import

Sub-bituminous coal is a lower-rank coal between lignite and bituminous coal. It has a lower degree of carbonization, higher moisture content, and a moderate calorific value. Usually dark brown to black, it is soft and brittle. Compared to bituminous and anthracite coal, sub-bituminous coal has a lower sulfur content, which results in reduced emissions of pollutants upon combustion, making it a relatively more environmentally friendly energy source. Its higher heat value compared to lignite allows it to provide more stable thermal energy during combustion.

Due to its low cost and reduced pollutant emissions, sub-bituminous coal is primarily used in power plants as a fuel to support thermal power generation. It is also commonly used as boiler fuel in industries such as cement production and paper manufacturing. Its moderate heat output makes it suitable for mid- to low-temperature processes requiring steady heat but unsuited for high-temperature metallurgical applications. According to CRI, sub-bituminous coal is widely used in coal-fired power plants for boiler combustion, contributing to power generation. Despite its lower heat value and combustion efficiency compared to bituminous and anthracite coal, the abundant reserves and low cost make sub-bituminous coal significant in the global energy market. Also, less sulfur emissions than bituminous coal makes it applied in countries with higher environment regulations.

The upstream sector for sub-bituminous coal includes coal mining and processing, while downstream industries encompass power, paper, cement, and chemical sectors. Mining typically involves surface or underground extraction, followed by sorting, washing, and processing to meet industrial standards. Equipment designed for large-scale manufacture and suitable technology are usually required. In order to improve combustion efficiency and reduce pollution emissions, modern thermal power plants are usually equipped with advanced combustion control systems and flue gas desulfurization equipment.

Major producers of sub-bituminous coal include Indonesia, Australia, the United States, and China. These countries’ abundant reserves and established mining technologies position them as major global suppliers, with Indonesia being a key exporter due to its low-cost extraction and favorable geographic location, mainly exporting to Southeast Asian countries and India.

Vietnam, while having coal reserves, primarily focuses on anthracite mining. Sub-bituminous coal reserves are limited, creating a high dependency on imports for Vietnam’s market demand. As an economical and relatively environmentally friendly option, sub-bituminous coal is in growing demand in Vietnamese thermal power plants. CRI’s analysis shows that with Vietnam’s rapid industrialization and government initiatives to improve infrastructure and expand the power network, energy demand is on the rise, fueling an increase in sub-bituminous coal imports.

According to CRI, in 2023, Vietnam’s total sub-bituminous coal imports reached approximately USD 1.7 billion. By August 2024, imports had already surpassed USD 1.2 billion, marking year-on-year growth. Key suppliers to Vietnam between 2021 and 2024 included Indonesia, Australia, and Singapore, with primary exporting companies such as SUEK AG, China Huadian Engineering Co., and PT Bayan Resources Tbk. Major importers in Vietnam’s power sector include Nghi Son 2 Power Limited Liability Company, Vinh Tan 4 Thermal Power Plant, and other power plants and supply stations.

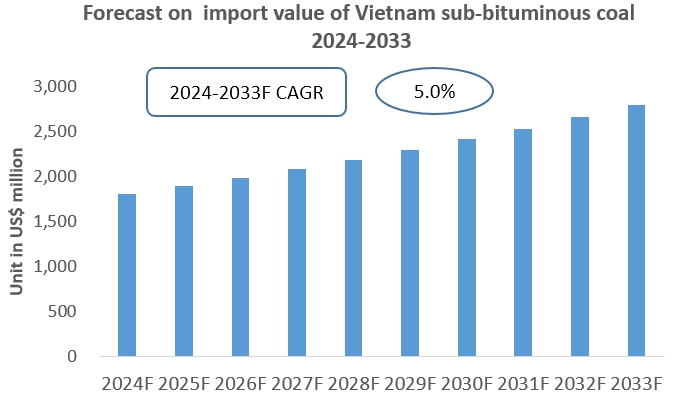

As Vietnam’s economy continues to grow and industrialization progresses, CRI forecasts an expanding sub-bituminous coal market, with imports set to keep rising due to limited domestic production capacity.

Topics covered:

- The Import and Export of Sub-bituminous Coal in Vietnam (2021-2024)

- Total Import Volume and Percentage Change of Sub-bituminous Coal in Vietnam (2021-2024)

- Total Import Value and Percentage Change of Sub-bituminous Coal in Vietnam (2021-2024)

- Total Import Volume and Percentage Change of Sub-bituminous Coal in Vietnam (2024)

- Total Import Value and Percentage Change of Sub-bituminous Coal in Vietnam (2024)

- Average Import Price of Sub-bituminous Coal in Vietnam (2021-2024)

- Top 10 Sources of Sub-bituminous Coal Imports in Vietnam and Their Supply Volume

- Top 10 Suppliers in the Import Market of Sub-bituminous Coal in Vietnam and Their Supply Volume

- Top 10 Importers of Sub-bituminous Coal in Vietnam and Their Import Volume

- How to Find Distributors and End Users of Sub-bituminous Coal in Vietnam

- How Foreign Enterprises Enter the Sub-bituminous Coal Market of Vietnam

- Forecast for the Import of Sub-bituminous Coal in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

1.1 Geography of Vietnam

1.2 Economic Condition of Vietnam

1.3 Demographics of Vietnam

1.4 Domestic Market of Vietnam

1.5 Recommendations for Foreign Enterprises Entering the Vietnam Sub-bituminous Coal Imports Market

2 Analysis of Sub-bituminous Coal Imports in Vietnam (2021-2024)

2.1 Import Scale of Sub-bituminous Coal in Vietnam

2.1.1 Import Value and Volume of Sub-bituminous Coal in Vietnam

2.1.2 Import Prices of Sub-bituminous Coal in Vietnam

2.1.3 Apparent Consumption of Sub-bituminous Coal in Vietnam

2.1.4 Import Dependency of Sub-bituminous Coal in Vietnam

2.2 Major Sources of Sub-bituminous Coal Imports in Vietnam

3 Analysis of Major Sources of Sub-bituminous Coal Imports in Vietnam (2021-2024)

3.1 Indonesia

3.1.1 Analysis of Vietnam’s Sub-bituminous Coal Import Volume and Value from Indonesia

3.1.2 Analysis of Average Import Price

3.2 Australia

3.2.1 Analysis of Vietnam’s Sub-bituminous Coal Import Volume and Value from Australia

3.2.2 Analysis of Average Import Price

3.3 Singapore

3.3.1 Analysis of Vietnam’s Sub-bituminous Coal Import Volume and Value from Singapore

3.3.2 Analysis of Average Import Price

3.4 China

3.5 South Korea

3.6 Germany

4 Analysis of Major Suppliers in the Import Market of Sub-bituminous Coal in Vietnam (2021-2024)

4.1 SUEK AG

4.1.1 Company Introduction

4.1.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.2 CHINA HUADIAN ENGINEERING CO, LTD

4.2.1 Company Introduction

4.2.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.3 PT BAYAN RESOURCES TBK

4.3.1 Company Introduction

4.3.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.4 Exporter 4

4.4.1 Company Introduction

4.4.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.5 Exporter 5

4.5.1 Company Introduction

4.5.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.6 Exporter 6

4.6.1 Company Introduction

4.6.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.7 Exporter 7

4.7.1 Company Introduction

4.7.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.8 Exporter 8

4.8.1 Company Introduction

4.8.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.9 Exporter 9

4.9.1 Company Introduction

4.9.2 Analysis of Sub-bituminous Coal Exports to Vietnam

4.10 Exporter 10

4.10.1 Company Introduction

4.10.2 Analysis of Sub-bituminous Coal Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Sub-bituminous Coal in Vietnam (2021-2024)

5.1 NGHI SON 2 POWER LIMITED LIABILITY COMPANY

5.1.1 Company Introduction

5.1.2 Analysis of Sub-bituminous Coal Imports

5.2 VINH TAN 4 THERMAL POWER PLANT

5.2.1 Company Introduction

5.2.2 Analysis of Sub-bituminous Coal Imports

5.3 NHÀ MÁY NHI?T ?I?N V?NH TÂN 4

5.3.1 Company Introduction

5.3.2 Analysis of Sub-bituminous Coal Imports

5.4 Importer 4

5.4.1 Company Introduction

5.4.2 Analysis of Sub-bituminous Coal Imports

5.5 Importer 5

5.5.1 Company Introduction

5.5.2 Analysis of Sub-bituminous Coal Imports

5.6 Importer 6

5.6.1 Company Introduction

5.6.2 Analysis of Sub-bituminous Coal Imports

5.7 Importer 7

5.7.1 Company Introduction

5.7.2 Analysis of Sub-bituminous Coal Imports

5.8 Importer 8

5.8.1 Company Introduction

5.8.2 Analysis of Sub-bituminous Coal Imports

5.9 Importer 9

5.9.1 Company Introduction

5.9.2 Analysis of Sub-bituminous Coal Imports

5.10 Importer 10

5.10.1 Company Introduction

5.10.2 Analysis of Sub-bituminous Coal Imports

6. Monthly Analysis of Sub-bituminous Coal Imports in Vietnam from 2021 to 2024

6.1 Analysis of Monthly Import Value and Volume

6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Sub-bituminous Coal Imports in Vietnam

7.1 Policy

7.1.1 Current Import Policies

7.1.2 Trend Predictions for Import Policies

7.2 Economic

7.2.1 Market Prices

7.2.2 Growth Trends of Sub-bituminous Coal Production Capacity in Vietnam

7.3 Technology

8. Forecast for the Import of Sub-bituminous Coal in Vietnam, 2024-2033

Reviews

There are no reviews yet.