Description

Vietnam Soap Import

Soap is a type of salt made from fatty acids (and sometimes other carboxylic acids), used for cleaning, lubrication, and other applications. Different soap types, including personal-use soaps, metallic soaps, and resin soaps, serve varied purposes. Personal soap is among the most widely used cleaning agents, while metallic and resin soaps play essential roles in industrial applications.

Soap products come in diverse categories, covering various organic surfactants and their formulations. Typically, soap is produced in solid forms, such as bars, blocks, sheets, or molded pieces, but it also comes in liquid forms. As a household chemical product, soap is used not only for personal and laundry cleaning but also extensively in industrial cleaning, offering functions like washing, degreasing, sanitizing, and skincare. Specialized types include disinfectant soap, medicinal soap, and bleaching soap.

In recent years, Vietnam’s soap market has expanded rapidly due to improving living standards and rising per capita income. Trends in the soap market show an increasing demand for natural, organic, functional, and handcrafted soaps. As a staple consumer product, soap has high and stable demand in Vietnam, with steady growth in market size.

In industrial fields, soap is used to clean, disinfect, and maintain industrial equipment, ensuring a safe and clean production environment. Industries like metal processing, machinery manufacturing, automotive maintenance, textiles, and leather processing widely use soap to remove oils and impurities from workpieces and materials. In the chemical sector, soap often acts as a thickener, lubricant, emulsifier, or catalytic ingredient.

Soap’s upstream industries primarily include chemical raw material suppliers for fatty acids, glycerin, surfactants, plant extracts, fragrances, and colorants. Its downstream industries cover manufacturing, retail, e-commerce, and beauty and personal care. Leading global soap producers and exporters include Procter & Gamble (P&G), Unilever, L’Oréal, and Kao.

Vietnam’s limited domestic soap production capacity makes it partly reliant on imports to meet market demand. According to CRI data, Vietnam imported approximately USD 120 million worth of soap in 2023. In the first half of 2024, soap imports reached USD 67 million, marking a nearly 20% increase from the same period in 2023.

CRI analyzes that Vietnam’s primary soap import sources from 2021-2024 included South Korea, Japan, and Singapore, with major suppliers like GALDERMA S.A., PT Unilever Oleochemical Indonesia, and Johnson & Johnson Consumer Asia Pacific Supply Chain Centre. Key soap importers in Vietnam are companies in beauty, personal care, and household goods sectors, primarily foreign-invested firms, including DKSH Vietnam Co., L’Oréal Vietnam Co., and Galderma Vietnam Co.

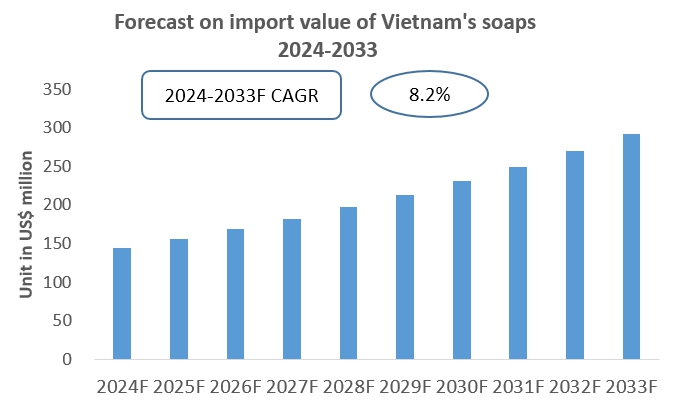

With economic growth, rising income levels, expanding consumer markets, and manufacturing development, Vietnam’s soap market shows significant growth potential. CRI forecasts that soap imports to Vietnam will continue increasing in the coming years as demand rises in both personal and industrial applications.

Topics covered:

- The Import and Export of Soap in Vietnam (2021-2024)

- Total Import Volume and Percentage Change of Soap in Vietnam (2021-2024)

- Total Import Value and Percentage Change of Soap in Vietnam (2021-2024)

- Total Import Volume and Percentage Change of Soap in Vietnam (2024)

- Total Import Value and Percentage Change of Soap in Vietnam (2024)

- Average Import Price of Soap in Vietnam (2021-2024)

- Top 10 Sources of Soap Imports in Vietnam and Their Supply Volume

- Top 10 Suppliers in the Import Market of Soap in Vietnam and Their Supply Volume

- Top 10 Importers of Soap in Vietnam and Their Import Volume

- How to Find Distributors and End Users of Soap in Vietnam

- How Foreign Enterprises Enter the Soap Market of Vietnam

- Forecast for the Import of Soap in Vietnam (2024-2033)

Table of Contents

1 Overview of Vietnam

1.1 Geography of Vietnam

1.2 Economic Condition of Vietnam

1.3 Demographics of Vietnam

1.4 Domestic Market of Vietnam

1.5 Recommendations for Foreign Enterprises Entering the Vietnam Soap Imports Market

2 Analysis of Soap Imports in Vietnam (2021-2024)

2.1 Import Scale of Soap in Vietnam

2.1.1 Import Value and Volume of Soap in Vietnam

2.1.2 Import Prices of Soap in Vietnam

2.1.3 Apparent Consumption of Soap in Vietnam

2.1.4 Import Dependency of Soap in Vietnam

2.2 Major Sources of Soap Imports in Vietnam

3 Analysis of Major Sources of Soap Imports in Vietnam (2021-2024)

3.1 South Korea

3.1.1 Analysis of Vietnam’s Soap Import Volume and Value from South Korea

3.1.2 Analysis of Average Import Price

3.2 Japan

3.2.1 Analysis of Vietnam’s Soap Import Volume and Value from Japan

3.2.2 Analysis of Average Import Price

3.3 Singapore

3.3.1 Analysis of Vietnam’s Soap Import Volume and Value from Singapore

3.3.2 Analysis of Average Import Price

3.4 France

3.5 Malaysia

3.6 Indonesia

4 Analysis of Major Suppliers in the Import Market of Soap in Vietnam (2021-2024)

4.1 GALDERMA S A

4.1.1 Company Introduction

4.1.2 Analysis of Soap Exports to Vietnam

4.2 PT UNILEVER OLEOCHEMICAL INDONESIA

4.2.1 Company Introduction

4.2.2 Analysis of Soap Exports to Vietnam

4.3 JOHNSON & JOHNSON CONSUMER ASIA PACIFIC SUPPLY CHAIN CENTRE

4.3.1 Company Introduction

4.3.2 Analysis of Soap Exports to Vietnam

4.4 Exporter 4

4.4.1 Company Introduction

4.4.2 Analysis of Soap Exports to Vietnam

4.5 Exporter 5

4.5.1 Company Introduction

4.5.2 Analysis of Soap Exports to Vietnam

4.6 Exporter 6

4.6.1 Company Introduction

4.6.2 Analysis of Soap Exports to Vietnam

4.7 Exporter 7

4.7.1 Company Introduction

4.7.2 Analysis of Soap Exports to Vietnam

4.8 Exporter 8

4.8.1 Company Introduction

4.8.2 Analysis of Soap Exports to Vietnam

4.9 Exporter 9

4.9.1 Company Introduction

4.9.2 Analysis of Soap Exports to Vietnam

4.10 Exporter 10

4.10.1 Company Introduction

4.10.2 Analysis of Soap Exports to Vietnam

5 Analysis of Major Importers in the Import Market of Soap in Vietnam (2021-2024)

5.1 DKSH VIETNAM CO, LTD

5.1.1 Company Introduction

5.1.2 Analysis of Soap Imports

5.2 L’OREAL VIETNAM CO, LTD

5.2.1 Company Introduction

5.2.2 Analysis of Soap Imports

5.3 GALDERMA VIETNAM CO, LTD

5.3.1 Company Introduction

5.3.2 Analysis of Soap Imports

5.4 Importer 4

5.4.1 Company Introduction

5.4.2 Analysis of Soap Imports

5.5 Importer 5

5.5.1 Company Introduction

5.5.2 Analysis of Soap Imports

5.6 Importer 6

5.6.1 Company Introduction

5.6.2 Analysis of Soap Imports

5.7 Importer 7

5.7.1 Company Introduction

5.7.2 Analysis of Soap Imports

5.8 Importer 8

5.8.1 Company Introduction

5.8.2 Analysis of Soap Imports

5.9 Importer 9

5.9.1 Company Introduction

5.9.2 Analysis of Soap Imports

5.10 Importer 10

5.10.1 Company Introduction

5.10.2 Analysis of Soap Imports

6. Monthly Analysis of Soap Imports in Vietnam from 2021 to 2024

6.1 Analysis of Monthly Import Value and Volume

6.2 Forecast of Monthly Average Import Prices

7. Key Factors Affecting Soap Imports in Vietnam

7.1 Policy

7.1.1 Current Import Policies

7.1.2 Trend Predictions for Import Policies

7.2 Economic

7.2.1 Market Prices

7.2.2 Growth Trends of Soap Production Capacity in Vietnam

7.3 Technology

8. Forecast for the Import of Soap in Vietnam, 2024-2033

Reviews

There are no reviews yet.