Description

Vietnam Candy Industry

Vietnam, located in the eastern part of the Indochina Peninsula, is the fourth-largest economy in ASEAN. With a total land area of approximately 330,000 square kilometers and a population of about 103 million by the end of 2023, Vietnam has seen rapid economic growth in recent years, leading to increased household incomes and a boost in demand for candy products.

In 2023, Vietnam’s candy sales grew by 6.9% year-on-year, reaching US$ 518 million. According to CRI, Vietnam’s candy industry can be primarily divided into chocolate, hard candy, and soft candy. Soft candy holds the largest market share, with sales reaching US$ 170 million in 2023, up 5.6% year-on-year.

Chocolate is the fastest-growing category, with an average annual growth rate of 8.6% over the past five years, reaching US$ 140 million in 2023, a 7.7% increase from the previous year.

In terms of retail channels, supermarkets remain the primary retail distribution channel for chocolate candy in Vietnam due to their modern storage systems and air-conditioned spaces. Chocolate is challenging to store in Vietnam’s typical high-temperature environment, posing difficulties for traditional grocery stores, which often lack refrigerated display cases or cold chain distribution systems to maintain product integrity during transportation. Supermarkets, typically equipped with air conditioning, are better suited to keep products cool during transit. Additionally, the primary buyers of chocolate candy are affluent urban consumers, who are also the main target market for supermarkets. These consumers value the one-stop shopping experience provided by supermarkets, which can save them time on daily necessities purchases.

In Vietnam’s candy market, the main players in the chocolate and sugar candy segments have little overlap, with each company primarily focusing on its main track. According to CRI, the major players in Vietnam’s chocolate market include Mars Vietnam Co Ltd, Nestlé Vietnam Co Ltd, and Chocolaterie Guylian NV. Key players in the sugar candy market include Perfetti Van Melle Vietnam Ltd and Haiha Confectionery JSC.

After the end of the COVID-19 pandemic, there has been an increased focus on health and wellness, with consumers making more conscious decisions regarding food intake. People are increasingly inclined to choose healthier chocolates, such as dark chocolate with reduced sugar or added nuts and fruits for functional benefits. In the sugar candy market, Vietnamese consumers increasingly prefer the elasticity and soft texture of gummies, jellies, and chewable candies. These products’ soft texture is suitable for children, and by offering products in cute shapes like animals, fruits, or toys, sub-categories like gummies, jellies, and chewable tablets may become more appealing to children, potentially becoming the primary audience for gummies in the future.

Over the next few years, with the continued growth of Vietnam’s economy, the sales of sugar candies are expected to expand further. Product innovation is also likely to stimulate consumer demand, supported by significant investments in marketing and advertising activities by leading companies. However, given the growing health consciousness among Vietnamese consumers, many aim to reduce their daily sugar intake. High sugar diets are well-known to be associated with obesity, diabetes, and other chronic diseases. Increased disposable incomes and higher education levels will drive this shift towards healthier diets, with more affluent and knowledgeable consumers more likely to make informed dietary choices.

Nevertheless, it should be noted that most consumers will continue to seek “reduced sugar” rather than “sugar-free” options, as they do not want to forgo the sweetness of candy. Thus, leading brands in this category are expected to focus on providing lower-sugar products rather than sugar-free ones.

In addition to developing low-sugar candies, there may be a growing demand for functional products with additional health benefits, such as boosting the immune system, enhancing energy levels, or reducing stress. Therefore, ingredients like vitamins, minerals, and herbal extracts are expected to be incorporated into Vietnamese candy products to meet this demand.

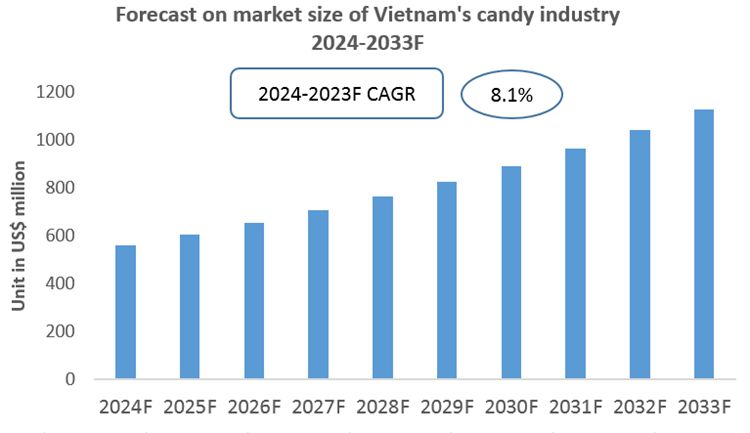

CRI forecasts that Vietnam’s candy industry will continue to grow, with the market size expected to reach US$ 1.13 billion by 2033, with a compound annual growth rate (CAGR) of 8.1% from 2024 to 2033.

Topics covered:

- Overview of Vietnam’s Candy Industry

- Economic Conditions and Policies for Vietnam’s Candy Industry

- How Foreign Investment Enters Vietnam’s Candy Market

- Market Size of Vietnam’s Candy Industry (2019-2023)

- Analysis of Major Candy Manufacturers in Vietnam

- Key Drivers and Market Opportunities in Vietnam’s Candy Industry

- Main Drivers, Challenges, and Opportunities for Vietnam’s Candy Industry during the Forecast Period of 2024-2033

- Expected Revenue for Vietnam’s Candy Market during the Forecast Period of 2024-2033

- Strategies Adopted by Major Market Players to Increase Their Market Share in the Industry

- Which Segment of Vietnam’s Candy Market is Expected to Dominate by 2033?

- Vietnam Candy Market Forecast (2024-2033)

- Main Adverse Factors Facing Vietnam’s Candy Industry

Table of Contents

1. Overview of Vietnam

1.1. Geography

1.2. Demographics of Vietnam

1.3. Economic Conditions of Vietnam

1.4. Minimum Wage in Vietnam (2014-2024)

1.5. Impact of COVID-19 on Vietnam’s Candy Industry

2. Vietnam Candy Industry

2.1. Recent Trends in Vietnam’s Candy Industry

2.2. Policies for Vietnam’s Candy Industry

2.3. Retail Channels

3. Market Size of Vietnam’s Candy Industry

3.1. Chocolate Market Size (2019-2023)

3.2. Hard Candy Market Size (2019-2023)

3.3. Soft Candy Market Size (2019-2023)

4. Import and Export Statistics of Candy in Vietnam

4.1. Import Statistics of Candy in Vietnam

4.1.1. Import of Candy in Vietnam

4.1.2. Main Suppliers of Candy Imports in Vietnam

4.2. Export Statistics of Candy in Vietnam

4.2.1. Export of Candy in Vietnam

4.2.2. Main Destinations of Candy Exports in Vietnam

5. Market Competition Analysis of Vietnam’s Candy Industry

5.1. Barriers to Entry in Vietnam’s Candy Industry

5.1.1. Brand Barriers

5.1.2. Quality Barriers

5.1.3. Capital Barriers

5.2. Competitive Structure of Vietnam’s Candy Industry

5.2.1. Bargaining Power of Raw Material Suppliers

5.2.2. Bargaining Power of Consumers

5.2.3. Competitive Landscape of Vietnam’s Candy Industry

5.2.4. Potential Entrants in the Candy Industry

5.2.5. Substitutes for Candy Products

6. Analysis of Major Candy Brands in Vietnam

6.1. Mars Vietnam Co Ltd

6.1.1. Company Introduction

6.1.2. Main Products

6.2. Perfetti Van Melle Vietnam Ltd

6.2.1. Company Introduction

6.2.2. Main Products

6.3. Haiha Confectionery JSC

6.3.1. Company Introduction

6.3.2. Main Products

6.4. Company 4

6.4.1. Company Introduction

6.4.2. Main Products

6.5. Company 5

6.6. Company 6

6.7. Company 7

6.8. Company 8

6.9. Company 9

6.10. Company 10

6.11. Company 11

6.12. Company 12

7. Outlook for Vietnam’s Candy Industry (2024-2033)

7.1. Future Trends and Influencing Factors

7.1.1. Market Drivers

7.1.2. Market Constraints

7.2. Market Size Forecast

7.3. Import and Export Forecast

List of Charts

Chart Total Population of Vietnam, 2013-2023

Chart GDP Per Capita of Vietnam, 2013-2023

Chart Relevant Policies Issued by the Vietnamese Government for the Candy Industry, 2018-2024

Chart Candy Consumption in Vietnam, 2019-2023

Chart Chocolate Consumption in Vietnam, 2019-2023

Chart Hard Candy Consumption in Vietnam, 2019-2023

Chart Soft Candy Consumption in Vietnam, 2019-2023

Chart Import of Candy in Vietnam, 2019-2023

Chart Main Suppliers of Candy Imports in Vietnam, 2019-2023

Chart Export of Candy in Vietnam, 2019-2023

Chart Main Destinations of Candy Exports in Vietnam, 2019-2023

Chart Market Size Forecast of Vietnam’s Candy Industry, 2024-2033

Chart Import Forecast of Candy in Vietnam, 2024-2033

Chart Export Forecast of Candy in Vietnam, 2024-2033

Reviews

There are no reviews yet.