Description

Vietnam Air Conditioning Industry

A denture, also known as a dental prosthesis, is an auxiliary device that replaces teeth and is generally used to replace teeth that cannot be used properly due to accidents, natural loss or loss of teeth due to aging.

About 30% of Vietnam is located in the tropics, with high temperatures throughout the year and a hot climate, which is suitable for the use of air conditioners. At the same time, Vietnam’s strong economic growth, increased disposable income and higher consumption levels will lead to rapid growth in demand for air conditioners. Currently, the penetration rate of air conditioners in Vietnam is not high, and there is great potential for future development.

Vietnam ranks fifth in the market size of the air conditioner market in the Asia-Pacific region. With several companies investing in Vietnam to set up air conditioner production bases, Vietnam’s air conditioner production is gradually increasing.

According to the analysis of CRI, the CAGR of air conditioner production in Vietnam from 2017-2021 is 22.97%, and the production of air conditioners in Vietnam has been developing rapidly since 2020, with an annual production volume of 890,000 units, an increase of 69.94% year-on-year. in 2021, the number of air conditioners produced in Vietnam exceeds 1 million units, with a total production of 1,033,000 units, an increase of 16.31% year-on-year.

From the demand side, according to the analysis of CRI, the CAGR of demand for air conditioners in Vietnam from 2017-2021 is -0.86%, and there has been a small decline in the demand for air conditioners in the Vietnamese market in recent years.

After a 19.39% growth in demand for air conditioners in Vietnam in 2019, the Vietnamese air conditioner market began to shrink due to the impact of COvid-9, and the demand for air conditioners in Vietnam fell to 1.877 million units in 2021, down 12.82% year-on-year.

In terms of market type, the air conditioning industry can be divided into room air conditioners, ducted air conditioners, ductless air conditioners, and central air conditioners. In the Vietnamese market, room air conditioners dominate and are expected to remain dominant in the coming years. Central air conditioners are expected to be the fastest growing of all types. In terms of applications, residential air conditioners dominate the market and are expected to remain dominant in the coming years; commercial and retail are expected to have a faster growth rate.

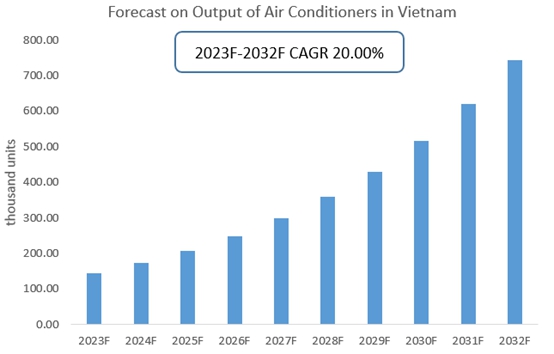

According to CRI, the market size of air conditioning industry will reach US$ 743.38 thousand in 2032 and the CAGR in 2023 to 2032 is 20.0%.

CRI estimates that the Vietnamese air conditioning market will reach $2.4 billion by 2023, with fierce competition from Japanese, Chinese and Korean brands taking a large share of the market and domestic brands dominating the market, including “newcomer” Karofi. The growth of the Vietnamese air conditioner market can be attributed to the fact that the market is growing. The growth of the Vietnamese air conditioning market can be attributed to the growth in tourism and hospitality, the development of energy-efficient air conditioners, the increase in Vietnam’s urban population and rising temperature levels. Increasing disposable income, changing lifestyles, and increasing technological innovations are other factors contributing to the growth of the air conditioning market in the country.

Topics covered:

- Vietnam Air Conditioning Industry Overview

- The economic and policy environment of Vietnam’s air conditioning industry

- What is the impact of COVID-19 on the Vietnamese air conditioning industry?

- Vietnam Air Conditioning Industry Market Size 2023-2032

- Analysis of major Vietnamese air conditioning industry manufacturers

- Key Drivers and Market Opportunities in Vietnam Air Conditioning Industry

- What are the key drivers, challenges and opportunities for the air conditioning industry in Vietnam during the forecast period 2023-2032?

- Which companies are the key players in the Vietnam Air Conditioning Industry market and what are their competitive advantages?

- What is the expected revenue of Vietnam Air Conditioning Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Vietnam air conditioning industry market is expected to dominate the market in 2032?

- What are the main negative factors facing the Vietnamese air conditioning industry?

Table of Contents

1 Overview of Vietnam

1.1 Geographical situation

1.2 Demographic structure of Vietnam

1.3 The economic situation in Vietnam

1.4 Minimum Wage in Vietnam 2013-2022

1.5 Impact of COVID-19 on the construction industry in Vietnam

2 Vietnam Air Conditioning Industry Overview

2.1 History of air conditioning development in Vietnam

2.2 FDI in Vietnam’s air conditioning industry

2.3 Policy environment of Vietnam’s air conditioning industry

3 Vietnam air conditioning industry supply and demand situation

3.1 Vietnam air conditioning industry supply situation

3.2 Vietnam air conditioning industry demand situation

4 Vietnam air conditioning industry import and export status

4.1.1 Vietnam’s air conditioning imports and import value

4.1.2 Vietnam’s main sources of air conditioning imports

4.2 Vietnam air conditioning industry export status

4.2.1 Vietnam’s air conditioner export volume and export value

4.2.2 Vietnam’s main export destinations for air conditioners

5 Cost analysis of Vietnam’s air conditioning industry

6 Vietnam air conditioning industry market competition

6.1 Barriers to entry in Vietnam’s air conditioning industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive structure of Vietnam’s air conditioning industry

6.2.1 Bargaining power of air conditioning suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Vietnam’s air conditioning industry

6.2.4 Potential entrants in the air conditioning industry

6.2.5 Alternatives to air conditioners

7 Analysis of major air conditioner manufacturing companies in Vietnam

7.1 Daikin Industries Ltd.

7.1.1 Company Profile of Daikin Industries Ltd.

7.1.2 Air Conditioner Production and Sales of Daikin Industries Ltd.

7.2 Panasonic Corporation

7.2.1 Panasonic Corporation Corporate Profile

7.2.2 Panasonic Corporation Air Conditioner Production and Sales

7.3 LG Electronics Inc.

7.3.1 LG Electronics Inc Corporate Profile

7.3.2 LG Electronics Inc Air Conditioner Production and Sales

7.4 Samsung Electronics Co.

7.4.1 Samsung Electronics Co., Ltd. Corporate Profile

7.4.2 Samsung Electronics Co., Ltd. Air Conditioner Production and Sales

7.5 Gree Electric Appliances Inc.

7.5.1 Corporate Profile of Gree Electric Appliances Inc.

7.5.2 Gree Electric Appliances Inc. Air Conditioner Production and Sales

7.6 Midea Group Co., Ltd.

7.6.1 Midea Group Co., Ltd. Corporate Profile

7.6.2 Air Conditioner Production and Sales of Midea Group Co.

7.7 Carrier Vietnam Air Conditioning Co.

7.7.1 Carrier Vietnam Air Conditioning Co., Ltd Corporate Profile

7.7.2 Carrier Vietnam Air Conditioning Co., Ltd Air Conditioner Production and Sales

7.8 Sharp Electronics (Vietnam) Co.

7.8.1 Corporate Profile of Sharp Electronics (Vietnam) Co.

7.8.2 Air Conditioner Production and Sales Volume of Sharp Electronics (Vietnam) Co.

7.9 Electrolux

7.9.1 Electrolux Corporate Profile

7.9.2 Electrolux Air Conditioner Production and Sales

7.10 Aqua

7.10.1 Aqua Company Profile

7.10.2 Aqua Air Conditioner Production and Sales

7.11 Reetech

7.11.1 Reetech Corporate Profile

7.11.2 Reetech Air Conditioner Production and Sales

8 Vietnam Air Conditioning Industry Outlook 2023-2032

8.1 Vietnam air conditioning industry development factors analysis

8.1.1 Drivers and Development Opportunities for Vietnam’s Air Conditioning Industry

8.1.2 Threats and challenges to Vietnam’s air conditioning industry

8.2 Vietnam air conditioning industry supply forecast

8.3 Vietnam Air Conditioner Market Demand Forecast

8.4 Import and export forecast for Vietnam’s air conditioning industry

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.