Description

Southeast Asia Tile Industry

Tile is a building and decorative material formed by grinding, mixing, pressing, glazing and sintering of refractory metal oxides and semi-metallic oxides. With beautiful appearance and durable texture, tiles are mainly used for covering floors and walls, as well as in kitchens and showers.

According to CRI’s analysis, with the economic development of Southeast Asian countries, the government continues to increase investment in public infrastructure, industrial facilities and residential construction, and the level of urbanization is gradually increasing, driving the development of Southeast Asia’s construction and building materials industry.

In Vietnam, for example, in 2022, 8,593 new enterprises were established in the real estate sector, up 13.7% year-on-year, and the total volume of apartments and single-family houses reached 150,000 units, with a much higher market absorption capacity than in 2021. Tile is one of the most used materials in building decoration, and the development of the real estate industry is driving up the market demand for tile in Vietnam.

There are differences in the degree of development of Southeast Asian tile industry in different countries. According to the analysis of CRI, some Southeast Asian countries have a large scale of tile manufacturing industry. For example, Vietnam is one of the world’s largest tile exporters, with products exported to many countries such as Japan, the United States, Australia, Thailand and Cambodia. Vietnam’s tile market is more fragmented and competitive. Taicera Enterprise Company, Toko Vietnam Co. Ltd, Prime Group and Bach Thanh Ceramic Co. Ltd are some of the larger tile companies in Vietnam’s tile market.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

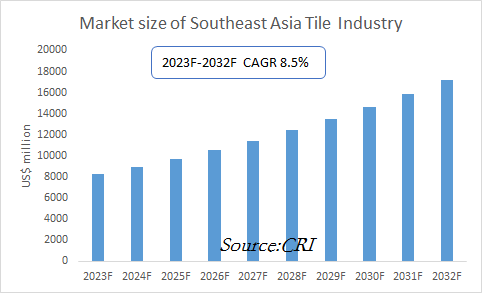

CRI expects the Southeast Asian tile industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Tile Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Tile Industry?

- Which Companies are the Major Players in Southeast Asia Tile Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Tile Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Tile Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Tile Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Tile Industry Market?

- Which Segment of Southeast Asia Tile Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Tile Industry?

Table of Contents

1 Singapore Tile Industry Analysis

1.1 Singapore’s Tile Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Tile Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.2.3 Imports and Exports

1.3 Analysis of Major Tile Manufacturing and Trading Companies in Singapore

2 Thailand Tile Industry Analysis

2.1 Thailand Tile Industry Development Environment

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Tile Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.2.3 Import and Export

2.3 Analysis of Major Tile Manufacturers and Traders in Thailand

3 Analysis of the Philippine Tile Industry

3.1 Philippine Tile Industry Development Environment

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Tile Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.2.3 Imports and Exports

3.3 Analysis of Major Tile Manufacturing and Trading Companies in the Philippines

4 Malaysia Tile Industry Analysis

4.1 Malaysia Tile Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Tile Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.2.3 Import and Export

4.3 Analysis of Major Tile Manufacturers and Traders in Malaysia

5 Indonesia Tile Industry Analysis

5.1 Indonesia Tile Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Tile Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.2.3 Import and Export

5.3 Analysis of Major Tile Manufacturers and Traders in Indonesia

6 Vietnam Tile Industry Analysis

6.1 Development Environment of Vietnam’s Tile Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Tile Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.2.3 Import and Export

6.3 Analysis of Major Tile Manufacturers and Traders in Vietnam

7 Myanmar Tile Industry Analysis

7.1 Development Environment of Myanmar Tile Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Tile Industry Operation in 2023-2032

7.2.1 Supply

7.2.2 Demand

7.2.3 Import and Export

7.3 Analysis of Major Tile Manufacturers and Traders in Myanmar

8 Brunei Tile Industry Analysis

8.1 Brunei Tile Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Tile Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.2.3 Import and Export

8.3 Brunei Major Tile Manufacturing and Trading Companies Analysis

9 Analysis of Lao Tile Industry

9.1 Development Environment of Lao Tile Industry

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Lao Tile Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.2.3 Import and Export

9.3 Analysis of Major Tile Manufacturers and Traders in Laos

10 Analysis of Cambodia’s Tile Industry

10.1 Development Environment of Cambodia Tile Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Tile Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.2.3 Import and Export

10.3 Analysis of Major Tile Manufacturing and Trading Companies in Cambodia

11 Southeast Asia Tile Industry Outlook 2023-2032

11.1 Southeast Asia Tile Industry Development Influencing Factors Analysis

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Supply Analysis of Southeast Asian Tile Industry 2023-2032

11.3 Southeast Asia Tile Industry Demand Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Tile Industry

Reviews

There are no reviews yet.