Description

Southeast Asia Rare-Earth Element Industry

Rare-earth elements, also known as rare earth metals, are a synthesis of a total of 17 metallic chemical elements in the scandium, yttrium and lanthanide families of group III on the periodic table. Rare-earth elements are all soft, silvery-white metals with very similar chemical properties to each other, and are mostly found in deposits in symbiosis between two or two, making them difficult to separate and extract. Rare-earth elements have diverse and extensive applications in electrical and electronic components, lasers, glass, magnets, industrial and chemical catalysts, etc.

In the context of global carbon neutrality, the new energy vehicle industry is booming. According to CRI analysis, as the global industry chain gradually shifts to Southeast Asia, the demand for rare-earth elements in Southeast Asia is growing, and the rare-earth elements industry in Southeast Asia is developing rapidly. Data from the U.S. Geological Survey shows that from the global reserves, Vietnam’s rare earth resources reserves was 22 million tons in 2021, ranking second in the world; from the global production, Myanmar’s rare earth production was 26,000 tons in 2021, ranking third in the world, while Thailand’s rare earth production was raised from 1,000 tons in 2018 to 8,000 tons in 2021, with a compound annual growth rate of 100%.

There are some disparities in the degree of development of rare-earth element industry in Southeast Asia in different countries. According to CRI’s analysis, the development level of rare-earth element industry in some Southeast Asian countries is high. The Lynas plant in Malaysia is one of the world’s largest rare earth separation plants, processing Mt Weld concentrate and producing separated rare-earth oxides for sale to the Japanese, Chinese, European and North American markets. In contrast, Vietnam’s rare-earth industry is relatively small. Although Vietnam is rich in rare-earth element deposits, only 400 tons of rare earths were mined in 2021, and its broad development prospects have attracted companies from Japan, South Korea, Australia and other countries to invest in Vietnam.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

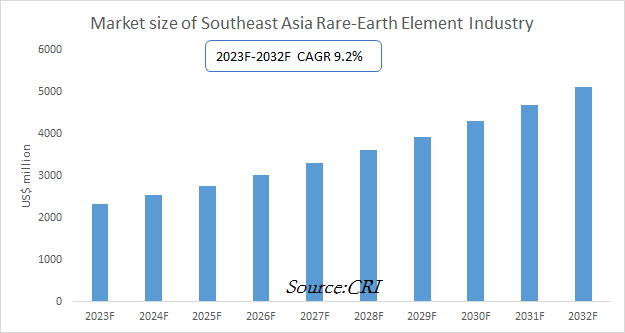

CRI expects the Southeast Asian rare-earth element industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Rare-Earth Element Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Rare-Earth Element Industry?

- Which Companies are the Major Players in Southeast Asia Rare-Earth Element Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Rare-Earth Element Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Rare-Earth Element Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Rare-Earth Element Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Rare-Earth Element Industry Market?

- Which Segment of Southeast Asia Rare-Earth Element Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Rare-Earth Element Industry?

Table of Contents

1 Singapore Rare-Earth Elements Industry Analysis

1.1 Singapore Rare-Earth Elements Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Rare-Earth Elements Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.2.3 Import and Export

1.3 Analysis of Major Rare-Earth Elements Producers and Traders in Singapore

2 Analysis of Thailand Rare-Earth Elements Industry

2.1 Development Environment of Rare-Earth Elements Industry in Thailand

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Rare-Earth Elements Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.2.3 Import and Export

2.3 Analysis of Major Rare-Earth Elements Producers and Traders in Thailand

3 Analysis of Rare-Earth Elements Industry in the Philippines

3.1 Development Environment of Rare-Earth Elements Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Rare-Earth Elements Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.2.3 Import and Export

3.3 Analysis of Major Rare-Earth Elements Producers and Traders in the Philippines

4 Analysis of Rare-Earth Elements Industry in Malaysia

4.1 Malaysia Rare-Earth Elements Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Rare-Earth Elements Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.2.3 Import and Export

4.3 Analysis of Major Rare-Earth Elements Producers and Traders in Malaysia

5 Indonesia Rare-Earth Elements Industry Analysis

5.1 Indonesia Rare-Earth Elements Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Indonesia Minimum Wage

5.2 Indonesia Rare-Earth Elements Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.2.3 Import and Export

5.3 Analysis of Major Rare-Earth Elements Producers and Traders in Indonesia

6 Vietnam Rare-Earth Elements Industry Analysis

6.1 Vietnam Rare-Earth Elements Industry Development Environment

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Rare-Earth Elements Industry Operation in 2023-2032

6.2.1 Supply

6.2.2 Demand

6.2.3 Import and Export

6.3 Analysis of Major Rare-Earth Elements Producers and Traders in Vietnam

7 Myanmar Rare-Earth Elements Industry Analysis

7.1 Development Environment of Myanmar Rare-Earth Elements Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Rare-Earth Elements Industry Operation in 2023-2032

7.2.1 Supply

7.2.2 Demand

7.2.3 Import and Export

7.3 Analysis of Major Rare-Earth Elements Producers and Traders in Myanmar

8 Brunei Rare-Earth Elements Industry Analysis

8.1 Brunei Rare-Earth Elements Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Rare-Earth Elements Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.2.3 Import and Export

8.3 Brunei Major Rare-Earth Elements Producers and Traders Analysis

9 Analysis of Rare-Earth Elements Industry in Laos

9.1 Development Environment of Rare-Earth Elements Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Rare-Earth Elements Industry Operation in Laos 2023-2032

9.2.1 Supply

9.2.2 Demand

9.2.3 Import and Export

9.3 Analysis of Major Rare-Earth Elements Producers and Traders in Laos

10 Cambodia Rare-Earth Elements Industry Analysis

10.1 Development Environment of Rare-Earth Elements Industry in Cambodia

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Rare-Earth Elements Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.2.3 Import and Export

10.3 Analysis of Major Rare-Earth Elements Producers and Traders in Cambodia

11 Southeast Asia Rare-Earth Elements Industry Outlook 2023-2032

11.1 Southeast Asia Rare-Earth Elements Industry Development Influencing Factors Analysis

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Rare-Earth Elements Industry Supply Analysis 2023-2032

11.3 Southeast Asia Rare-Earth Elements Industry Demand Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Rare-Earth Elements Industry

Reviews

There are no reviews yet.