Description

Southeast Asia Laundry Detergent Industry

The climate in Southeast Asia is hot, humid and rainy, while the population base in Southeast Asia is large, mostly multi-population families, and clothes need to be washed frequently and in large quantities. With the rapid development of Southeast Asia’s economy and the improvement of living standards, the penetration rate of household appliances such as washing machines has gradually increased, and the demand for laundry detergents such as washing powder or laundry detergent has also grown, driving the development of Southeast Asia’s laundry industry.

The promising laundry detergent industry in Southeast Asia has attracted multinational companies such as Unilever and P&G to layout the Southeast Asian market. In Vietnam, for example, Unilever and P&G have occupied a major market share in the Vietnamese laundry detergent industry, and OMO is the highest-selling laundry detergent brand in the Vietnamese market. Vietnam’s local laundry detergent brands are late to enter the market, but are gradually increasing their market share. In addition, detergent brands from some Asian countries, such as China and Japan, have entered or are entering the Chinese market.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

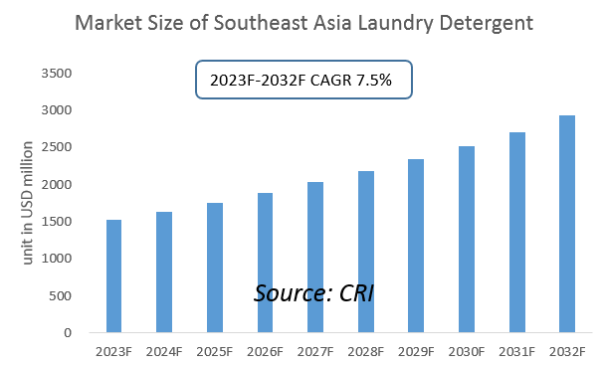

CRI expects the Southeast Asian laundry detergent industry to maintain growth from 2023-2032.

Topics covered:

- Southeast Asia Laundry Detergent Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Laundry Detergent Industry?

- Which Companies are the Major Players in Southeast Asia Laundry Detergent Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Laundry Detergent Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Laundry Detergent Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Laundry Detergent Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Laundry Detergent Industry Market?

- Which Segment of Southeast Asia Laundry Detergent Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Laundry Detergent Industry?

Table of Contents

1 Singapore Laundry Detergent Industry Analysis

1.1 Development Environment of Singapore’s Laundry Detergent Industry

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Laundry Detergent Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.2.3 Import and Export Situation

1.3 Analysis of Major Laundry Detergent Manufacturing and Sales Companies in Singapore

2 Analysis of the Thai Laundry Detergent Industry

2.1 Development Environment of Thailand’s Laundry Detergent Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Laundry Detergent Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.2.3 Import and Export Status

2.3 Analysis of Major Laundry Detergent Manufacturers and Sales Companies in Thailand

3 Analysis of the Philippine Laundry Detergent Industry

3.1 Development Environment of the Philippine Laundry Detergent Industry

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Laundry Detergent Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.2.3 Import and Export Situation

3.3 Analysis of Major Laundry Detergent Manufacturing and Sales Companies in the Philippines

4 Analysis of the Malaysian Laundry Detergent Industry

4.1 Development Environment of the Malaysian Laundry Detergent Industry

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Laundry Detergent Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.2.3 Import and Export Status

4.3 Analysis of Major Laundry Detergent Manufacturing and Sales Companies in Malaysia

5 Analysis of the Indonesian Laundry Detergent Industry

5.1 Development Environment of Indonesia Laundry Detergent Industry

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Laundry Detergent Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.2.3 Import and Export Status

5.3 Analysis of Major Laundry Detergent Manufacturers and Sales Companies in Indonesia

6 Analysis of Vietnam’s Laundry Detergent Industry

6.1 Development Environment of Vietnam’s Laundry Detergent Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Laundry Detergent Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.2.3 Import and Export Situation

6.3 Analysis of Major Laundry Detergent Manufacturing and Sales Companies in Vietnam

7 Analysis of Myanmar’s laundry detergent industry

7.1 Development Environment of Myanmar’s Laundry Detergent Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Clothes Detergent Industry Operation in 2023-2032

7.2.1 Supply

7.2.2 Demand

7.2.3 Import and Export Situation

7.3 Analysis of Major Laundry Detergent Manufacturing and Sales Companies in Myanmar

8 Analysis of Brunei’s Laundry Detergent Industry

8.1 Development Environment of Brunei Laundry Detergent Industry

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Laundry Detergent Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.2.3 Import and Export Status

8.3 Brunei Major Laundry Detergent Manufacturing and Sales Companies Analysis

9 Analysis of the Laundry Detergent Industry in Laos

9.1 Development Environment of the Laundry Detergent Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Laundry Detergent Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.2.3 Import and Export Situation

9.3 Laos Major Laundry Detergent Manufacturing and Sales Companies Analysis

10 Analysis of the Cambodian Laundry Detergent Industry

10.1 Development Environment of Cambodian Laundry Detergent Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Laundry Detergent Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.2.3 Import and Export Situation

10.3 Analysis of Major Clothing Detergent Manufacturers and Sales Companies in Cambodia

11 Southeast Asia Laundry Detergent Industry Outlook 2023-2032

11.1 Analysis of Factors Influencing the Development of the Southeast Asia Laundry Detergent Industry

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Laundry Detergent Industry Revenue Forecast 2023-2032

11.3 Southeast Asia Laundry Detergent Industry Demand Analysis 2023-2032

11.4 Impact of COVID-19 Outbreak on the Laundry Detergent Industry

Reviews

There are no reviews yet.