Description

Southeast Asia Insurance Industry

Insurance is a major form of risk management and can be divided into two categories, property insurance and personal insurance, depending on the object of the insurance. The booming economy of Southeast Asia has driven the expansion of its insurance industry. Although the overall development of insurance in Southeast Asia has also been rapid in recent years, there are great differences in the speed and stage of development among countries.

Singapore has a developed economy, a mature and large insurance market, and a regulatory system that is well aligned with international standards. While Myanmar, Cambodia and Laos, which are economically backward countries, have very low insurance coverage, and the depth and density of insurance are at a low level. The insurance industry in the rest of the countries is at a certain stage of development.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

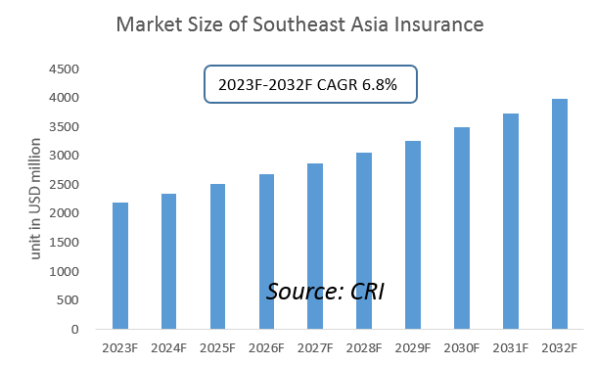

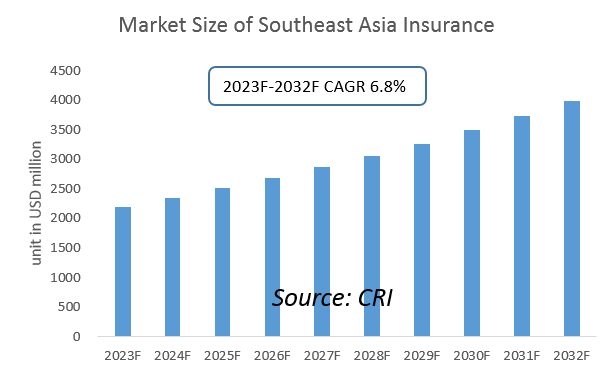

With the huge potential for economic growth, gradual increase in disposable income, expansion of the middle class and rising insurance awareness, the Southeast Asian insurance market faces a promising future. CRI expects the insurance industry in Southeast Asia to maintain growth from 2023-2032.

Topics covered:

-

- What is the current status of the insurance industry in Southeast Asia from 2018-2022 and what has been the impact of COVID-19 on it?

The insurance industry in Southeast Asia has been experiencing steady growth in recent years, driven by various factors such as increasing income levels, growing awareness of the importance of insurance, and adoption of digital technologies. However, the outbreak of COVID-19 has resulted in significant challenges for insurers, including increased claims and disruptions in operations. Nevertheless, the pandemic has also highlighted the need for insurance to mitigate unforeseen risks and events.

- Who are the major players in the Southeast Asia insurance industry and what are their competitive benchmarks?

Major players in the Southeast Asia insurance industry include AIA, Prudential, Allianz, and Great Eastern, among others. These companies compete based on several factors such as pricing, product range, customer service, and distribution channels.

- What are the key drivers and market opportunities for the insurance industry in Southeast Asia?

Key drivers of growth in the Southeast Asia insurance industry include the growing middle class, increasing demand for insurance products, adoption of digital technologies, and focus on sustainability and ESG factors. Market opportunities include demand for health and protection insurance products, potential partnerships with fintech companies, and expansion into underserved markets.

- What are the key drivers, challenges, and opportunities facing the Southeast Asia insurance industry from 2023-2032?

The Southeast Asia insurance industry is expected to experience growth from 2023-2032 driven by factors such as increasing demand in emerging markets, digital technologies, and focus on ESG factors. Challenges include addressing the protection gap and adapting to changing consumer preferences. Opportunities include increased demand for health and protection insurance products, partnerships with tech companies, and expansion into underserved markets.

- What is the expected revenue of the Southeast Asia insurance industry from 2023-2032?

It will depend on various factors such as regulatory changes, technological advancements, and economic growth.

- What strategies are key players using to increase their market share in the industry?

Key players in the industry are expanding product range, investing in digital technologies, forming partnerships with fintech companies, and expanding into underserved markets.

- What are the competitive advantages of major players in the Southeast Asia insurance industry?

Major players have competitive advantages such as strong brand recognition, ability to offer a wide range of products and services, and investment in digital technologies to improve customer experience and operational efficiency.

- Which segment of the Southeast Asia insurance industry is expected to dominate the market in 2032?

Given that the market is still evolving, and there are many different segments and sub-segments within the industry.

- What are the major adverse factors facing the Southeast Asia insurance industry?

Major adverse factors facing the Southeast Asia insurance industry include rising competition from new entrants, increasing regulatory requirements, potential for increased claims due to natural disasters, changing consumer preferences, and behaviors.

Related reports:

- Malaysia Insurance Industry Research Report 2023-2032

- Vietnam Insurance Industry Research Report 2023-2032

- Indonesia Insurance Industry Research Report 2023-2032

Table of Contents

1 Analysis of the Insurance Industry in Singapore

1.1 Singapore Insurance Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Insurance Industry Operation in Singapore 2023-2032

1.2.1 Personal Insurance

1.2.2 Property Insurance

1.3 Analysis of Major Insurance Companies in Singapore

2 Analysis of Thailand’s Insurance Industry

2.1 Development Environment of Thailand Insurance Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Insurance Industry Operation 2023-2032

2.2.1 Personal Insurance

2.2.2 Property Insurance

2.3 Analysis of Major Insurance Companies in Thailand

3 Analysis of the Insurance Industry in the Philippines

3.1 Development Environment of the Insurance Industry in the Philippines

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Insurance Industry Operation 2023-2032

3.2.1 Personal Insurance

3.2.2 Property Insurance

3.3 Analysis of Major Insurance Companies in the Philippines

4 Analysis of the Malaysian Insurance Industry

4.1 Malaysia Insurance Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysian Insurance Industry Operation 2023-2032

4.2.1 Personal Insurance

4.2.2 Property Insurance

4.3 Analysis of Major Insurance Companies in Malaysia

5 Indonesia Insurance Industry Analysis

5.1 Indonesia Insurance Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Insurance Industry Operation 2023-2032

5.2.1 Personal Insurance

5.2.2 Property Insurance

5.3 Analysis of Major Insurance Companies in Indonesia

6 Vietnam Insurance Industry Analysis

6.1 Development Environment of Vietnam Insurance Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Insurance Industry Operation 2023-2032

6.2.1 Personal Insurance

6.2.2 Property Insurance

6.3 Analysis of Major Insurance Companies in Vietnam

7 Analysis of Myanmar Insurance Industry

7.1 Development Environment of Myanmar Insurance Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Insurance Industry Operation 2023-2032

7.2.1 Personal Insurance

7.2.2 Property Insurance

7.3 Analysis of Major Insurance Companies in Myanmar

8 Analysis of Brunei’s Insurance Industry

8.1 Brunei Insurance Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Insurance Industry Operation 2023-2032

8.2.1 Personal Insurance

8.2.2 Property Insurance

8.3 Analysis of Major Insurance Companies in Brunei

9 Analysis of the Insurance Industry in Laos

9.1 Development Environment of the Insurance Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Insurance Industry Operation 2023-2032

9.2.1 Personal Insurance

9.2.2 Property Insurance

9.3 Analysis of Major Insurance Companies in Laos

10 Analysis of Cambodia’s Insurance Industry

10.1 Development Environment of Cambodia’s Insurance Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Insurance Industry Operation 2023-2032

10.2.1 Personal Insurance

10.2.2 Property Insurance

10.3 Analysis of Major Insurance Companies in Cambodia

11 Southeast Asia Insurance Industry Outlook 2023-2032

11.1 Analysis of Factors Affecting the Development of Insurance Industry in Southeast Asia

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Insurance Industry Size Forecast 2023-2032

11.3 Impact of COVID -19 Epidemic on Insurance Industry

Reviews

There are no reviews yet.