Description

Southeast Asia Glass Industry

Glass is a transparent, brittle, impermeable, and hard material. Glass is chemically inert in the daily environment and is a common industrial material. According to the difference of glass production process and materials, glass can be divided into more than ten categories such as reinforced glass, laminated glass, dimming glass, self-cleaning glass, embossed glass, etc., which are used in different fields.

There are some differences in the degree of development of the glass industry in Southeast Asia in different countries. According to CRI’s analysis, the glass industry in some Southeast Asian countries is more developed. For example, Indonesia’s glass industry has developed rapidly in recent years, thanks to Indonesia’s strong growth in the construction industry and the automotive industry, Indonesia’s glass market industry scale gradually expanded.

In the construction industry, for example, glass is often used in the curtain wall of buildings, doors, windows, escalator stopper, etc. Indonesia has a large population and to meet the growing population, Indonesia builds about 720,000- 760,000 new housing units every year, but there is still a shortage of about 160,000- 200,000 housing units. The huge construction projects make the demand for glass in Indonesia grow.

Southeast Asian countries have abundant labor and lower production costs, attracting global glass manufacturers to gradually shift their production capacity to the region. According to CRI’s analysis, as early as 1986, glass giant AGC established a joint venture in Indonesia, PT Asahimas, which has become the largest float glass producer in Indonesia with an annual production capacity of 720,000 tons. In 2021, Korean glass producer KCC Glass Group started construction of a float glass production plant in Indonesia and plans to put it into operation in 2024, with an expected annual production capacity of 438,000 tons.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

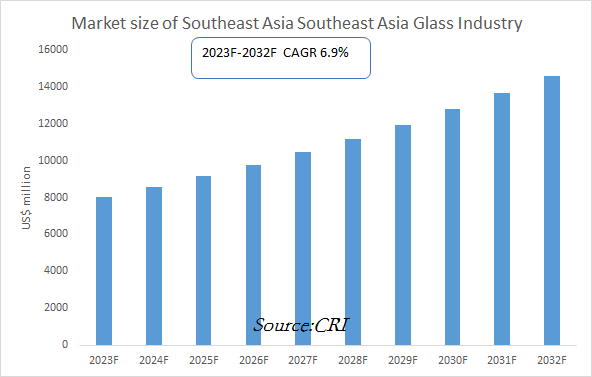

CRI expects the Southeast Asian glass industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Glass Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Glass Industry?

- Which Companies are the Major Players in Southeast Asia Glass Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Glass Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Glass Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Glass Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Glass Industry Market?

- Which Segment of Southeast Asia Glass Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Glass Industry?

Table of Contents

1 Singapore Glass Industry Analysis

1.1 Singapore Glass Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Glass Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.2.3 Imports and Exports

1.3 Analysis of Major Glass Producers and Traders in Singapore

2 Analysis of Thailand’s Glass Industry

2.1 Development Environment of Thai Glass Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Glass Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.2.3 Import and Export

2.3 Analysis of Major Glass Producers and Traders in Thailand

3 Analysis of the Philippine Glass Industry

3.1 Development Environment of Philippine Glass Industry

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Glass Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.2.3 Imports and Exports

3.3 Analysis of Major Glass Producers and Traders in the Philippines

4 Malaysia Glass Industry Analysis

4.1 Malaysia Glass Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Glass Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.2.3 Import and Export

4.3 Analysis of Major Glass Producers and Traders in Malaysia

5 Indonesia Glass Industry Analysis

5.1 Indonesia Glass Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Glass Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.2.3 Imports and Exports

5.3 Analysis of Major Glass Producers and Traders in Indonesia

6 Vietnam Glass Industry Analysis

6.1 Development Environment of Vietnam Glass Industry

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Glass Industry Operation in 2023-2032

6.2.1 Supply

6.2.2 Demand

6.2.3 Import and Export

6.3 Analysis of Major Glass Producers and Traders in Vietnam

7 Analysis of Myanmar Glass Industry

7.1 Development Environment of Myanmar Glass Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Glass Industry Operation in 2023-2032

7.2.1 Supply

7.2.2 Demand

7.2.3 Import and Export

7.3 Analysis of Major Glass Producers and Traders in Myanmar

8 Brunei Glass Industry Analysis

8.1 Brunei Glass Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Glass Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.2.3 Imports and Exports

8.3 Analysis of Brunei’s Major Glass Producers and Traders

9 Analysis of the Lao Glass Industry

9.1 Development Environment of Lao Glass Industry

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Lao Glass Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.2.3 Imports and Exports

9.3 Analysis of Major Glass Producers and Traders in Laos

10 Analysis of the Glass Industry in Cambodia

10.1 Development Environment of Cambodian Glass Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Glass Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.2.3 Import and Export

10.3 Analysis of Major Glass Producers and Traders in Cambodia

11 Southeast Asia Glass Industry Outlook 2023-2032

11.1 Analysis of Factors Affecting the Development of Southeast Asian Glass Industry

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Supply Analysis of Southeast Asian Glass Industry 2023-2032

11.3 Southeast Asia Glass Industry Demand Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Glass Industry

Reviews

There are no reviews yet.