Description

Southeast Asia Frozen Food Industry

As Southeast Asia’s economy develops, urbanization continues, the pace of daily life of residents accelerates, and the population of working women gradually increases, the demand for frozen foods in Southeast Asia is expanding day by day. At the same time, the increased penetration of mobile Internet has also driven the booming development of e-commerce, providing consumers with more channels to purchase quality frozen foods.

Southeast Asia Frozen Food Industry has a large gap between different countries, which is reflected in the different production, transportation and storage capacities of frozen food, different penetration rates of refrigerators, and differences in the scale of the frozen food industry in Southeast Asia. For example, Thailand’s frozen food industry is growing rapidly and is rated as one of the “most promising industries in 2023” by the Ministry of Commerce of Thailand.

In 2022, 99 new companies were registered in Thailand’s frozen food industry, an 87% increase year-on-year, bringing the total number of frozen food companies to 838, of which about 90% are small enterprises. To promote the development of Thailand’s frozen food industry, the government has also developed policies and safety standards to enhance international and local consumer confidence in the safety and quality of Thai frozen food products.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021. The most economically advanced countries in Southeast Asia do not have a set minimum wage, with the actual minimum wage exceeding US$400/month (for foreign maids), while the lowest minimum wage level in Myanmar is only about US$93/month.

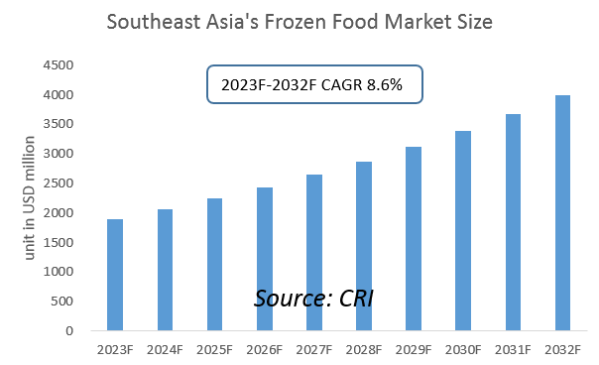

CRI expects the market size of the frozen food industry in Southeast Asia to continue to grow from 2023-2032, fueled by export demand and driven by local consumption.

Topics covered:

- Southeast Asia Frozen Food Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Frozen Food Industry?

- Which Companies are the Major Players in Southeast Asia Frozen Food Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Frozen Food Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Frozen Food Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Frozen Food Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Frozen Food Industry Market?

- Which Segment of Southeast Asia Frozen Food Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Frozen Food Industry?

Table of Contents

1 Singapore Frozen Food Industry Analysis

1.1 Singapore Frozen Food Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Frozen Food Industry Operation 2023-2032

1.2.1 Supply

1.2.2 Demand

1.2.3 Import and Export Situation

1.3 Analysis of Major Frozen Food Manufacturers and Traders in Singapore

2 Analysis of the Frozen Food Industry in Thailand

2.1 Development Environment of Thailand Frozen Food Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Frozen Food Industry Operation 2023-2032

2.2.1 Supply

2.2.2 Demand

2.2.3 Import and Export Situation

2.3 Analysis of Major Frozen Food Production and Trading Companies in Thailand

3 Analysis of the Philippine Frozen Food Industry

3.1 Philippine Frozen Food Industry Development Environment

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Frozen Food Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.2.3 Import and Export Situation

3.3 Analysis of Major Frozen Food Production and Trading Companies in the Philippines

4 Analysis of Frozen Food Industry in Malaysia

4.1 Malaysia Frozen Food Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Frozen Food Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.2.3 Import and Export Situation

4.3 Analysis of Major Frozen Food Production and Trading Companies in Malaysia

5 Indonesia Frozen Food Industry Analysis

5.1 Indonesia Frozen Food Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Frozen Food Industry Operation 2023-2032

5.2.1 Supply

5.2.2 Demand

5.2.3 Import and Export Situation

5.3 Analysis of Major Frozen Food Production and Trading Companies in Indonesia

6 Analysis of Vietnam Frozen Food Industry

6.1 Development Environment of Frozen Food Industry in Vietnam

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Frozen Food Industry Operation 2023-2032

6.2.1 Supply

6.2.2 Demand

6.2.3 Import and Export Situation

6.3 Analysis of Major Frozen Food Production and Trading Enterprises in Vietnam

7 Analysis of Frozen Food Industry in Myanmar

7.1 Development Environment of Myanmar Frozen Food Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Frozen Food Industry Operation 2023-2032

7.2.1 Supply

7.2.2 Demand

7.2.3 Import and Export Situation

7.3 Analysis of Myanmar’s Major Frozen Food Production and Trading Companies

8 Analysis of Brunei Frozen Food Industry

8.1 Brunei Frozen Food Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Frozen Food Industry Operation 2023-2032

8.2.1 Supply

8.2.2 Demand

8.2.3 Import and Export Status

8.3 Analysis of Brunei’s Major Frozen Food Production and Trading Companies

9 Analysis of the Frozen Food Industry in Laos

9.1 Development Environment of Frozen Food Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Frozen Food Industry Operation 2023-2032

9.2.1 Supply

9.2.2 Demand

9.2.3 Import and Export Situation

9.3 Analysis of Major Frozen Food Production and Trading Companies in Laos

10 Analysis of Frozen Food Industry in Cambodia

10.1 Development Environment of Cambodia Frozen Food Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Frozen Food Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.2.3 Import and Export Situation

10.3 Analysis of Major Frozen Food Production and Trading Companies in Cambodia

11 Southeast Asia Frozen Food Industry Outlook 2023-2032

11.1 Southeast Asia Frozen Food Industry Development Influencing Factors Analysis

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Frozen Food Industry Supply Analysis 2023-2032

11.3 Southeast Asia Frozen Food Industry Demand Analysis 2023-2032

11.4 Southeast Asia Frozen Food Industry Import and Export Status Analysis 2023-2032

11.5 Impact of COVID -19 Epidemic on Frozen Food Industry

Reviews

There are no reviews yet.