Description

Southeast Asia Dental Industry

The State of Global Oral Health Report 2022 shows that about 3.5 billion people worldwide have oral disease and about 2 billion people have dental caries in their permanent teeth. About three quarters of the global oral disease patients are from low- or middle-income countries. With the economic development, urbanization and lifestyle changes in Southeast Asia, the prevalence of oral diseases in Southeast Asia is also increasing.

Products such as high sugar foods, beverages, tobacco and alcohol are among the major causes of oral health problems. In Singapore, for example, the increased time spent indoors by residents during the COVID-19 epidemic led to a large increase in the consumption of snacks and beverages in Singapore. At the same time, about 80% of Singaporeans suffer from oral diseases, with tooth sensitivity, tooth discoloration and plaque being the main oral problems faced by Singaporeans. According to CRI’s analysis, similar problems exist in other Southeast Asian countries, so the Southeast Asian dental industry has a promising future.

The Southeast Asian dental industry varies somewhat from country to country. According to CRI analysis, the dental industry in Singapore has a certain scale and the industry is growing fast. Singapore Ministry of Health data show that in 2021, Singapore has 1,147 dental clinics, the number of 3.49% year-on-year growth, including 248 public clinics, up 1.22%, and 899 private institutions, up 4.29%. The dental industry in Vietnam is relatively small, and surveys show that in Vietnam, there are only 0.4 dentists per 10,000 people, far below the level of mature markets such as Europe and the United States.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of nearly 700 million by the end of 2022, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$79,000 in 2022. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2022. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2022, while Indonesia, which has the largest population, will have a population of about 280 million people in 2022.

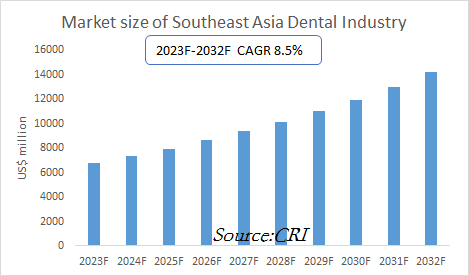

CRI expects the Southeast Asian dental industry to continue to grow from 2023-2032.

Topics covered:

- Southeast Asia Dental Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Dental Industry?

- Which Companies are the Major Players in Southeast Asia Dental Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Dental Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Dental Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Dental Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Dental Industry Market?

- Which Segment of Southeast Asia Dental Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Dental Industry?

Table of Contents

1 Analysis of the Dental Industry in Singapore

1.1 Singapore Dental Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Dental Industry Operating Conditions 2023-2032

1.2.1 Supply

1.2.2 Demand

1.3 Analysis of Major Dental Clinics in Singapore

2 Analysis of the Dental Industry in Thailand

2.1 Development Environment of the Dental Industry in Thailand

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Thailand Minimum Wage

2.2 Thailand Dental Industry Operating Conditions 2023-2032

2.2.1 Supply

2.2.2 Demand

2.3 Analysis of Major Dental Clinics in Thailand

3 Analysis of the Philippine Dental Industry

3.1 Philippine Dental Industry Development Environment

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Dental Industry Operation 2023-2032

3.2.1 Supply

3.2.2 Demand

3.3 Analysis of Major Dental Clinics in the Philippines

4 Malaysia Dental Industry Analysis

4.1 Malaysia Dental Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Dental Industry Operation 2023-2032

4.2.1 Supply

4.2.2 Demand

4.3 Analysis of Major Dental Clinics in Malaysia

5 Indonesia Dental Industry Analysis

5.1 Indonesia Dental Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Dental Industry Operating Conditions 2023-2032

5.2.1 Supply

5.2.2 Demand

5.3 Analysis of Major Dental Clinics in Indonesia

6 Vietnam Dental Industry Analysis

6.1 Vietnam Dental Industry Development Environment

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Dental Industry Operation in 2023-2032

6.2.1 Supply

6.2.2 Demand

6.3 Analysis of Major Dental Clinics in Vietnam

7 Myanmar Dental Industry Analysis

7.1 Development Environment of Myanmar Dental Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Myanmar Minimum Wage

7.2 Myanmar Dental Industry Operating Conditions 2023-2032

7.2.1 Supply

7.2.2 Demand

7.3 Analysis of Major Dental Clinics in Myanmar

8 Brunei Dental Industry Analysis

8.1 Brunei Dental Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Dental Industry Operating Conditions 2023-2032

8.2.1 Supply

8.2.2 Demand

8.3 Analysis of Major Dental Clinics in Brunei

9 Analysis of the Dental Industry in Laos

9.1 Development Environment of the Dental Industry in Laos

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Laos Dental Industry Operating Conditions 2023-2032

9.2.1 Supply

9.2.2 Demand

9.3 Analysis of Major Dental Clinics in Laos

10 Analysis of the Dental Industry in Cambodia

10.1 Development Environment of Dental Industry in Cambodia

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Dental Industry Operation in 2023-2032

10.2.1 Supply

10.2.2 Demand

10.3 Analysis of Major Dental Clinics in Cambodia

11 Southeast Asia Dental Industry Outlook 2023-2032

11.1 Analysis of Factors Influencing the Development of Southeast Asia Dental Industry

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Dental Industry Supply Analysis 2023-2032

11.3 Southeast Asia Dental Industry Demand Analysis 2023-2032

11.4 Impact of COVID -19 Epidemic on Dental Industry

Reviews

There are no reviews yet.