Description

Southeast Asia Aviation Industry Overview

Tourism is one of the economic pillars of the Southeast Asian region and is one of the main drivers of its economic growth. Airplane is the preferred mode of transportation for most international tourists traveling for tourism. As the impact of COVID-19 on the global economy wanes and tourism in Southeast Asia recovers, the airline industry has grown. Boeing expects Southeast Asian airlines will need 4,400 new aircraft worth US$700 billion in the future to support their expanding air travel needs over the next 20 years.

Southeast Asia in this report includes 10 countries: Singapore, Thailand, Philippines, Malaysia, Indonesia, Vietnam, Myanmar, Brunei, Laos and Cambodia. With a total population of over 600 million by the end of 2021, Southeast Asia has an overall economic growth rate higher than the global average and is one of the key drivers of future global economic growth.

According to CRI’s analysis, the economic levels of the 10 Southeast Asian countries vary greatly, with Singapore being the only developed country with a per capita GDP of about US$73,000 in 2021. While Myanmar and Cambodia will have a GDP per capita of less than US$2,000 in 2021. The population and minimum wage levels of each country also vary greatly. Brunei, which has the smallest population, will have a total population of less than 500,000 people in 2021, while Indonesia, which has the largest population, will have a population of about 275 million people in 2021.

Affected by the economic level, there are some differences in the degree of development of aviation industry in 10 Southeast Asian countries. Indonesia, Singapore, Thailand, the Philippines, Malaysia and Vietnam have a large scale of aviation industry, while Myanmar, Cambodia and Laos have a more backward aviation industry with great development potential.

As Southeast Asia’s economy grows, the population’s standard of living improves, the middle class grows, private consumption grows, and demand for leisure and entertainment, such as travel, increases, which will also contribute to the expansion of its aviation industry.

CRI expects the Southeast Asian aviation industry to maintain growth from 2023-2032.

Topics covered:

- Southeast Asia Aviation Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Aviation Industry?

- Which Companies are the Major Players in Southeast Asia Aviation Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Aviation Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Aviation Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Aviation Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Aviation Industry Market?

- Which Segment of Southeast Asia Aviation Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Aviation Industry?

Table of Contents

1 Analysis of Singapore’s Aviation Industry

1.1 Singapore’s Aviation Industry Development Environment

1.1.1 Geography

1.1.2 Population

1.1.3 Economy

1.1.4 Minimum Wage in Singapore

1.2 Singapore Aviation Industry Operation 2018-2022

1.2.1 Domestic Passenger Traffic

1.2.2 International Passenger Transportation

1.2.3 Domestic Cargo Transportation

1.2.4 International Cargo Transportation

1.3 Analysis of Singapore’s Major Airports

2 Analysis of Thailand’s Aviation Industry

2.1 Development Environment of Thailand’s Aviation Industry

2.1.1 Geography

2.1.2 Population

2.1.3 Economy

2.1.4 Minimum Wage in Thailand

2.2 Thailand’s Aviation Industry Operation 2018-2022

2.2.1 Domestic Passenger Traffic

2.2.2 International Passenger Transportation

2.2.3 Domestic Cargo Transportation

2.2.4 International Cargo Transportation

2.3 Analysis of Major Airports in Thailand

3 Analysis of the Philippine Aviation Industry

3.1 Philippine Aviation Industry Development Environment

3.1.1 Geography

3.1.2 Population

3.1.3 Economy

3.1.4 Minimum Wage in the Philippines

3.2 Philippine Aviation Industry Operation 2018-2022

3.2.1 Domestic Passenger Traffic

3.2.2 International Passenger Traffic

3.2.3 Domestic Cargo Transportation

3.2.4 International Cargo Transportation

3.3 Analysis of Major Airports in the Philippines

4 Analysis of the Malaysian Aviation Industry

4.1 Malaysia’s Aviation Industry Development Environment

4.1.1 Geography

4.1.2 Population

4.1.3 Economy

4.1.4 Minimum Wage in Malaysia

4.2 Malaysia Aviation Industry Operation 2018-2022

4.2.1 Domestic Passenger Traffic

4.2.2 International Passenger Traffic

4.2.3 Domestic Cargo Transportation

4.2.4 International Cargo Transportation

4.3 Analysis of Malaysia’s Major Airports

5 Analysis of Indonesia’s Aviation Industry

5.1 Indonesia Aviation Industry Development Environment

5.1.1 Geography

5.1.2 Population

5.1.3 Economy

5.1.4 Minimum Wage in Indonesia

5.2 Indonesia Aviation Industry Operation 2018-2022

5.2.1 Domestic Passenger Traffic

5.2.2 International Passenger Transportation

5.2.3 Domestic Cargo Transportation

5.2.4 International Cargo Transportation

5.3 Analysis of Major Airports in Indonesia

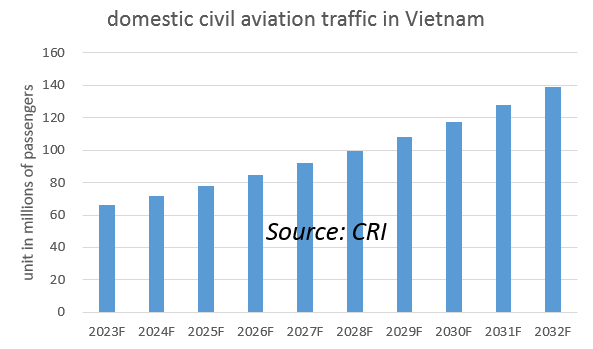

6 Analysis of Vietnam’s Aviation Industry

6.1 Environment of Vietnam’s aviation industry development

6.1.1 Geography

6.1.2 Population

6.1.3 Economy

6.1.4 Minimum Wage in Vietnam

6.2 Vietnam Aviation Industry Operation 2018-2022

6.2.1 Domestic Passenger Transportation

6.2.2 International Passenger Transportation

6.2.3 Domestic Cargo Transportation

6.2.4 International Cargo Transportation

6.3 Analysis of Major Airports in Vietnam

7 Analysis of Myanmar’s Aviation Industry

7.1 Development Environment of Myanmar’s Aviation Industry

7.1.1 Geography

7.1.2 Population

7.1.3 Economy

7.1.4 Minimum Wage in Myanmar

7.2 Myanmar Aviation Industry Operation 2018-2022

7.2.1 Domestic Passenger Transportation

7.2.2 International Passenger Transportation

7.2.3 Domestic Cargo Transportation

7.2.4 International Cargo Transportation

7.3 Analysis of Major Airports in Myanmar

8 Analysis of Brunei’s Aviation Industry

8.1 Brunei Aviation Industry Development Environment

8.1.1 Geography

8.1.2 Population

8.1.3 Economy

8.1.4 Brunei Minimum Wage

8.2 Brunei Aviation Industry Operation 2018-2022

8.2.1 Domestic Passenger Traffic

8.2.2 International Passenger Traffic

8.2.3 Domestic Cargo Transportation

8.2.4 International Cargo Transportation

8.3 Analysis of Brunei’s Major Airports

9 Analysis of the Lao Aviation Industry

9.1 Development Environment of Lao Aviation Industry

9.1.1 Geography

9.1.2 Population

9.1.3 Economy

9.1.4 Minimum Wage in Laos

9.2 Lao Aviation Industry Operation 2018-2022

9.2.1 Domestic Passenger Traffic

9.2.2 International Passenger Transportation

9.2.3 Domestic Cargo Transportation

9.2.4 International Cargo Transportation

9.3 Analysis of Major Airports in Laos

10 Analysis of Cambodia’s Aviation Industry

10.1 Development Environment of Cambodia’s Aviation Industry

10.1.1 Geography

10.1.2 Population

10.1.3 Economy

10.1.4 Minimum Wage in Cambodia

10.2 Cambodia Aviation Industry Operation 2018-2022

10.2.1 Domestic Passenger Transportation

10.2.2 International Passenger Transportation

10.2.3 Domestic Cargo Transportation

10.2.4 International Cargo Transportation

10.3 Analysis of Major Airports in Cambodia

11 Southeast Asia Aviation Industry Outlook 2023-2032

11.1 Analysis of Factors Affecting the Development of Southeast Asia’s Aviation Industry

11.1.1 Favorable Factors

11.1.2 Unfavorable Factors

11.2 Southeast Asia Airline Industry Passenger Volume Forecast 2023-2032

11.3 Southeast Asia Airline Industry Cargo Traffic Forecast 2023-2032

11.4 Impact of COVID-19 Outbreak on the Aviation Industry

Reviews

There are no reviews yet.