Description

With the development of China’s economy and rising living standards, the demand for pork in the Chinese market is on the rise. Due to the limited arable land, there is little room for growth in China’s local pork production, and China needs to import a large amount of pork every year.

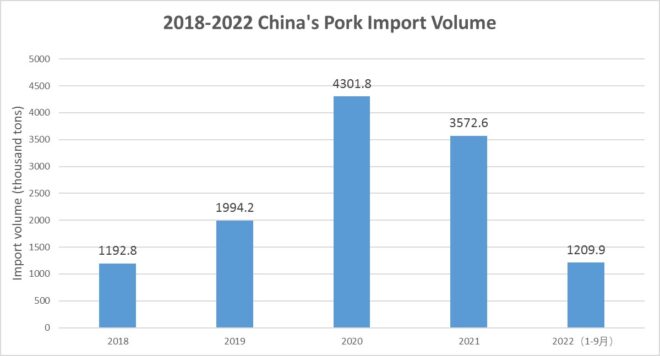

China’s pork imports continue to rise in 2018-2020. Due to the COVID-19 outbreak, China’s pork imports show a decreasing trend in 2021-2022.

In 2021, China imported 3.573 million tons of pork (excluding swine offal), down 17.0% year-on-year, and the import value was US$9.88 billion, down 16.8% year-on-year. in the first three quarters of 2022, China imported 1.210 million tons of pork, down 59.9% year-on-year, and the import value was US$2.52 billion, down 70.8% year-on-year.

The average price of imported pork in China generally showed an upward trend from 2018 to 2021. According to CRI’s analysis, the average price of pork imports in 2021 is US$2761.3 per kg. the average price of China’s pork imports in the first three quarters of 2022 is US$2080.1 per kg, down 27.2% year-on-year.

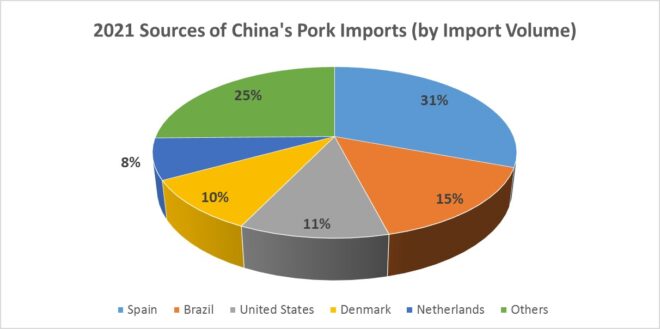

China imports pork from a total of 19 countries in 2021. According to CRI’s analysis, the top five import source countries by import volume are Spain, Brazil, the United States, Denmark and the Netherlands, with the cumulative imports of these five countries accounting for 74.7% of the total imports in 2021. Among them, China imported 1.09 million tons of pork from Spain, accounting for 30.7%, and the import value reached US$3.13 billion, accounting for 31.7%.

The two main categories of pork imported by China are fresh or cold pork and frozen pork. Among them, frozen pork is the main species imported by China. 2021 China imported a total of 3.571 million tons of frozen pork, and only about 0.2 million tons of imported pork was fresh or cold pork.

According to CRI’s analysis, among the various types of frozen pork, frozen bone-in pork foreleg, pork hind leg and its meat pieces and other frozen pork are the main imported species. 2.508 million tons of other frozen pork and 1.060 million tons of frozen bone-in pork foreleg, pork hind leg and its meat pieces were imported into China in 2021, accounting for 70.2% and 29.7% of the total import volume, respectively.

CRI expects China’s pork imports to continue to rise from 2023-2032 as the COVID-19 outbreak is brought under control and international logistics gradually recover.

Topics covered:

- China’s Pork Import Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on China’s Pork Import?

- Which Companies are the Major Players in China’s Pork Import Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in China’s Pork Import

- What are the Key Drivers, Challenges, and Opportunities for China’s Pork Import during 2023-2032?

- What is the Expected Revenue of China’s Pork Import during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in China’s Pork Import Market?

- Which Segment of China’s Pork Import is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing China’s Pork Import?

Reviews

There are no reviews yet.