Description

China’s Dairy Product Import Overview

With the rising living standards of Chinese residents, the demand for dairy products is also on the rise. China needs to import a large number of dairy products every year due to the high production cost of local dairy products and limited room for production growth.

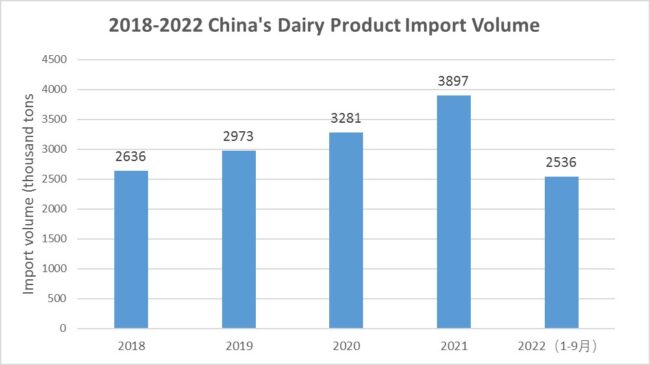

In 2021, China imported a total of 3.897 million tons of various dairy products, up 18.8% year-on-year, with an import value of US$13.36 billion, up 14.0% year-on-year. 2021, China imported a total of 2.536 million tons of various dairy products in the first three quarters of 2022, down 18.6% year-on-year, with an import value of US$10.69 billion, up 0.9% year-on-year.

China imports two main categories of dairy products: dried dairy products and liquid milk. 2021, China imported 2.611 million tons of dried dairy products, up 17.7% year-on-year, accounting for 65.9% of total imports that year, and US$11.49 billion, up 11.0% year-on-year, accounting for 83.1% of total imports that year.

One more million tons of dried dairy products were imported into China in the first three quarters of 2022, down 17.5% year-on-year, with imports of US$9.45 billion, up 2.4% year-on-year.

China’s dried dairy product imports mainly include large packaged milk powder, infant milk powder, cheese, cream, whey and condensed milk, etc. CRI analysis shows that in 2021, China imported 1.275 million tons of large packaged milk powder, up 31.2% year-on-year, and the import value was US$4.60 billion, up 39.6% year-on-year.

New Zealand is China’s largest source of large packaged milk powder imports by import volume, with China importing 889,000 tons of New Zealand large packaged milk powder in 2021, accounting for 69.7% of total large packaged milk powder imports in that year.

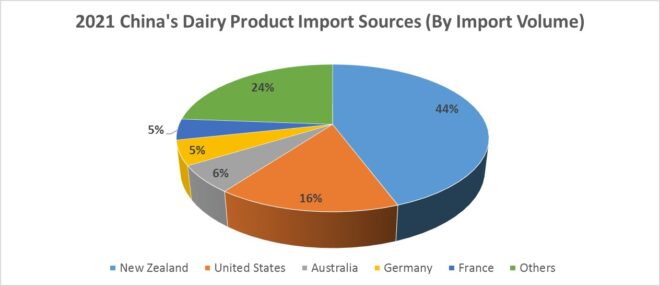

When converted to raw milk, the top three sources of dairy imports into China in 2021 by import volume are New Zealand, the U.S. and Australia. According to CRI analysis, dairy products imported from New Zealand accounted for 44.3% of total imports.

By import volume, the top three sources of dairy products imports to China in 2021 are New Zealand, Australia and Germany, with imports from New Zealand accounting for 52.0% of total imports.

According to CRI’s analysis, consumption of dairy products will continue to expand as China’s national income increases and its consumption structure is gradually optimized. CRI expects China’s dairy import demand to grow strongly from 2023-2032, as the production of imported dairy products is strictly monitored to ensure quality and international competitiveness.

Topics covered:

- China’s Dairy Product Import Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on China’s Dairy Product Import?

- Which Companies are the Major Players in China’s Dairy Product Import Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in China’s Dairy Product Import

- What are the Key Drivers, Challenges, and Opportunities for China’s Dairy Product Import during 2023-2032?

- What is the Expected Revenue of China’s Dairy Product Import during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in China’s Dairy Product Import Market?

- Which Segment of China’s Dairy Product Import is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing China’s Dairy Product Import?

Reviews

There are no reviews yet.