Description

China’s Sugar Import Overview

With the development of China’s economy and rising living standards, the demand for sugar in the Chinese market is on the rise. Due to the limited arable land, there is little room for growth in China’s local sugar production, and China needs to import a large amount of sugar every year.

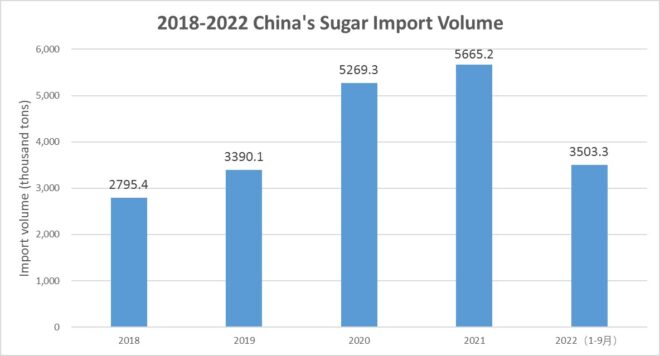

In 2021, China imported a total of 5.665 million tons of sugar, up 7.5% year-on-year, with imports of US$2.28 billion, up 26.6% year-on-year. According to CRI’s analysis, in the first three quarters of 2022, China imported 3.503 million tons of sugar, down 8.7% year-on-year, and the import value was US$1.71 billion, up 18.8% year-on-year.

As a bulk commodity, the average price of China’s sugar imports stabilized in the price range of US$330 to US$370 per ton in 2018-2020. In 2021, the average price of China’s sugar imports rose to US$402.9 per ton, up 17.8% year-on-year, and in the first three quarters of 2022, the average price of China’s sugar imports continued to rise to US$487.3 per ton, up 30.0% year-on-year.

The main types of sugar imported into China include beet sugar, sucrose, chemically pure sucrose, Granulated sugar, Superfine sugar and other refined sugars, etc. According to CRI’s analysis, the main types of sugar imported into China are other sucrose without flavoring or coloring agents and granulated sugar.

In 2021, the import volume of other sugar sucrose without flavoring or coloring reached 4.967 million tons, accounting for 87.7% of the total import volume and US$1.94 billion, accounting for 85.1% of the total import value in that year. The import volume of granulated sugar amounted to 683,000 tons, accounting for 12.1%, and the import value of US$330 million, accounting for 14.5%.

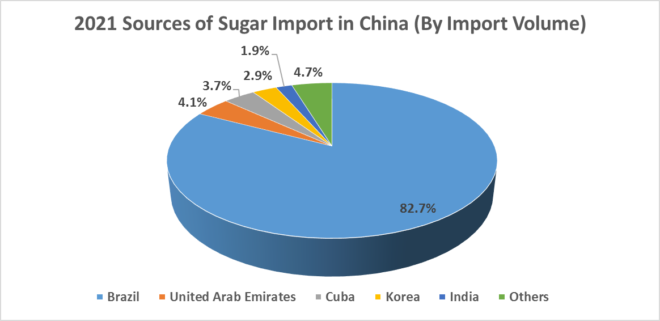

CRI analysis shows that in 2021, the main sources of China’s sugar imports by import volume are Brazil, UAE, Cuba, South Korea and India. Brazil is China’s largest source of sugar imports. 4.687 million tons of sugar will be imported from Brazil in 2021, accounting for 82.7% of total imports in that year, and US$18.21 billion, or 79.8% of imports.

China is the world’s major sugar consumer. With the improvement of China’s national living standard and the upgrade of consumption structure, China’s sugar consumption continues to grow rapidly, but China’s domestic sugar production capacity cannot meet the demand of the consumer market and needs to seek a large number of imports, therefore, CRI expects China’s sugar imports will continue to grow in the future.

Topics covered:

- China’s Sugar Import Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on China’s Sugar Import?

- Which Companies are the Major Players in China’s Sugar Import Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in China’s Sugar Import ring 2023-2032?

- What is the Expected Revenue of China’s Sugar Import during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in China’s Sugar Import Market?

- Which Segment of China’s Sugar Import is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing China’s Sugar Import?

Reviews

There are no reviews yet.