Description

UAS Traffic Management System Market

Executive Summary

Over the past decade, unmanned aerial vehicles (UAVs) have witnessed several significant developments such as considerable reductions in weight, size, and cost, enhancement battery life, and increase in the degree of autonomy in operations.

These developments have led to their wider adoption for a diverse range of applications across commercial and non-commercial end users. Companies operating in the UAV industry are working toward the development of fully autonomous UAVs, which will eliminate the need for a ground-based controller in the future.

This will enable UAVs to perform tasks without human interventions. Moreover, this will reduce the operating cost of UAVs and make them a highly cost-effective solution across a varied range of commercial applications.

Presently, the spectrum of UAV applications is increasing, especially for small UAVs, which are now being widely adopted across the hobbyist end user. The prime factor behind the rise in demand for UAVs for commercial and hobbyist applications is their low price, compact size, and improved performance.

UAVs have now become more convenient in their operation, and consequently, are widely preferred among different industry verticals. Commercial UAVs have witnessed significant growth over the past few years, especially after exemptions from Federal Aviation Administration (FAA) regulations in the U.S. European countries are also lenient toward the rulemaking for commercial UAVs.

These exemptions have supported the demand growth for commercial and consumer UAVs globally. The military UAV market dominates the overall UAV market in terms of revenue generation, owing to the high unit price, which ranges from nearly $XX thousand to $XX million. Military UAVs are an integral part of any country’s defense system.

Countries across the globe have increased their spending to procure advanced UAVs for surveillance on their border and to combat the rising terrorist activities. The U.S. is an early adopter of drone technology, and it is anticipated to be able to maintain its dominance in terms of revenue generation in the global UAV market during the forecast period.

On the other hand, Asia-Pacific (APAC), which is one of the largest importers of UAVs, holds immense potential to grow at a rapid pace and convert itself into a multi-billion-dollar market. The lack of a regulatory framework for the adoption of UAVs in beyond-visual-line-of-sight (BVLOS) operations pose a substantial threat to the more widespread adoption of UAVs.

However, consortiums and regulatory bodies are anticipated to play a pivotal role in the drone industry growth, since the future growth of the market majorly depends on regulatory frameworks.

Some of the prominent consortiums are Association for Unmanned Vehicle Systems International (AUVSI), UAV Systems Association (UAVSA), and Association of Remotely Piloted Aircraft Systems the U.K. (ARPAS The U.K.).

Considering the increased demand for drones in commercial applications as well as the growth potential, established markets, such as the U.S. and major European countries, are actively implementing their respective laws and regulations governing the commercial drone industry.

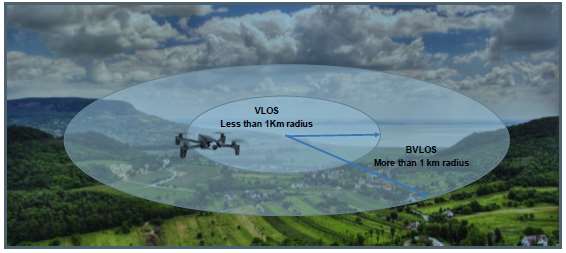

The FAA and the European Aviation Safety Agency (EASA) are the prominent regulatory bodies in the U.S. and Europe, respectively. Initially, drones took fleet for a short range of about 1 km distance from the controller, keeping the drone in the visual line of sight (VLOS) of the remote pilot.

However, about over a decade, the need for operating drones beyond VLOS is proliferating due to the increasing demand for commercial applications, such as package delivery, critical infrastructure inspection (rail, oil and gas, windmill), and others.

These applications require drones to operate in BVLOS operations. The following figure represents the operating range for drones in BVLOS and VLOS.

Figure 1: Operat ing Range for VLOS and BVLOS

For operating drones in the BVLOS range, there are various restrictions imposed by the aviation department in various countries. Each country has its own set of rules for drone operations. For instance, the FAA is the regulatory body for American Civil Aviation. The authority creates regulations for the use of drones in commercial applications.

For operating UAVs in BVLOS for commercial applications, the operator has to take a clearance certificate, and after obtaining the certificate, there are also certain restrictions related to the flying range and height of UAVs.

There are some specific applications such as search and rescue, package delivery, inspection, and border patrol, which can be performed through BVLOS operations. In military and government applications, the drones already fly in the BVLOS range, while in commercial applications, the BVLOS operations are yet to commence by 2021.

In most countries, BVLOS flights, as of now, are not permitted, or they are highly regulated. According to FAA, in 2019, numerous applications emerged regarding BVLOS operations in FAA. The increase in the need for BVLOS operations makes it necessary for the industry to introduce and deploy unmanned or UAS traffic management (UTM) systems.

Since 2016, NASA is leading most of the research and development initiatives in the UTM arena and has been involved in testing its UTM platform with various industry partners under its testing capability level (TCL) program.

A similar degree of research is taking place in Europe to develop and design a UTM system. The drone market in Europe envisions drone services for 3D mapping, infrastructure, geo-fencing, and goods delivery in the coming future.

Since 2016, U-space in Europe has been gradually developing a new set of services to support safe and efficient applications of drones in the airspace. There is a fixed timeframe according to which these services are expected to be launched in Europe.

In addition to this, other countries such as China, Singapore, Japan, and Australia are also making considerable efforts to develop their respective UTM systems.

Key Questions Answered in this Report:

• What are the enabling technologies within the UAS traffic management (UTM) system market?

• What is the demand for commercial drones for various applications?

• What are the driving and challenging factors for the growth of the UTM system market?

• Which are the various trials and demonstrations that have been conducted from 2018 till date?

• What are the various regulations in countries, such as the U.S., Canada, U.K., France, China, and India?

• How is the industry expected to evolve during the forecast period, 2021-2031?

• What are the key developmental strategies that are implemented by the key players to sustain the competitive market?

• What are the different UTM concepts in each country?

• What is the competitive scenario and who are the stakeholders in the UTM value chain?

• Which are the different companies involve in the UTM market?

Global UAS Traffic Management (UTM) System Market Forecast, 2021-2031

The UAS traffic management (UTM) system industry analysis projects the market to grow at a significant CAGR of 17.13% on the basis of value during the forecast period from 2021 to 2031. North America and Europe and the two major regions in the UAS traffic management (UTM) system market, wherein these regions have carried out trials and demonstrations of UTM capabilities.

The demand for UTM services has been increasing in the past five years and this is due to the growing drone operations. There are several factors that are contributing to the significant growth of UAS traffic management (UTM) system market. Some of these factors include focus on BVLOS operations and potential opportunities for key stakeholders.

Scope of the Global UAS Traffic Management (UTM) System Market

The UAS traffic management (UTM) system market research provides detailed market information for segmentation such as potential application areas and region. The purpose of this market analysis is to examine the UAS traffic management (UTM) system market outlook in terms of factors driving the market, trends, technological developments, and competitive benchmarking, among others.

The report further takes into consideration the market dynamics and the competitive landscape, along with the detailed financial and product contribution of the key players operating in the market.

Global UAS Traffic Management System Segmentation

While highlighting the key driving and restraining forces for this market, the report also provides a detailed study of the potential application areas for UAS Traffic Management. These potential application areas include precision agriculture, package delivery, critical infrastructure inspection, mapping, disaster management, law enforcement, and construction.

The UAS traffic management (UTM) system market is segregated by region under four major regions, namely North America, Europe, Asia-Pacific, and Rest-of-the-World. Information for each of these regions (by country) has been provided in the market study.

Key Companies in the Global UAS Traffic Management (UTM) System Industry

The key market players in the UAS traffic management (UTM) system market include Unifly, Altitude Angel, Skyward.io, OneSky, DeDrone, DJI Innovation, Kitty Hawk, Precision Hawk, vHive, Airbus, Thales, Leonardo Company, SRC Inc., and AirMap, among others.

Related Reports: Global Renewable Drones Market Analysis and Forecast Report 2030

Related Reports: Global Drone Camera Market Analysis and Forecast Report 2030

Related Reports: Global Drone Taxi Market Analysis and Forecast Report 2030

Related Reports: Global LiDAR Drone Market Analysis and Forecast Report 2030

Related Reports: Global Agriculture Drones Market Analysis and Forecast Report 2030

Reviews

There are no reviews yet.