Description

Malaysia Furniture Industry

Malaysia’s per capita GDP is over 10,000 dollars, which is the third highest in ASEAN. The industry is mainly concentrated in the fields of electronics, petroleum, chemicals, textiles, wood processing and food processing. Malaysia’s furniture industry is one of the sub-sectors of wood processing.

Malaysia expects foreigners to use Malaysia as a production base to expand into the ASEAN market, and products manufactured in Malaysia can enjoy various tax incentives under the ASEAN Free Trade Agreement (AFTA). Malaysia offers a number of incentives to foreign investors, depending on the size and scope of the company’s investment, as well as the sector or industry in which it is investing. Furniture manufacturing is also one of the industries that the Malaysian government encourages foreign investment in.

The success of Malaysia’s furniture industry is closely linked to the resurgence of rubberwood. The transformation of rubberwood into a major source of timber breathed new life into the industry. From then on, Malaysia became a leading producer and exporter of wooden furniture to over 160 countries worldwide. Currently, the Malaysian furniture industry has secured its place among the top 10 furniture exporters in the world, with approximately 80% of its production destined for international markets.

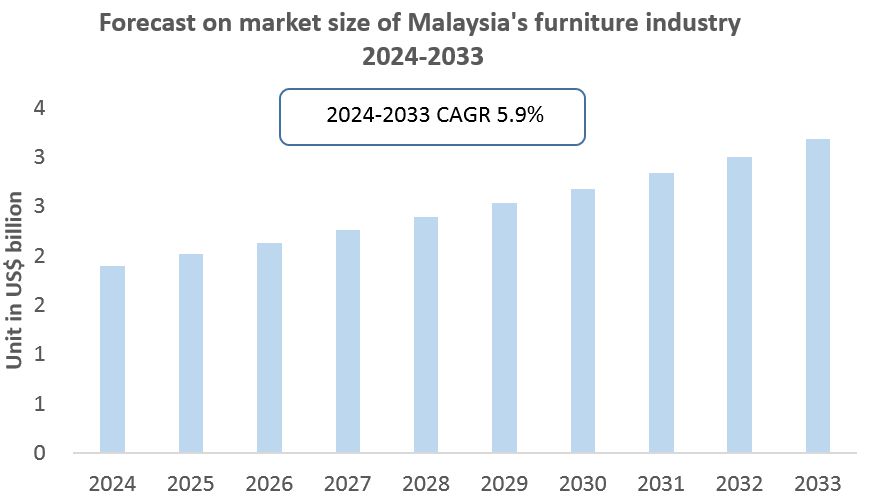

According to CRI, the market size of Malaysia furniture industry is expected to reach USD 1.9 billion by 2024. Approximately 80-85% of Malaysia’s furniture is exported, with the major exporting countries being the United States, Japan and Australia. Wooden furniture accounts for the lion’s share of exported furniture. Since 2022, the US household market has started to cool down after the Federal Reserve started to raise interest rates, which has directly led to a decline in Malaysia’s furniture exports.

According to CRI’s analysis, the market size of Malaysia furniture industry will reach US$ 3.9 billion in 2033 with a CAGR of 5.9% from 2024 to 2033.

In the future, Malaysia furniture market will continue to expand. It will be driven by several major growth drivers. First, a growing urban population and rising disposable incomes are driving consumer demand for home furnishings and modern furniture designs. In addition, the growing influence of e-commerce and digital marketing channels is expanding the market’s reach and accessibility to a wider customer base. As sustainability and eco-friendly practices gain prominence, the market is benefiting from a shift towards eco-friendly materials and production methods. According to CRI, the adaptability of the Malaysian furniture market, coupled with these growth drivers, positions it for continued expansion and competitiveness in the global furniture industry.

Topics covered:

- Malaysia Furniture Industry Overview

- The economic and policy environment of Malaysia’s furniture industry

- Malaysia Furniture Industry Market Size, 2024-2033

- Analysis of the main Malaysia furniture production enterprises

- Key drivers and market opportunities for Malaysia’s furniture industry

- What are the key drivers, challenges and opportunities for Malaysia’s furniture industry during the forecast period 2024-2033?

- Which companies are the key players in the Malaysia furniture industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia furniture industry market during the forecast period 2024-2033?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia furniture industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the furniture industry in Malaysia?

Table of Contents

1 Overview of Malaysia

1.1 Geographical situation

1.2 Demographic structure of Malaysia

1.3 The economic situation in Malaysia

1.4 Minimum Wage in Malaysia 2013-2022

1.5 Impact of COVID-19 on the furniture industry in Malaysia

2 Overview of Malaysia’s furniture industry

2.1 History of Malaysia architecture development

2.2 FDI in Malaysia’s furniture sector

2.3 Policy environment of Malaysia’s furniture industry

3 Malaysia furniture industry supply and demand situation

3.1 Malaysia furniture industry supply situation

3.2 Malaysia furniture industry demand situation

4 Malaysia furniture industry import and export status

4.1.1 Malaysia’s furniture imports and import volume

4.1.2 Main import sources of Malaysia furniture

4.2 Malaysia’s furniture industry export status

4.2.1 Malaysia’s furniture export volume and export value

4.2.2 Malaysia’s main export destinations for furniture

5 Cost analysis of the furniture industry in Malaysia

5.1 Cost Analysis of Malaysian Furniture Industry

5.1.1 Labor costs

5.1.2 Cost of raw materials

5.1.3 Other costs

5.2 Price Analysis of Malaysian Furniture

6 Malaysia Furniture Industry Market Competition

6.1 Barriers to entry in Malaysia’s furniture industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive structure of Malaysia’s furniture industry

6.2.1 Bargaining power of furniture suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Malaysia’s furniture industry

6.2.4 Potential entrants in the furniture industry

6.2.5 Alternatives to furniture

7 Analysis of major furniture companies in Malaysia

7.1 Latitude Tree Holdings Berhad

7.1.1 Latitude Tree Holdings Berhad Corporate Profile

7.1.2 Latitude Tree Holdings Berhad Enterprise Revenue Status

7.2 Lii Hen Industries Bhd

7.2.1 Lii Hen Industries Bhd Corporate Profile

7.2.2 Lii Hen Industries Bhd Revenue Status

7.3 Poh Huat Furniture Industries

7.3.1 Poh Huat Furniture Industries Corporate Profile

7.3.2 Poh Huat Furniture Industries Revenue Status

7.4 Sern Kou Resources Berhad

7.4.1 Sern Kou Resources Berhad Corporate Profile

7.4.2 Sern Kou Resources Berhad Corporate Revenues

7.5 Tawei Furniture Sdn Bhd

7.5.1 Tawei Furniture Sdn Bhd Corporate Profile

7.5.2 Tawei Furniture Sdn Bhd Enterprise Revenue Status

7.6 Home Styler Furniture Sdn Bhd

7.6.1 Home Styler Furniture Sdn Bhd Corporate Profile

7.6.2 Home Styler Furniture Sdn Bhd Corporate Revenue Status

7.7 LY Furniture Sdn Bhd

7.7.1 LY Furniture Sdn Bhd Corporate Profile

7.7.2 LY Furniture Sdn Bhd Corporate Revenue Status

7.8 Federal International Holdings Berhad

7.8.1 Corporate Profile of Federal International Holdings Berhad

7.8.2 Federal International Holdings Berhad Revenue Status

7.9 Kamdar Sdn. Bhd.

7.9.1 Kamdar Sdn. Bhd. Company Profile

7.9.2 Kamdar Sdn. Bhd. Corporate Revenue Status

7.10 Sliderdrobe Sdn Bhd

7.10.1 Sliderdrobe Sdn Bhd Corporate Profile

7.10.2 Sliderdrobe Sdn Bhd Corporate Revenue Status

8 Malaysia Furniture Industry Outlook 2023-2032

8.1 Analysis of development factors in Malaysia’s furniture industry

8.1.1 Drivers and Development Opportunities in Malaysia’s Furniture Industry

8.1.2 Threats and challenges to the Malaysia furniture industry

8.2 Malaysia Furniture Industry Supply Forecast

8.3 Malaysia Furniture Market Demand Forecast

8.4 Malaysia furniture industry import and export forecast

LIST OF CHARTS

Chart Total population of Malaysia 2008-2023

Chart GDP per capita in Malaysia 2013-2023

Chart Furniture Industry Related Policies Issued by the Malaysia Government 2018-2024

Chart Market size of furniture industry in Malaysia

Chart 2019-2023 Malaysia furniture industry imports

Chart 2019-2023 Malaysia furniture industry import amount

Chart 2019-2023 Malaysia furniture industry importers and import value

Chart 2019-2023 Export volume of Malaysia’s furniture industry

Chart 2019-2023 Export value of Malaysia’s furniture industry

Chart Exporting countries and export value of Malaysia’s furniture industry in 2019-2023

Chart 2024-2033 Malaysia furniture industry production forecast

Chart 2024-2033 Malaysia Furniture Market Size Forecast

Chart 2024-2033 Malaysia furniture industry import forecast

Chart 2024-2033 Export forecast for Malaysia’s furniture industry

Reviews

There are no reviews yet.