Description

Malaysia Construction Industry

The construction industry encompasses a wide range of activities, including planning, design, and execution, aimed at creating various physical structures such as buildings, infrastructure, and more. It involves the collaboration of professionals such as architects, engineers, contractors, and workers to complete projects ranging from residential and commercial buildings to roads, bridges, and utilities. Despite the diversity of projects, they all contribute to the improvement and development of communities and infrastructure.

In any country, the construction industry is significant, serving as a pillar of the economy while having a direct impact on the quality of life and urban landscape. According to CRI, the industry’s prosperity often reflects the nation’s economic health and stage of development. In addition, its growth influences other sectors such as real estate, manufacturing, and finance, and thus has an impact on the broader economy. Therefore, the construction industry typically occupies a prominent position and exerts considerable influence within a country.

The construction market in Malaysia is divided into six sectors, namely Commercial Construction, Industrial Construction, Infrastructure Construction, Energy and Utilities Construction, Institutional Construction and Residential Construction. In 2023, the infrastructure construction sector accounted for the highest market share, followed by residential construction.

Strengths of Malaysian construction sector are attributed by capabilities of Malaysian construction companies to implement projects namely construction of buildings, roads and highways, railways, bridges and airports, water treatment and power plants; steel structure fabrication, installation and erection; mixed development projects including housing, hotels, leisure and luxury residences; and building maintenance, including for high-rise towers.

The steady growth of the Malaysian economy has provided a solid foundation for the expansion of the construction industry. Economic growth has driven demand for residential, commercial and industrial buildings as well as increased investment in infrastructure projects. The Malaysian government has played an important role in promoting the construction industry by stimulating the economy through the implementation of various construction projects and infrastructure programs such as the construction of roads, bridges and public transportation systems. In addition, the government has also introduced social welfare programs such as low-cost housing schemes, further boosting the demand for the construction sector.

Malaysia’s construction industry has attracted significant FDI, particularly in the real estate and commercial construction sectors. Foreign investors are optimistic about Malaysia’s high growth potential and strategic position, which has boosted the construction sector.

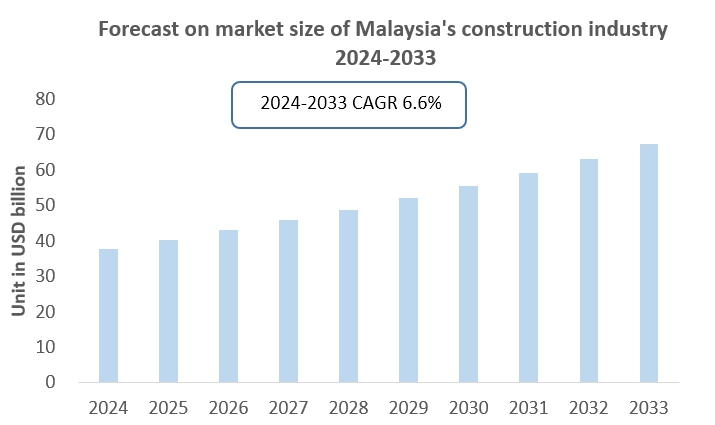

In 2023, the Malaysia construction market size was estimated at USD 35.5 billion. According to CRI’s analysis, the Malaysia construction market size is expected to reach 67.3 billion USD in 2033, growing at a CAGR of 6.6%. Although the Malaysian construction industry will face the challenges of lack of skilled labor and lax regulation, it will continue to grow in the future with the support of government policies and advanced technology.

Topics covered:

- Malaysia Construction Industry Overview

- The economic and policy environment of the construction industry in Malaysia

- Malaysia construction industry market size, 2024-2033

- Analysis of major Malaysia construction industry manufacturers

- Key Drivers and Market Opportunities in Malaysia’s Construction Industry

- What are the key drivers, challenges and opportunities for the construction industry in Malaysia during the forecast period 2024-2033?

- Which companies are the key players in the Malaysia construction industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia construction industry market during the forecast period of 2024-2033?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia construction industry market is expected to dominate the market in 2032?

- What are the main negative factors facing the construction industry in Malaysia?

Table of Contents

1 Overview of Malaysia

1.1 Geographical situation

1.2 Demographic structure of Malaysia

1.3 The economic situation in Malaysia

1.4 Minimum Wage in Malaysia 2013-2022

1.5 Impact of COVID-19 on the construction industry in Malaysia

2 Overview of Malaysia’s construction industry

2.1 History of Malaysia architecture development

2.2 FDI in Malaysia’s construction sector

2.3 Policy environment of Malaysia’s construction industry

3 Malaysia construction industry supply and demand situation

3.1 Malaysia construction industry supply situation

3.2 Malaysia construction industry demand situation

4 Malaysia construction industry import and export status

4.1 Import and export

4.1.1 Malaysia’s construction imports and import volume

4.1.2 Main import sources of Malaysia construction

4.2 Malaysia’s construction industry export status

4.2.1 Malaysia’s construction export volume and export value

4.2.2 Malaysia’s main export destinations for construction

5 Cost analysis of the construction industry in Malaysia

5.1 Malaysia construction industry cost analysis

5.2 Charges for construction works in Malaysia

6 Malaysia Construction Industry Market Competition

6.1 Barriers to entry in Malaysia’s construction industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive structure of Malaysia’s construction industry

6.2.1 Bargaining power of construction suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in Malaysia’s construction industry

6.2.4 Potential entrants in the construction industry

6.2.5 Alternatives to construction

7 Analysis of major construction companies in Malaysia

7.1 Gamuda Berhad

7.1.1 Gamuda Berhad Corporate Profile

7.1.2 Gamuda Berhad Enterprise Revenue Status

7.2 IJM Corporation Berhad

7.2.1 IJM Corporation Berhad Corporate Profile

7.2.2 IJM Corporation Berhad Revenue Status

7.3 YTL Corporation Berhad

7.3.1 YTL Corporation Berhad Corporate Profile

7.3.2 YTL Corporation Berhad Corporate Revenue Status

7.4 WCT Holdings Berhad

7.4.1 WCT Holdings Berhad Corporate Profile

7.4.2 WCT Holdings Berhad Corporate Revenues

7.5 Malaysian Resources Corporation Berhad

7.5.1 Malaysian Resources Corporation Berhad Corporate Profile

7.5.2 Malaysian Resources Corporation Berhad Enterprise Revenue Status

7.6 Gadang Holdings Berhad

7.6.1 Gadang Holdings Berhad Corporate Profile

7.6.2 Gadang Holdings Berhad Corporate Revenue Status

7.7 Hock Seng Lee Berhad (HSL)

7.7.1 Hock Seng Lee Berhad (HSL) Corporate Profile

7.7.2 Hock Seng Lee Berhad (HSL) Corporate Revenue Status

7.8 Mudajaya Group Berhad

7.8.1 Corporate Profile of Mudajaya Group Berhad

7.8.2 Mudajaya Group Berhad Corporate Revenue Status

7.9 Muhibbah Engineering (M) Bhd

7.9.1 Muhibbah Engineering (M) Bhd Company Profile

7.9.2 Muhibbah Engineering (M) Bhd Corporate Revenue Status

7.10 Sunway Construction Group Berhad

7.10.1 Sunway Construction Group Berhad Corporate Profile

7.10.2 Sunway Construction Group Berhad Corporate Revenue Status

8 Malaysia Construction Industry Outlook 2023-2032

8.1 Analysis of development factors in Malaysia’s construction industry

8.1.1 Drivers and Development Opportunities in Malaysia’s Construction Industry

8.1.2 Threats and challenges to the Malaysia construction industry

8.2 Malaysia Construction Industry Supply Forecast

8.3 Malaysia Construction Market Demand Forecast

8.4 Malaysia construction industry import and export forecast

LIST OF CHARTS

Chart Total population of Malaysia 2008-2023

Chart GDP per capita in Malaysia 2013-2023

Chart Construction Industry Related Policies Issued by the Malaysia Government 2018-2024

Chart Market size of construction industry in Malaysia

Chart Domestic consumption in the construction industry in Malaysia 2018-2023

Chart 2019-2023 Malaysia construction industry imports

Chart 2019-2023 Malaysia construction industry importers and import value

Chart 2019-2023 Export volume of Malaysia’s construction industry

Chart 2019-2023 Export value of Malaysia’s construction industry

Chart Exporting countries and export value of Malaysia’s construction industry in 2019-2023

Chart 2024-2033 Malaysia construction industry production forecast

Chart 2024-2033 Malaysia Construction Market Size Forecast

Chart 2024-2033 Malaysia construction industry import forecast

Chart 2024-2033 Export forecast for Malaysia’s construction industry

Related Reports

India Construction Industry Research Report 2024-2033

Indonesia Construction Industry Research Report 2024-2033

Vietnam Construction Industry Research Report 2023-2032

Vietnam Construction Machinery Industry Research Report 2023-2032

North America, Japan, & Europe Silicone Water Repellent for Construction Market Forecast to 2030

Plastic Compounding Market: Segmented: By Type (Polyethylene (PE), Polypropylene (PP), Poly Vinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), Poly-Butylene Terephthalate (PBT), Polyamide (PA), Acrylonitrile Butadiene Styrene (ABS), and Others), By Application (Packaging, Automotive, Construction, Electronics, Healthcare, and Others), And Region 鈥?Global Analysis of Market Size, Share & Trends For 2021鈥?022 And Forecasts To 2032

Construction Additives Market Report Forecast 2030

Europe Construction Aggregate Market Research Report Forecast to 2027

Research Report on Southeast Asia Construction Machinery Industry 2023-2032

Research Report on Southeast Asia Construction Industry 2023-2032

Global Construction Software Market Research Report- Forecast till 2030

3D Reconstruction Technology Market Forecast 2028

Reviews

There are no reviews yet.