Description

Malaysia Automobile Industry

Since the first domestic automobile “PROTON” was manufactured in 1983, the automotive industry has become one of the major industries supporting the Malaysian economy. Currently, there are more than 20 manufacturing and assembly plants in Malaysia, where passenger cars, commercial vehicles, motorcycles, scooters, etc. are manufactured.

In 2022, the total number of automobiles manufactured and assembled was approximately 702,300 for passenger cars and commercial vehicles, an increase of 41.6% compared to 2021. Passenger car sales increased 41.8% to 641,773 units. Commercial vehicle sales rose 39.9% to 78,885 units. Malaysian automobile production increased 27.2% year-on-year to 68,881 units in December. In Southeast Asia, Malaysia is the third largest after Thailand and Indonesia.

The Malaysian automobile market is a market with great potential, and it has also attracted a large number of investors and foreign brands to join. During the first six months of 2023,auto sales in Malaysia totalled 366,037 units according to the Malaysian Automotive Association (MAA). This represents a 10.3% year-on-year (YoY) increase compared to the same period last year. Perodua is unsurprisingly leading in terms of total vehicle sales in 1H 2023 with 144,690 units, which is enough for a market share of 39.5%.

Both figures are higher than in 1H 2022, when Perodua managed 127,343 deliveries and a market share of 38.4%. Meanwhile, Proton is second place with 76,012 units, up 32.4% from the 57,402 units in 1H 2022. The national carmaker’s market share has also gone up by 3.5% YoY to hit 20.8% in 1H 2023. Coming in third place is Toyota with 48,145 units and a market share of 13.2% – the former is higher than the 45,449 units recorded in 1H 2022, but the latter is actually down by 0.5%.

Malaysia has great advantages in developing the automobile industry and launched Malaysia’s first national automobile policy (NAP2006) in 2006. The policy-driven NAP has played an important role in boosting the Malaysian automotive industry so far. Malaysia has strengths in services related to the mobile industry and the electrical and electronics (E&E) industry. With these advantages of the country, Malaysia has set up three challenging new elements.

In order to continue to develop the automotive industry, which leads the mobility industry, integration with the service industry and the electrical and electronics industry is key according to the vision of NAP2020. Cooperation with the electrical and electronics industry will deepen, as shown in the development roadmap for components important for next-generation vehicles. The future automobile industry will have in-depth cooperation with the power electronics industry from the development stage, which may promote cross-industry integration and lead to substantial changes in the supply chain of the automobile industry.

Nowadays, the development of electric vehicles has become an emerging trend around the world. However, Malaysia’s existing EV infrastructure is still lacking, particularly the lack of EV charging stations.

Currently, Malaysia only has about 600 EV charging stations, which are insufficient to cater to a broad EV market. Barriers to developing the EV ecosystem in Malaysia include high costs and inadequate supporting infrastructure, including component shortages, lack of EV experts and skills, electricity grid challenges, increased demand for lithium-ion batteries, and lack of EV charging standards. Although Malaysia is an upper-middle-income country, and EV owners can also claim tax relief for owning one of those vehicles, EVs remain prohibitively expensive for many people.

Topics covered:

- Malaysia Automobile Industry Overview

- The economic and policy environment of Malaysia’s automobile industry

- What is the impact of COVID-19 on the Malaysia’s automobile industry?

- Malaysia Automobile Industry Market Size, 2023-2032

- Analysis of the main Malaysia’s automobile production enterprises

- Key drivers and market opportunities for Malaysia’s automobile industry

- What are the key drivers, challenges and opportunities for Malaysia’s automobile industry during the forecast period 2023-2032?

- Which companies are the key players in the Malaysia automobile industry market and what are their competitive advantages?

- What is the expected revenue of Malaysia automobile industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Malaysia automobile industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the automobile industry in Malaysia?

Related Reports:

-

- Philippines Electric Vehicle Industry Research Report 2023-2032

- Indonesia Electric Vehicle Industry Research Report 2023-2032

- Vietnam Electric Vehicle Industry Research Report 2023-2032

- Thailand Automobile Tire Industry Research Report 2024-2033

- Vietnam Automobile Tire Industry Research Report 2024-2033

- Philippines Automobile Industry Research Report 2023-2032

- Mexico Automobile Industry Research Report 2023-2032

- Malaysia Automobile Industry Research Report 2023-2032

- Indonesia Automobile Industry Research Report 2023-2032

- Research Report on Thailand’s Automobile Industry, 2022-2031

- Research Report on Vietnam Automobile Industry 2022-2031

- Research Report on Automobile Industry in Southeast Asia, 2022-2031

Table of Contents

1 OVERVIEW OF MALAYSIA

1.1 Geographical situation

1.2 Demographic structure of Malaysia

1.3 Economic situation in Malaysia

1.4 Minimum Wage in Malaysia 2013-2023

1.5 Impact of COVID-19 on the Malaysian Automobile Industry

2 MALAYSIA AUTOMOBILE INDUSTRY OVERVIEW 2018-2023

2.1 History of Automobile Development in Malaysia

2.2 FDI in Malaysia’s automobile industry

2.3 Policy Environment of Malaysia’s Automobile Industry

3 MALAYSIA AUTOMOBILE INDUSTRY SUPPLY AND DEMAND STATUS

3.1 Malaysia Automobile Industry Supply Status

3.1.1 Automobile

3.1.2 By types

3.1.3 EV

3.2 Sales volume of Malaysia’s automobile

3.2.1 Automobile

3.2.2 By types

3.2.3 EV

4 MALAYSIA AUTOMOBILE INDUSTRY IMPORT AND EXPORT STATUS

4.2 Import Status of Malaysia’s Automobile Industry

4.1.1 Malaysia Automobile Import Volume and Import Value

4.1.2 Major Import Sources of Automobiles in Malaysia

4.2 Export Status of Malaysia’s Automobile Industry

4.2.1 Malaysia Automobile Export Volume and Export Value

4.2.2 Main Export Destinations of Malaysian Automobiles

5 COST AND PRICE ANALYSIS OF THE MALAYSIAN AUTOMOBILE INDUSTRY

5.1 Cost

5.1.1 Raw Materials

5.1.2 Labor Costs

5.1.3 Manufacturing Overhead

5.2 Price of automobile

6 MALAYSIA AUTOMOBILE INDUSTRY MARKET COMPETITION

6.1 Barriers to entry in Malaysia’s automobile industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Malaysia’s Automobile Industry

6.2.1 Bargaining Power of Automobile Suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in the Malaysian Automobile Industry

6.2.4 Potential Entrants in the Automobile Industry

6.2.5 Alternatives to Automobiles

7 ANALYSIS OF MAJOR AUTOMOBILE Brands IN MALAYSIA (Top 5 to 10 brands)

7.1 Perodua

7.1.1 Perodua Corporate Profile

7.1.2 Perodua Corporate Automobile Sales

7.2 Proton

7.2.1 Proton Corporate Profile

7.2.2 Proton Corporate Automobile Sales

7.3 Toyota.

7.3.1 Toyota of Honda Motor Co.

7.3.2 Toyota ., Ltd. Corporate Automobile Sales

7.4 Honda

7.4.1 Corporate Profile of Honda

7.4.2 Honda Corporate Automobile Sales

7.5 Mitsubishi

7.5.1 Mitsubishi Corporate Profile

7.5.2 Mitsubishi Corporate Automobile Sales

7.6 Mazda

7.6.1 Mazda Corporate Profile

7.6.2 Mazda Corporate Automobile Sales

7.7 Mercedes Benz

7.7.1 Mercedes Benz a Corporate Profile

7.7.2 Mercedes Benz Corporate Automobile Sales

7.8 Bmw Motor Corporation

7.8.1 Bmw Motor Corporation Corporate Profile

7.8.2 Bmw Motor Corporation Corporate Automobile Sales

7.9 Nissan

7.9.1 Nissan Corporate Profile

7.9.2 Nissan Corporate Automobile Sales

7.10 Isuzu

7.10.1 Isuzu Corporate Profile

7.10.2 Isuzu Corporate Automobile Sales

8 MALAYSIA AUTOMOBILE INDUSTRY OUTLOOK 2023-2032

8.1 Malaysia Automobile Industry Development Factors Analysis

8.1.1 Drivers and Development Opportunities for Malaysia’s Automobile Industry

8.1.2 Threats and Challenges to Malaysia’s Automobile Industry

8.2 Malaysia Automobile Industry Supply Forecast

8.3 Malaysia Automobile Market Demand Forecast

8.4 Malaysia Automobile Industry Import and Export Forecast

LIST OF CHARTS

Chart Total Population of Malaysia 2008-2022

Chart GDP per capita in Malaysia 2013-2022

Chart Automobile Industry Related Policies Issued by Government in Malaysia 2018-2023

Chart 2018-2022 Automobile Production in Malaysia

Chart 2018-2022 Domestic Consumption of Automobiles in Malaysia

Chart 2018-2022 Malaysia Automobile Import Volume

Chart 2018-2022 Malaysia Automobile Import Value

Chart 2018-2022 Malaysia Automobile Importing Countries and Import Value

Chart 2018-2022 Malaysia Automobile Export Volume

Chart 2018-2022 Malaysia Automobile Export Value

Chart 2018-2022 Malaysia Automobile Export Countries and Export Value

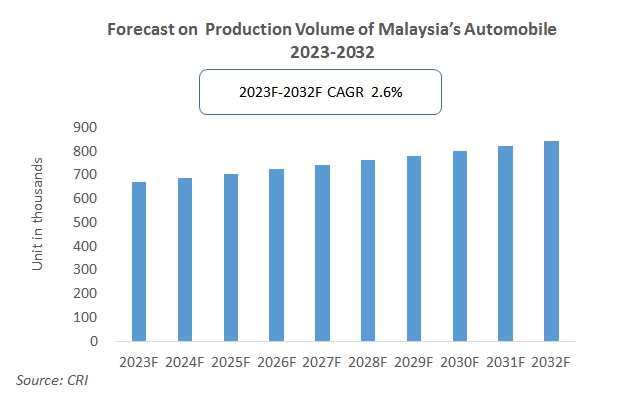

Chart 2023-2032 Malaysia Automobile Production Forecast

Chart Malaysia Automobile Market Size Forecast 2023-2032

Chart 2023-2032 Malaysia Automobile Import Forecast

Chart 2023-2032 Malaysia Automobile Export Forecast

Reviews

There are no reviews yet.