Minimally Invasive Surgery Overview

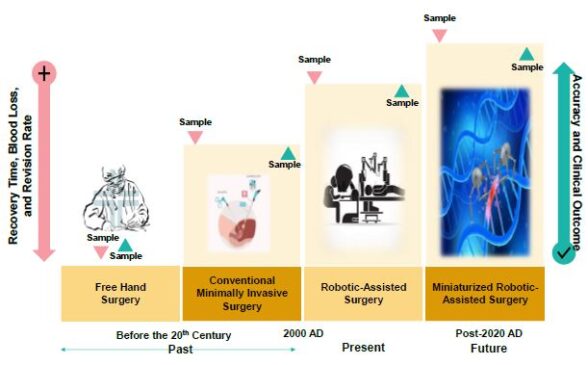

The past few decades have witnessed a slow yet significant transformation in the healthcare robotics market. The beginning of the transformation can be traced back to the 19th century. Technological advancements in surgical systems and instruments have led to major breakthroughs and disruptive phases in the healthcare landscape across the world.

These breakthroughs began with the invention of the cystoscope in 1805. In addition, Antoine Jean Desormeaux developed the endoscope for the examination of the urinary tract and bladder.

The first laparoscopic procedure was performed in 1901. The inventions of the digital camera further aided in the visualization of internal tracts. Thus, the preference for minimally invasive surgeries (MISs) continued to grow over the decades, which led to the emergence of robotic-assisted surgeries.

The idea of robotic-assisted MIS procedures has been conceptualized and is being driven by the increasing need for using multiple tools through multiple access ports to support MISS. The first da Vinci system by Intuitive Surgical, Inc. received FDA approval for general laparoscopic surgery in XX.

As of 2018, the number of MIS procedures conducted annually was XX million, out of which XX million were robotic assisted.

“The global minimally invasive surgical systems market is to be valued at $27,882.8 million in 2020 and is anticipated to reach $55,716.7 million by the end of 2031.”

What are Prohibitive and Inhibitive Factors for Minimally Invasive Surgery Market Growth?

The introduction of new technologies, practices, and methodologies has a significant impact on the global minimally invasive surgical systems market. Constant competition among market players ensures that leading players in the market are innovative in terms of the usability of the systems as well as their features.

Several factors, such as the shift in preference for safer options than open surgeries, increasing preference for instruments with more dexterity, increasing affordability, and technological advances in the field of artificial intelligence (AI), haptics, and telesurgery are expected to play a key role in the growth of the market during the forecast period.

The preference for minimally invasive surgical (MIS) procedures is expected to increase during the next ten years, with robotic-assisted surgeries quickly gaining the market share. Practices involving MIS procedures encompass a wide range of fields, including radiology, radio intervention, cardiology (and interventionalist cardiology), and arthroscopy, among others.

Furthermore, the growing demand for MIS is likely to be propelled through offering a more connected interface, motion scaling, and tremor filtration.

The high cost of surgical robotic systems is one of the key factors restraining the growth in the adoption of surgical robotics technology. The adoption of surgical robotic systems incurs high installation and maintenance costs.

Additionally, the lack of skilled professionals is a challenge to the growth of this market. Among the factors contributing to adverse events during robotic-assisted surgeries, user errors and inadequately trained surgeons cumulatively account for XX% share of the adverse events.

Who are key players on Minimally Invasive Surgery market?

Boston Scientific Corporation

Boston Scientific Corporation is a developer and marketer of medical devices used in a wide range of interventional medical specialties. The company markets its products to approximately XX hospitals, clinics, and medical offices in more than XX countries worldwide.

The company has seven core businesses, namely, interventional cardiology, cardiac rhythm management, endoscopy, urology and pelvic health, peripheral interventions, neuromodulation, and electrophysiology.

Boston Scientific Corporation acquired EndoChoice in 2016, which then became part of its endoscopy business. Additionally, Boston Scientific Corporation acquired Emcision Ltd. Also in March 2018, Boston Scientifc Corporation acquired EMcision Limited, to expand its endoscopy portfolio to include the Habib EndoHPB probe and novel endoscopic bipolar radiofrequency devices.

Arthrex Inc.

Asensus Surgical, Inc.

Conmed Corporation

Fujifilm Holdings Corporation

Intuitive Surgical, Inc.

Karl Storz SE & Co. KG

Medtronic plc

Olympus Corporation

Hoya Corporation (Pentax Medical)

Siemens Healthineers AG

Smith & Nephew plc

Sony Corporation

Stryker Corporation

Zimmer Biomet Holdings, Inc.

What are key findings in Global Minimally Invasive Surgical Systems Market: Focus on Product Type, Application, End Users, 25 Countries’ Data, Patent Scenario, and Competitive Landscape – Analysis and Forecast, 2021-2031?

▪ The growing demand for robotic surgeries has given rise to several R&D programs focused on handheld robotics.

▪ Over the next decade, companies are likely to focus on enhancing their manufacturing capacities as demand for surgeries is likely to grow at an ever-faster rate.

▪ Miniaturization of surgical instruments, especially robotic instruments, is expected to be the next big thing in surgical robotics. However, the development of new mechanisms to support the infrastructure for the same is likely to be challenging, if not impossible, to achieve.

▪ There is an ongoing shift toward single-use endoscopes.