Market Highlights

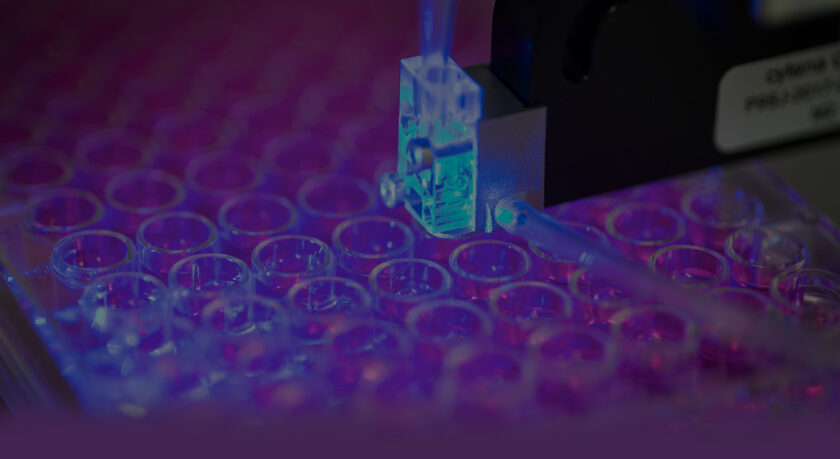

the global cell line development market is expected to register a CAGR of~12.5 from 2021 to 2027 and hold a value of ~USD 10,700million by 2027.

The global cell line development market is driven by the increasing R&D in the pharmaceutical and biopharmaceutical industry, focusing on cell line development. According to the National Institutes of Health (NIH), the federal spending on stem cell line research in 2017 was USD 1.58 billion. The developing economies are also contributing to the increasing R&D activities. For instance, the Indian government is supporting cell line development through national funding agencies like the Department of Biotechnology (DBT), the Department of Science and Technology (DST), Indian Council of Medical Research (ICMR).

Several market players are dominating the global cell line development market, contributing to a significant market share. The prominent players are involved in organic and inorganic strategies such as agreements, new product development &launches, joint ventures, mergers &acquisitions, and partnerships to sustain their market positions. For instance, in October 2019, ATCC launched a new authentication service that helps researchers easily confirm mouse cell lines’ identity. The service was developed in partnership with the National Institutes for Standards and Technology (NIST). The service demonstrates ATCC’s continued leadership in developing global biological standards.

Regional Analysis

Based on region, North America is anticipated to dominate the global cell line development market in the year 20120, owing to the factors such as the growing number of application of cell line development in new treatment pathway for various diseases such as cancer and other neurological diseases, well-established healthcare infrastructure, government support to accelerate research in biotechnology and biopharmaceutical industry, and presence of key players in this region involved in product launch, expansion, acquisition & strategic collaborations. For instance, in December 2016, Sartorius GmbH acquired cell line contractor Cellca. The company provides a laboratory that will provide room for expansion in the nearby research institutes.

On the other hand, Europe is expected to hold the second-largest position in the global cell line development market in 2020. Key factors attributing to the market growth are the launch of innovative technologies for cell line synthesis, an increase in various research for cell line development, and initiatives are taken by the government to support the R&D focused on cell line development. For instance, Lonza company based in Switzerland launched reformulated CHO media. The serum-free media is designed to help therapeutic protein manufacturers achieve higher titers.

Asia-Pacific is anticipated to be the fastest-growing regional market over the assessment period due to rapidly improving healthcare infrastructure, increasing demand for monoclonal antibodies to treat various diseases such as myocardial disease and cancer, among others, use of cell line for vaccine development by the companies and government support in regulating biotechnology products in this region.

Furthermore, the growth of the market in the rest of the world cell line development market is attributed to the technological advancements in cell line development, and high penetration of advanced healthcare technologies in research organizations focused on cell line development in Saudi Arabia and the UAE. Developing countries such as Brazil, Argentina, and Colombia, among others in Latin America, are also key contributors to the growth of the market.

Segmentation

The global cell line development market has been segmented into type,product, source and application.

By type, the market is segmented into primary cell line, hybridoma cell line, continuous cell line, recombinant cell line. Recombinant cell line is projected to hold major share in the year 2021, whereas primary cell line is anticipated to be the fastest growing segment during the forecast period. The recombinant cell line consists of recombinant DNA. The advances in rDNA technology offers enzymes, synthetic hormones immunobiological and anti-cancer agents that are contributing to the market growth of this segment. The growing demand for biopharmaceuticals and biosimilars across the globe will also enhance the demand for recombinant cell lines.

By product, the market has been segregated equipment, media & reagents, accessories &consumables. The equipment segment is estimated to hold majority of the share in the year 2021. The equipment market is further categorized into incubators, centrifuges, bioreactors, storage equipment, microscopes, and others. The media and reagents segment is expected to hold a considerable share of the market in 2021. Reagents and media are required from incubation to preservation of cell lines. These products are used repetitively in cell culture or bio-production.

Based on the source, the global cell line development market has been classified into mammalian and non mammalian cells.Mammalian cell line is dominating the market in the year 2021. This segment is expected to maintain its dominance throughout the study periodowing to the increased production of biologics drugs which require mammalian cells for development. The non mammalian cells are further subsegmented into insects and amphibians

By application,the cell line development market is classified into drug discovery, bioproduction, tissue engineering, and others. Bioproduction segment held the largest market share in 2020. Some of the key factors attributing to the market growth include increasing in-vitro research activities, growing safety and efficacy concerns about the product, growing adoption of biosimilars, and high demand for cellular medicines. Commonly used cell lines for the production of biologics are CHO, CHO-K1, GS-knockout CHO-K1, 293T, HEK293, 1321N1, 293EC18/CRE-Luc, 293EC18, U-2OS, and RH7777.

Key Players

Some of the key players in the global cell line development market are American Type Culture Collection (ATCC) (U.S.), Lonza Group AG (Switzerland), Thermo Fisher Scientific, Inc. (U.S.), GE Healthcare (U.S.), Sigma-Aldrich Corporation (U.S.), Selexis SA (Switzerland), Promega Corporation (US), Corning, Inc. (U.S.), WuXiAppTec, Inc. (China), and Sartorious AG (Germany).

Request a sample