“The global polyurethane-based foams in automotive market was valued at $10,710.0 million in 2020 and is expected to reach $19,798.3 million by 2031, growing at a CAGR of 5.77% between 2021 and 2031. ” according to CRI’s latested report: Polyurethane-Based Foams in Automotive Market – A Global and Regional Analysis: Focus on Type, Applications, End-User, and Country Analysis – Analysis and Forecast, 2021-2031

Polyurethane-based foams in automotive market Overview

The automotive sector is constantly evolving, with numerous technological advancements in the industry resulting in improved vehicle features and functions that improve the driving experience.

The car industry’s dynamic evolution can be related to a variety of factors, including changing consumer preferences, an increasing focus on driver safety, environmental concerns, and severe government laws focused on accident prevention to improve driver safety. Automotives have advanced rapidly in terms of vehicle performance, passenger safety, communication capabilities, and driving comfort during the last few years.

The development of new vehicle ideas is complicated by a number of variables. Customer needs for noise reduction, driving comfort, and aerodynamics are becoming increasingly difficult to meet.

Innovative lightweight construction materials such as polyurethane foams are employed to ensure that the created measures contribute as little weight to the vehicle as feasible while also meeting the customers’ high demands for chemical resistance and temperature stability.

Polyurethane is a preferred material for this because of its form and function flexibility, as well as its exceptional material properties. Polyurethane foams are becoming quite common in the automotive sector.

Polyurethane foams can be found almost anywhere due to their superior qualities compared to other materials. Polyurethane foams are by far the most important group of polymeric foams since their low density and thermal conductivity, along with their unique mechanical qualities, make them great thermal and acoustic insulators, as well as structural and comfort materials.

Despite the wide range of applications, polyurethane foams production is still heavily reliant on petroleum, requiring the sector to adapt to ever-stricter laws and demanding customers. As a result of the requirement to use renewable raw materials and new process technologies, well-established raw materials and process technologies may face a turning point in the near future.

The fundamental components of polyurethane foams production and the new issues that the polyurethane foams industry is projected to face in the near future with relation to process approaches and possible alternatives are examined.

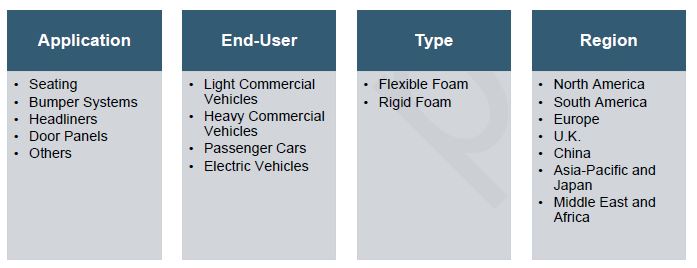

Polyurethane foam has five main application categories which are seating, bumper system, headliners, door panels, and others. among them seating application utilize largest share of polyurethane foam in average automotive vehicle. Because of their quality, polyurethane flexible foams are the current trend in the automotive seating industry. Polyurethane foams were designed to enhance the riding comfort of automotive vehicles.

Global Polyurethane-Based Foams in Automotive Market Coverage

The growth of a number of passenger vehicles demanding polyurethane foam have contributed to the growth of the market. However, the key potential factor for polyurethane foam is growing per capita income in low- and middle-income countries.

Production of passenger cars holds largest share amongst all other segments such as light commercial vehicles, heavy commercial vehicles, and electric vehicles. Polyurethane is widely used in the automotive industry for high-resilience foam seating, rigid foam insulation panels, B-pillars, headliners, suspension insulators, bumpers, and other interior sections.

Who are key players on Global polyurethane-based foams in automotive market?

Rogers Corporation is a manufacturer of specialized materials for various applications. The company operates through four reportable segments, namely, advanced connectivity solutions, elastomeric material solutions, power electronics solutions, and others.

Elastomeric material solutions offers PORON polyurethane foam. Through its product offerings, the company caters to various markets such as aerospace and defense, automotive, medical, footwear, wind and solar, portable electronics, and others. It has business operations in the Americas, APAC, and EMEA.

In October 2021, the company launched PORON AquaPro 37TS9, a new series of PORON AquaPro polyurethane product portfolio. The product has the ability to protect and safeguard sensitive electronic components from both water ingress and impact.

Rogers Corporation’s elastomeric material solutions has administrative and manufacturing facilities in Moosup, Connecticut; Rogers, Connecticut; Woodstock, Connecticut; Bear, Delaware; Carol Stream, Illinois; Narragansett, Rhode Island; Ansan, South Korea; and Suzhou, China.

More details can be found: Polyurethane-Based Foams in Automotive Market – A Global and Regional Analysis: Focus on Type, Applications, End-User, and Country Analysis – Analysis and Forecast, 2021-2031

Other players in the report

Huntsman International LLC

Dow

Recticel NV/SA

Foam Supplies, Inc.

Huebach Corporation

Caligen Europe B.V.

Vita (Holdings) Limited

Bridgestone Corporation

M/s Sheela Foam Ltd.

Saint-Gobain

Greiner AG

Interplasp

UFP Technologies, Inc.

Covestro AG

Key Questions Answered

• What are the major factors and trends impacting the polyurethane-based foams in automotive market, and how has COVID-19 affected the market?

• What are the steps taken by the existing players to improve their market positioning, and is there any substitute used in the end-use industry for polyurethane-based foam?

• Which are the leading types and applications in the market, and how are they expected to perform in the coming years?

• What are the latest developments across the globe with respect to research and development, and what would be the trending technology used in the polyurethane-based foams in automotive market?

• What are the consumption patterns of polyurethane-based foam across different regions and countries? Moreover, is there any government regulation across the globe impacting the polyurethane-based foams in automotive market?