High Purity Alumina market to Surge at 18.99% CAGR, which is anticipated to reach USD 14.69 billion by 2030.

CRI Report has released a report titled “High Purity Alumina Market – Analysis of Market Size, Share & Trends for 2020 – 2030 and Forecasts to 2030” which is anticipated to reach USD 14.69 billion by 2030. According to a study by CRI Report, the market is anticipated to portray a CAGR of 18.99% between 2020 and 2030. The falling prices of LEDs, rising consumer awareness of its cost-effectiveness and eco-friendly aspect, and expanding use in the automotive sector for applications like adaptive driving are all key factors driving market growth. Over the projection period, the expansion of the LED market is expected to have a beneficial impact on HPA consumption.

The market report on the High Purity Alumina market includes in-depth insights as:

- The estimated value of the market was USD 2.58 billion in the year 2020.

- Region-wise, the market in Asia-Pacific which held the largest market share in the year 2020, emerged as a key market for High Purity Alumina market.

- Based on Product, 4N emerged as a key segment in the High Purity Alumina market.

- Based on Application, the LED segment emerged as a key segment in the High Purity Alumina market.

- Key players are likely to focus on product innovations and expansion through mergers to retain their positions in developed markets.

“An important driver for the high purity alumina industry is the rising manufacturing of electric vehicles (EVs). The demand for lithium-ion batteries is rising as the number of electric vehicles (EVs) grows. As HPA is used to coat lithium-ion battery separators, this has resulted in rapid HPA consumption.”, according to this report

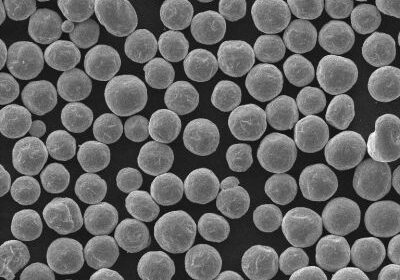

High purity alumina (HPA) is a type of aluminum oxide with a high purity (Al2O3). High Purity Alumina is a crucial component used in the manufacturing of synthetic sapphire. It is a high-value, high-margin, and high-demand commodity. Synthetic sapphire is used to make substrates for LED lights, semiconductor wafers for the electronics industry, and scratch-resistant sapphire glass for wristwatch faces, optical windows, and smartphone components. In the production of synthetic sapphire, there is no substitute for HPA. HPA is increasingly being utilized as a separator sheet coating in lithium-ion batteries.

High Purity Alumina market is segmented by Products 4N, 5N, 6N. Among these, the 4N category dominated the market in 2020. LED bulbs and electrical displays are the most popular uses for 4N HPA. Leading firms in this market are increasing their R&D expenditures in order to provide product customization to meet the needs of certain application areas. During the forecast period, the market for 4N HPA is projected to be driven by government support, which will lead to increased use of LEDs and lower costs than other types of HPA.

Key Players in the Market

- Some of the key players operating in the High Purity Alumina market are Sumitomo Chemical Co. Ltd., Nippon Light Metal Holdings Co. Ltd., Altech Chemicals Ltd., Bakowski, Pure Alumina, Zibo Honghe Chemical Co. Ltd., AEM Canada, Bakowski SAS, Alcoa Inc., Norsk Hydro ASA.

Get Valuable Insights into High Purity Alumina market

In the new report, CRI Report thrives to present an unbiased analysis of the High Purity Alumina market that covers the historical demand data as well as the forecast figures for the period, i.e., 2020-2030. The study includes compelling insights into growth that is witnessed in the market. The market is segmented by Product Outlook into 4N, 5N, 6N. By Application Outlook into LED, Semiconductor, Phosphor, Sapphire, Lithium-ion battery, Others. Geographically, the market is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East, and Africa.