CRI Insights on Contech Vietnam 2023 and Construction Machinery Industry Trend in Vietnam

Construction Machinery Industry Trend in Vietnam

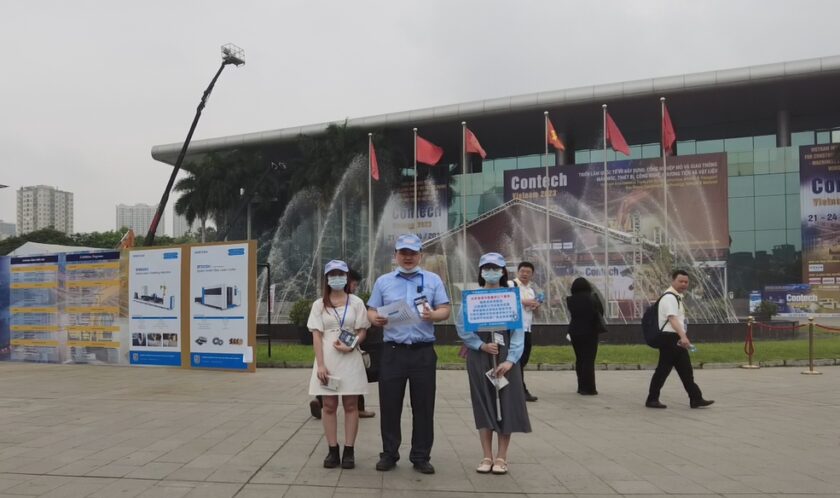

CRI team visits Contech Vietnam 2023

Contech Vietnam 2023 Vietnam Construction Machinery Exhibition was held at the National Architecture and Planning Exhibition Hall in Hanoi, the capital of Vietnam, from April 21 to 24, 2023. More than 100 companies from all over the world participated in the exhibition.

Colleagues from CRI (元哲咨询) went to Vietnam from Shanghai, visited the exhibition, interviewed more than 20 exhibitors, and recorded videos, including Vietnamese local enterprises, Chinese-funded enterprises, and Malaysian enterprises and other projects in the South Vietnam market Machinery-related companies.

On April 23, 2023, the colleagues of Yuanzhe Consulting went to the site of Contech Vietnam 2023.

Our Staff interviewed and communicated with the heads of more than 20 construction machinery companies at the Contech 2023 exhibition site, including local Vietnamese companies and Chinese companies. Brands and talks about the future development prospects of Vietnam’s construction machinery industry.

Vietnam Construction Machinery Market Size

According to the forecast of CRI Report, with the growth of Vietnam’s economy and the acceleration of infrastructure construction, the market size of Vietnam’s construction machinery will reach about 9.4 billion US dollars in 2032, and the compound annual growth rate (CAGR) from 2023 to 2032 will reach as high as 18%.

According to the research conducted by CRI Team on exhibitors, most companies are optimistic about the development prospects of Vietnam’s construction machinery industry and plan to invest more human resources and capital in the Vietnamese market.

According to the analysis of CRI Report, Vietnam’s construction machinery industry started relatively late and did not start to develop until the 1980s. At that time, the Vietnamese government began to implement economic reform policies and introduced a large amount of foreign capital, including construction machinery manufacturing enterprises. With the rapid development of Vietnam’s economy in recent years, the construction of infrastructure, such as roads, bridges, and urban rail transit, has accelerated, and Vietnam’s construction machinery industry has also accelerated its development.

On the one hand, Vietnam has gradually become an important construction machinery consumer market. At the same time, due to the low cost of production factors such as human resources, land, and energy in Vietnam, more and more foreign-funded enterprises have entered Vietnam’s construction machinery industry and established machine assembly enterprises or construction machinery parts manufacturing enterprises. The products of these enterprises are not only sold in Vietnam, but also exported to all over the world.

Major Construction Machinery Enterprises in Vietnam

According to the analysis of CRI Report, the major enterprises in Vietnam’s construction machinery industry are as follows:

Vinacomin Machinery Company : Founded in 1993, it is a local Vietnamese company that mainly produces mining machinery and construction machinery.

Sao Mai Machinery Company : Founded in 1990, it is a local Vietnamese company that mainly produces construction machinery and mining machinery.

Doosan Vietnam Company : Founded in 2006, it is a subsidiary of South Korean Doosan Group in Vietnam, mainly producing heavy machinery and equipment.

Hitachi Construction Machinery Vietnam Company : Established in 2012, it is a subsidiary of the Japanese Hitachi Group in Vietnam, mainly producing excavators, bulldozers and other construction machinery.

Caterpillar Vietnam : Founded in 1994, it is a subsidiary of American Caterpillar in Vietnam. It mainly produces excavators, bulldozers and other construction machinery.

Import and Export Status of Vietnam construction machinery industry

According to the analysis of CRI Report, Vietnam’s construction machinery industry currently relies heavily on imports, and complete machines and parts are mainly imported from China, Japan, South Korea and other countries. However, according to Yuanzhe Consulting’s interviews with construction machinery companies in the Vietnamese market, more and more construction machinery companies plan to set up factories in Vietnam. Therefore, it is expected that in 2023-2032, the dependence of Vietnam’s construction machinery industry on imported products will gradually decrease.

Research Report on Southeast Asia Construction Machinery Industry 2023-2032

Topics Covered

- Southeast Asia Construction Machinery Industry Status and Major Sources in 2018-2022

- What is the Impact of COVID-19 on Southeast Asia Construction Machinery Industry?

- Which Companies are the Major Players in Southeast Asia Construction Machinery Industry Market and What are their Competitive Benchmarks?

- Key Drivers and Market Opportunities in Southeast Asia Construction Machinery Industry

- What are the Key Drivers, Challenges, and Opportunities for Southeast Asia Construction Machinery Industry during 2023-2032?

- What is the Expected Revenue of Southeast Asia Construction Machinery Industry during 2023-2032?

- What are the Strategies Adopted by the Key Players in the Market to Increase Their Market Share in the Industry?

- What are the Competitive Advantages of the Major Players in Southeast Asia Construction Machinery Industry Market?

- Which Segment of Southeast Asia Construction Machinery Industry is Expected to Dominate the Market in 2032?

- What are the Major Adverse Factors Facing Southeast Asia Construction Machinery Industry?

Full Report: Research Report on Southeast Asia Construction Machinery Industry 2023-2032