Description

Indonesia Washing Machine Industry

Washing machines are household appliances that are widely used to wash clothes using detergents. They include semi-automatic and fully automatic machines that can assist in washing, rinsing and drying without the need to supervise different operations. They can save time and are easier to clean, operate and maintain than other electrical equipment.

They are currently available in a variety of sizes and styles, depending on budget, lifestyle and the size of the user’s home. The increasing purchasing power of washing machines and rising income levels of individuals across the world are currently one of the key factors driving the market. Moreover, the demand for home washing machines is also increasing due to the rising electrification in rural areas.

As Indonesia’s economy develops, disposable income increases and consumption levels rise, the penetration rate of washing machines gradually increases, and consumer demand for washing machines gradually changes from a single cleaning tool to one with diverse functions. According to CRI’s analysis, the penetration rate of washing machines in Indonesia is low and there is huge room for development.

Indonesia’s cheap labor, low land costs and favorable policy subsidies have attracted global washing machine manufacturers to invest in Indonesia. This follows Toshiba’s $39 million investment in a washing machine plant in East Jakarta, aimed at increasing its sales revenue outside of Japan, and Sharp Electronics’ Rp1.2 trillion investment in a new plant in Karawang, West Java, which will more than double the company’s current production capacity in Indonesia for refrigerators and washing machines.

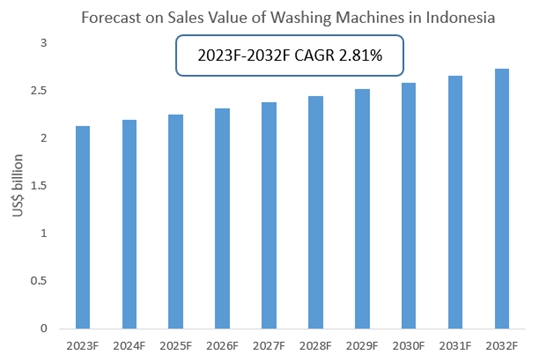

Due to increasing modernization and technological advancements, Indonesia washing machine market is expected to grow at a CAGR of 2.81% during the forecast period to reach USD 2.45 billion by 2028, according to an analysis by CRI. Moreover, growing urbanization, product innovation, and increasing revenues are expected to boost the Indonesian washing machine market during the forecast period.

According to CRI, the sales value of washing machines will reach US$ 2.73 billion in 2032 and the CAGR in 2023 to 2032 is 2.81%.

Topics covered:

- Indonesia Washing Machine Industry Overview

- The economic and policy environment of the washing machine industry in Indonesia

- What is the impact of COVID-19 on the Indonesian washing machine industry?

- Indonesia Washing Machine Industry Market Size 2023-2032

- Analysis of major Indonesian washing machine industry manufacturers

- Key drivers and market opportunities for the washing machine industry in Indonesia

- What are the key drivers, challenges and opportunities for the Washing Machine industry in Indonesia during the forecast period of 2023-2032?

- Which are the key players in Indonesia Washing Machine industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia Washing Machine Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia Washing Machine Industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the washing machine industry in Indonesia?

Table of Contents

1 Overview of Indonesia

1.1 Geographical situation

1.2 Demographic structure of Indonesia

1.3 Economic situation in Indonesia

1.4 Minimum Wage in Indonesia 2013-2022

1.5 Impact of COVID-19 on the Indonesian washing machine industry

2 Indonesia Washing Machine Industry Overview

2.1 History of washing machine development in Indonesia

2.2 FDI in Indonesian washing machine industry

2.3 Policy Environment of Indonesian Washing Machine Industry

3 Indonesia washing machine industry supply and demand situation

3.1 Indonesia washing machine industry supply situation

3.2 Indonesia Washing Machine Industry Demand Situation

4 Indonesia washing machine industry import and export status

4.1.1 Indonesia washing machine import volume and import value

4.1.2 Main import sources of washing machines in Indonesia

4.2 Indonesia washing machine industry export status

4.2.1 Indonesia washing machine export volume and export value

4.2.2 Main Export Destinations of Indonesian Washing Machines

5 Cost analysis of Indonesian washing machine industry

6 Market competition in the Indonesian washing machine industry

6.1 Barriers to entry in the Indonesian washing machine industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Indonesian Washing Machine Industry

6.2.1 Bargaining power of washing machine suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in the Indonesian washing machine industry

6.2.4 Potential Entrants in the Washing Machine Industry

6.2.5 Alternatives to washing machines

7 Indonesia Major Washing Machine Manufacturers and Sales Companies Analysis

7.1 PT. LG Electronics Indonesia.

7.1.1 Corporate Profile of PT. LG Electronics Indonesia

7.1.2 PT. LG Electronics Indonesia Corporate Refrigerator Sales

7.2 PT . Lx Pantos Indonesia.

7.2.1 PT . Lx Pantos Indonesia. corporate profile

7.2.2 PT . Lx Pantos Indonesia. enterprise refrigerator sales

7.3 PT . Phc Indonesia .

7.3.1 PT . Phc Indonesia. corporate profile

7.3.2 PT . Phc Indonesia. enterprise refrigerator sales

7.4 PT . Lx Pantos Indonesia Kawasan Industries

7.4.1 PT . Lx Pantos Indonesia Kawasan Industries Corporate Profile

7.4.2 PT . Lx Pantos Indonesia Kawasan Industries Enterprise Refrigerator Sales

7.5 Midea Electric Trading Singapure. Indonesia Trading Company.

7.5.1 Midea Electric Trading Singapure. Indonesia Trading Company. corporate profile

7.5.2 Midea Electric Trading Singapure. Indonesia Trading Company. Enterprise Refrigerator Sales

7.6 PT Surya Alam Tunggal. Indonesia.

7.6.1 Corporate Profile of PT Surya Alam Tunggal. Indonesia.

7.6.2 PT Surya Alam Tunggal. Indonesia. Enterprise Refrigerator Sales

7.7 Aqua/Sanyo

7.7.1 Aqua/Sanyo Corporate Profile

7.7.2 Aqua/Sanyo Corporate Refrigerator Sales

7.8 Polytron

7.8.1 Polytron Corporate Profile

7.8.2 Polytron Enterprise Refrigerator Sales

7.9 Sharp

7.9.1 Sharp Company Profile

7.9.2 Sharp Enterprises’ Refrigerator Sales

7.10 Panasonic

7.10.1 Panasonic Corporate Profile

7.10.2 Panasonic Corporate Refrigerator Sales

8 Indonesia Washing Machine Industry Outlook 2023-2032

8.1 Indonesia Washing Machine Industry Development Factors Analysis

8.1.1 Driving Forces and Development Opportunities in Indonesia’s Washing Machine Industry

8.1.2 Threats and Challenges to Indonesia’s Washing Machine Industry

8.2 Indonesia Washing Machine Industry Supply Forecast

8.3 Indonesia Washing Machine Market Demand Forecast

8.4 Indonesia Washing Machine Industry Import and Export Forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.