Description

Indonesia Plastic Industry

Indonesia, located in Southeast Asia, is the fourth most populous country in the world with a population exceeding 270 million. It is the largest economy in ASEAN and has the largest consumer base in Southeast Asia. The growth of Indonesia’s plastic industry has been fueled by the continuous growth of the Indonesian economy.

Indonesia’s GDP per capita has been growing, with a compound annual growth rate of 3.9% from 2014 to 2023, reaching US$ 4,914 in 2023, an increase of 2.7% year-over-year. In 2023, Indonesia’s real GDP was US$ 1.41 trillion, calculated at constant 2010 market prices, an increase of 5.05% year-over-year, although this was a 0.3% decrease from 2022. Despite a slight slowdown, Indonesia’s GDP growth rate remains well above the global rate of 2.6%.

The Indonesian plastic and plastic products industry is gradually recovering. In 2022, Indonesia’s imports of plastics and their products increased by 17.9% year-over-year, reaching US$11.2 billion, making it the 19th largest importer of plastics and their products globally. According to CRI analysis, plastics and their products are the fifth largest import category for Indonesia. Indonesia’s imports of plastics and their products mainly come from China (US$ 3.45 billion), Singapore (US$ 1.26 billion), Thailand (US$ 1.24 billion), South Korea (US$ 1 billion), and Malaysia (US $960 million).

In terms of exports, Indonesia’s exports of plastic raw materials and products have been trending upwards. In 2022, exports of plastics and their products amounted to US$ 3.13 billion, making Indonesia the 39th largest exporter of plastics and their products globally, a year-over-year increase of 20.4%. According to CRI analysis, Japan, China, Vietnam, Malaysia, and the United States are the top five export destinations for Indonesian plastic raw materials and products.

Plastics and plastic products in Indonesia are used extensively across various industries including packaging, construction, electronics, and automotive manufacturing. Driven by Indonesia’s continued economic development and population growth, the domestic consumer market is expected to continue expanding in the medium to long term. Moreover, as the penetration of e-commerce accelerates in Indonesia, the demand for plastic packaging is expected to remain strong. Additionally, growing demand from end-user industries such as electrical and electronics and the construction sector is expected to drive growth in the Indonesian plastic market.

To control environmental issues caused by disposable plastic products, the Indonesian government has issued a policy to phase out the use of various single-use plastic products by the end of 2029, including polystyrene foam used in food packaging, disposable plastic cutlery, plastic straws, plastic shopping bags, multi-layer packaging films, and small plastic packaging bags.

Despite the Indonesian government’s stringent environmental policies, which impose certain restrictions on the use of plastics, the long-term growth potential for the Indonesian plastic industry remains significant. The industry is expected to grow significantly through investments from both FDI and domestic companies, focusing on the development and production of environmentally friendly plastic products to mitigate policy impacts on the Indonesian plastic industry.

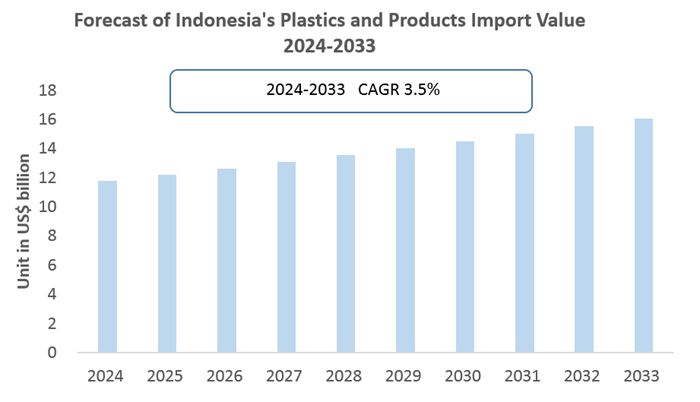

CRI predicts that there are substantial investment opportunities for foreign investors in the Indonesian plastic industry. Imports of plastics and their products are expected to continue growing in the coming years, with imports projected to reach US$ 16.08 billion by 2033, achieving a compound annual growth rate (CAGR) of 3.5% from 2024 to 2033.

Topics covered:

- Overview of the Indonesian Plastic Industry

- Economic and Policy Environment of the Indonesian Plastic Industry

- How Foreign Investment Enters the Indonesian Plastic Industry

- Market Size of the Indonesian Plastic Industry from 2024 to 2033

- Analysis of Major Plastic Industry Manufacturers in Indonesia

- Key Drivers and Market Opportunities for the Indonesian Plastic Industry

- Main Drivers, Challenges, and Opportunities for the Indonesian Plastic Industry during the 2024-2033 Forecast Period

- Who are the key players in the Indonesian plastic industry market, and what are their competitive advantages?

- Expected revenue for the Indonesian Plastic Industry Market during the 2024-2033 forecast period

- What strategies have major players adopted to increase their market share in the industry?

- Which segment of the Indonesian plastic industry market is expected to dominate by 2032?

- Major adverse factors facing the Indonesian plastic industry

Related Reports:

Philippines Plastic Industry Research Report 2024-2033

Malaysia Plastic Industry Research Report 2024-2033

Mexico Plastic Industry Research Report 2024-2033

Vietnam Plastic Industry Research Report 2024-2033

Research Report on Southeast Asia Plastic Packaging Industry 2023-2032

Table of Contents

1 Overview of Indonesia

1.1. Geography

1.2. Population Structure

1.3. Economic Overview

1.4. Minimum Wage Standards (2015-2024)

1.5. Impact of COVID-19 on the Plastic Industry

2 Development Environment of the Indonesian Plastic Industry

2.1. Historical Development

2.2. Types of Plastics Available

2.3. Policy Framework

3 Supply and Demand Dynamics in the Indonesian Plastic Industry

3.1. Supply Analysis

3.1.1. Production Capacity

3.1.2. Production Volume

3.2. Demand Analysis

3.2.1. Volume of Demand

3.2.2. Market Size

4 Import and Export Conditions of Indonesian Plastic Industry

4.1. Import Overview

4.1.1. Import Volume and Value

4.1.2. Primary Sources of Imports

4.2. Export Overview

4.2.1. Export Volume and Value

4.2.2. Key Export Destinations

5 Market Competition Analysis

5.1. Entry Barriers of Indonesian Plastic Industry

5.1.1. Brand Recognition

5.1.2. Quality Standards

5.1.3. Capital Investment

5.2. Competitive Landscape

5.2.1. Supplier Bargaining Power

5.2.2. Consumer Bargaining Power

5.2.3. Industry Competition

5.2.4. New Entrants

5.2.5. Substitutes

6 Analysis of Major Plastic Brands in Indonesia

6.1. Asahimas Chemical Company

6.2. BASF SE

6.3. Lotte Chemical Titan Holding Berhad

6.4. PT INNAN

6.5. PT Pertamina (Persero)

6.6. PT Polychem Indonesia Tbk

6.7. PT Chandra Asri Petrochemical

6.8. LyondellBasell Industries Holdings BV

6.9. PT Standard Toyo Polymer (Tosoh Corporation)

6.10. Sulfindo Adiusaha

Each entry includes development history, main products, and operational model.

7 2024-2033 Outlook for the Indonesian Plastic Industry

7.1. Development Factors

7.1.1. Growth Drivers and Opportunities

7.1.2. Challenges and Threats

7.2. Supply Forecast

7.3. Demand Forecast

7.4. Import and Export Projections

List of Charts

Chart: Total Population of Indonesia (2009-2023)

Chart: Per Capita GDP of Indonesia (2014-2023)

Chart: Government Policies Related to the Plastic Raw Material Industry (2019-2023)

Chart: Production of Plastic Raw Materials in Indonesia (2019-2023)

Chart: Domestic Consumption of Plastic Raw Materials in Indonesia (2019-2023)

Chart: Import Volume of Plastic Raw Materials in Indonesia (2019-2023)

Chart: Import Value of Plastic Raw Materials in Indonesia (2019-2023)

Chart: Importing Countries and Values for Plastic Raw Materials in Indonesia (2019-2023)

Chart: Export Volume of Plastic Raw Materials and Products from Indonesia (2019-2023)

Chart: Export Value of Plastic Raw Materials and Products from Indonesia (2019-2023)

Chart: Exporting Countries and Values for Plastic Raw Materials from Indonesia (2019-2023)

Chart: Production Forecast for Plastic Raw Materials in Indonesia (2024-2033)

Chart: Forecast of Domestic Market Size for Plastic Raw Materials in Indonesia (2024-2033)

Chart: Import Forecast for Plastic Raw Materials in Indonesia (2024-2033)

Chart: Export Forecast for Plastic Raw Materials in Indonesia (2024-2033)

Reviews

There are no reviews yet.