Description

Indonesia Motorcycle Industry

A motorcycle is a two- or three-wheeled vehicle driven by a gasoline engine and steered by the front wheel by a handlebar, which is light, flexible and fast. According to CRI’s analysis, Southeast Asia is the region with the highest per capita motorcycle ownership in the world, and Indonesia is the third largest motorcycle market in the world, after China and India.

The Indonesian two-wheeler market can be categorized on the basis of vehicle type, engine capacity, and region. In terms of vehicle type segment, the market is segmented into scooters, motorcycles, and mopeds. According to CRI’s analysis, scooters accounted for the largest market share in the Indonesia two-wheeler market in 2019 and this segment is also expected to dominate the market during the forecast period. In terms of engine capacity segment, the vehicles are classified into less than 150 cc, between 151 cc and 250 cc, and more than 250 cc.

According to CRI, light scooters are the most popular among Indonesians, with engines below 150 cc, and are expected to continue dominating the market during the forecast period.

The motorcycle market in Indonesia is dominated by Japanese manufacturers. These manufacturers produce motorcycles in Indonesia and then export their products, with a market share of over 95%. The leading motorcycle companies in Indonesia are Honda, Yamaha, Kawasaki, and Suzuki.

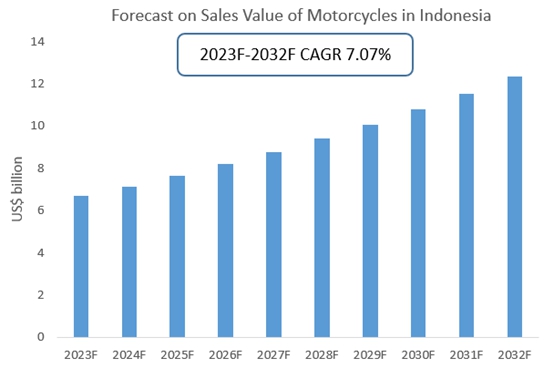

Due to the increasing demand for economic transportation modes, CRI forecasts that the two-wheeler market in Indonesia will reach USD 8.78 billion in sales by 2027, growing at a CAGR of 7.07% from 2023-2027. Increasing disposable income, rising demand for cheaper personal transportation, increasing number of female riders, improving road infrastructure, and increasing availability of credit and loan facilities are the key factors for the growth of the two-wheeler market in Indonesia.

According to CRI, the sale value of motorcycles will reach US$ 12.35 billion in 2032 and the CAGR in 2023 to 2032 is 7.07%.

Topics covered:

- Indonesia Motorcycle Industry Overview

- Economic and Policy Environment of the Motorcycle Industry in Indonesia

- What is the impact of COVID-19 on the Indonesian motorcycle industry?

- Indonesia Motorcycle Industry Market Size, 2023-2032

- Analysis of major Indonesian motorcycle industry producers

- Key Drivers and Market Opportunities in Indonesia’s Motorcycle Industry

- What are the key drivers, challenges and opportunities for the Indonesian motorcycle industry during the forecast period 2023-2032?

- Which are the key players in the Indonesian Motorcycle Industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia Motorcycle Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesian motorcycle industry market is expected to dominate the market in 2032?

- What are the main negative factors facing the motorcycle industry in Indonesia?

Table of Contents

1 Overview of Indonesia

1.1 Geographical situation

1.2 Demographic structure of Indonesia

1.3 Economic situation in Indonesia

1.4 Minimum Wage in Indonesia 2013-2022

1.5 Impact of COVID-19 on the Indonesian motorcycle industry

2 Indonesia Motorcycle Industry Overview

2.1 History of Motorcycle Development in Indonesia

2.2 FDI in Indonesia’s motorcycle industry

2.3 Policy Environment of Indonesia Motorcycle Industry

3 Indonesia motorcycle industry supply and demand situation

3.1 Indonesia motorcycle industry supply situation

3.2 Indonesia motorcycle industry demand situation

4 Indonesia motorcycle industry import and export status

4.1.1 Indonesia Motorcycle Import Volume and Import Value

4.1.2 Indonesia’s main sources of motorcycle imports

4.2 Indonesia Motorcycle Industry Export Status

4.2.1 Indonesia Motorcycle Export Volume and Export Value

4.2.2 Major export destinations of Indonesian motorcycles

5 Indonesia Motorcycle Industry Cost Analysis

6 Indonesia motorcycle industry market competition

6.1 Barriers to entry in the Indonesian motorcycle industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Indonesia Motorcycle Industry

6.2.1 Bargaining power of motorcycle suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in the Indonesian Motorcycle Industry

6.2.4 Potential entrants in the motorcycle industry

6.2.5 Alternatives to motorcycles

7 Analysis of major motorcycle companies in Indonesia

7.1 Honda

7.1.1 Honda Company Profile

7.1.2 Honda Motorcycle Production and Sales

7.2 Yamaha

7.2.1 Yamaha Corporate Profile

7.2.2 Yamaha Motorcycle Production and Sales

7.3 Suzuki

7.3.1 Suzuki Corporate Profile

7.3.2 Suzuki Motorcycle Production and Sales

7.4 Kawasaki

7.4.1 Kawasaki corporate profile

7.4.2 Kawasaki motorcycle production and sales

7.5 TVS

7.5.1 TVS Company Profile

7.5.2 TVS Motorcycle Production and Sales

7.6 KTM

7.6.1 KTM Corporate Profile

7.6.2 KTM Motorcycle Production and Sales

7.7 Bajaj

7.7.1 Bajaj Corporate Profile

7.7.2 Bajaj Motorcycle Production and Sales

7.8 Harley Davidson

7.8.1 Harley Davidson Corporate Profile

7.8.2 Harley Davidson Motorcycle Production and Sales

8 Indonesia Motorcycle Industry Outlook 2023-2032

8.1 Indonesia Motorcycle Industry Development Factors Analysis

8.1.1 Drivers and Development Opportunities for Indonesia’s Motorcycle Industry

8.1.2 Threats and Challenges to Indonesia’s Motorcycle Industry

8.2 Indonesia Motorcycle Industry Supply Forecast

8.3 Indonesia Motorcycle Market Demand Forecast

8.4 Indonesia Motorcycle Industry Import and Export Forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.