Description

Indonesia Electric Vehicle Industry

As the largest economy in Southeast Asia, Indonesia is becoming a key country in global electric vehicle (EV) production. According to Yuan Ze Consulting, Indonesia will produce 2.2 million electric vehicles by 2030. Indonesia is rich in nickel natural resources, with up to 52% of the world’s nickel resources. This puts the country in a key position in the global battery production supply chain.

The Indonesian government strongly supports the development of the electric vehicle industry, and the government plans to build an all-electric bus fleet for Jakarta’s metropolitan public transportation system in less than seven years, requiring 14,000 electric buses to achieve this goal. State-owned electric utility PLN has also committed to installing 31,000 additional electric vehicle charging stations by 2030. PLN has provided $3.7 billion in commercial and public sector investments in Indonesia to meet its 10-year commitment.

In addition, various government programs to increase the capacity of electric vehicles are underway. Various government support policies have also attracted a number of international automotive giants to Indonesia. Hyundai and LG, two Korean conglomerates, have signed a memorandum of understanding with the Indonesian government to form a joint venture company in Karawang, West Java specializing in electric vehicle battery production. The $1.1 billion company plans to produce more than 150,000 electric car batteries annually.

In addition, the Indonesian government is attempting to reduce emissions by 29% over the ne

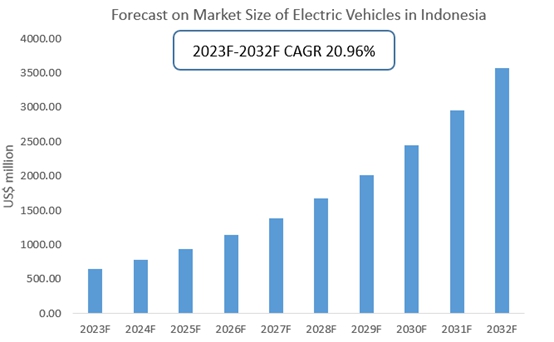

xt decade, which is also conducive to the rapid growth of the electric vehicle market. CRI forecasts that electric vehicle sales in Indonesia will surge in the coming years. Electric passenger car sales are expected to reach 250,000 units in 2030, accounting for 16 percent of all new passenger car sales, while demand for electric motorcycles is expected to reach 1.9 million units, accounting for 30 percent of all new two-wheelers sold. CRI expects the market size of electric vehicles in Indonesia to reach USD 2.02 billion by 2029, growing at a CAGR of 20.96% from 2022-2029.

According to CRI, the market size of electric vehicles industry will reach US$ 3575.26 million in 2032 and the CAGR in 2023 to 2032 is 20.96%.

Topics covered:

- Indonesia Electric Vehicle Industry Overview

- The Economic and Policy Environment of the Electric Vehicle Industry in Indonesia

- What is the impact of COVID-19 on the electric vehicle industry in Indonesia?

- Indonesia Electric Vehicle Industry Market Size 2023-2032

- Analysis of major Indonesian electric vehicle industry manufacturers

- Key Drivers and Market Opportunities in Indonesia’s Electric Vehicle Industry

- What are the key drivers, challenges and opportunities for Indonesia’s electric vehicle industry during the forecast period 2023-2032?

- Which companies are the key players in the Indonesian Electric Vehicle industry market and what are their competitive advantages?

- What is the expected revenue of Indonesia Electric Vehicle Industry market during the forecast period 2023-2032?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Indonesia Electric Vehicle Industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the electric vehicle industry in Indonesia?

Table of Contents

1 Overview of Indonesia

1.1 Geographical situation

1.2 Demographic structure of Indonesia

1.3 Economic situation in Indonesia

1.4 Minimum Wage in Indonesia 2013-2022

1.5 Impact of COVID-19 on the Indonesian Electric Vehicle Industry

2 Indonesia Electric Vehicle Industry Overview

2.1 History of Electric Vehicle Development in Indonesia

2.2 FDI in Indonesia’s electric vehicle industry

2.3 Policy Environment of Indonesia’s Electric Vehicle Industry

3 Indonesia Electric Vehicle Industry Supply and Demand Status

3.1 Indonesia Electric Vehicle Industry Supply Status

3.2 Indonesia Electric Vehicle Industry Demand Situation

4 Indonesia Electric Vehicle Industry Import and Export Status

4.1.1 Indonesia Electric Vehicle Import Volume and Import Value

4.1.2 Major Import Sources of Electric Vehicles in Indonesia

4.2 Export Status of Indonesia’s Electric Vehicle Industry

4.2.1 Indonesia Electric Vehicle Export Volume and Export Value

4.2.2 Main Export Destinations of Indonesian Electric Vehicles

5 Cost analysis of the Indonesian electric vehicle industry

6 Indonesia Electric Vehicle Industry Market Competition

6.1 Barriers to entry in Indonesia’s electric vehicle industry

6.1.1 Brand barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Indonesia’s Electric Vehicle Industry

6.2.1 Bargaining Power of Electric Vehicle Suppliers

6.2.2 Consumer bargaining power

6.2.3 Competition in the Indonesian Electric Vehicle Industry

6.2.4 Potential Entrants in the Electric Vehicle Industry

6.2.5 Alternatives to Electric Vehicles

7 Analysis of Major Electric Vehicle Companies in Indonesia

7.1 BMW AG

7.1.1 BMW AG Corporate Profile

7.1.2 BMW AG Corporate Electric Vehicle Sales

7.2 DFSK Motors

7.2.1 DFSK Motors Corporate Profile

7.2.2 DFSK Motors Corporate Electric Vehicle Sales

7.3 Honda Motor Co.

7.3.1 Corporate Profile of Honda Motor Co.

7.3.2 Honda Motor Co., Ltd. Corporate Electric Vehicle Sales

7.4 Isuzu Motors Limited

7.4.1 Corporate Profile of Isuzu Motors Limited

7.4.2 Isuzu Motors Limited Corporate Electric Vehicle Sales

7.5 Mazda

7.5.1 Mazda Corporate Profile

7.5.2 Mazda Corporate Electric Vehicle Sales

7.6 Mitsubishi Motors Corporation

7.6.1 Mitsubishi Motors Corporation Corporate Profile

7.6.2 Mitsubishi Motors Corporation Corporate Electric Vehicle Sales

7.7 Nissan Motor

7.7.1 Nissan Motor a Corporate Profile

7.7.2 Nissan Motor Corporate Electric Vehicle Sales

7.8 Suzuki Motor Corporation

7.8.1 Suzuki Motor Corporation Corporate Profile

7.8.2 Suzuki Motor Corporation Corporate Electric Vehicle Sales

7.9 Toyota Motor Corporation

7.9.1 Toyota Motor Corporation Corporate Profile

7.9.2 Toyota Motor Corporation Corporate Electric Vehicle Sales

7.10 Wuling Motor (SGMW Motors)

7.10.1 Wuling Motor (SGMW Motors) Corporate Profile

7.10.2 Wuling Motor (SGMW Motors) Corporate Electric Vehicle Sales

7.11 Mercedes Benz

7.11.1 Mercedes Benz Company Profile

7.11.2 Mercedes Benz Corporate Electric Vehicle Sales

7.12 Tesla

7.12.1 Tesla Corporate Profile

7.12.2 Tesla Corporate Electric Vehicle Sales

8 Indonesia Electric Vehicle Industry Outlook 2023-2032

8.1 Indonesia Electric Vehicle Industry Development Factors Analysis

8.1.1 Drivers and Development Opportunities for Indonesia’s Electric Vehicle Industry

8.1.2 Threats and Challenges to Indonesia’s Electric Vehicle Industry

8.2 Indonesia Electric Vehicle Industry Supply Forecast

8.3 Indonesia Electric Vehicle Market Demand Forecast

8.4 Indonesia Electric Vehicle Industry Import and Export Forecast

Disclaimer

Service Guarantees

Reviews

There are no reviews yet.