Description

India Furniture Industry

Furniture refers to movable objects that support various human activities, such as sitting, lying down, or storing items. Some common types of furniture include chairs, tables, beds, desks, and cabinets. These pieces can serve functional and aesthetic purposes, enhancing the practicality and visual appeal of indoor and outdoor spaces. Furniture is made from a variety of materials, including wood, metal, plastic, and textiles. Traditionally, furniture was handmade, but the advent of industrialization led to the mass production of standardized items.

Furniture serves different needs in different environments-office furniture is designed for workspaces, outdoor furniture is built for durability against weather conditions, and residential furniture focuses on comfort and style. According to CRI, the design and arrangement of furniture can greatly influence the functionality and ambiance of a space. Currently, furniture is widely available across India in various styles and designs, from classic and ornate to modern and minimalist, to suit the needs of individuals.

With a market size of USD 237.21 billion in 2023, the furniture market in Asia Pacific holds the largest market share. India, which has the second largest furniture industry in Asia Pacific, is also becoming one of the most preferred locations for multinational companies.

Currently, the Indian furniture market is primarily driven by the growing middle class population with higher disposable incomes. This demographic shift has led to an increased demand for space-efficient and stylish furniture, especially in urban areas where modern living spaces are prevalent. The rapid expansion of real estate, especially in the residential and commercial sectors, continues to drive demand for various types of furniture, including home, office and outdoor furniture.

Moreover, the proliferation of e-commerce platforms has played a significant role in accelerating the adoption of furniture products by offering a diverse range at competitive prices. In addition, customization has emerged as a key growth driver as consumers prioritize personalized, functional, and design-oriented furniture solutions.

Another major factor contributing to the market growth is the increasing emphasis on sustainability and eco-friendly practices, which is driving the demand for furniture made from renewable or recycled materials. Government initiatives such as the “Make in India” campaign have also encouraged domestic manufacturing, improving the availability of quality furniture at affordable prices, thereby fostering market expansion.

According to CRI, the Indian furniture market size will reach $23.9 billion in 2023 and is expected to reach $59.4 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.3% during 2024-2033.

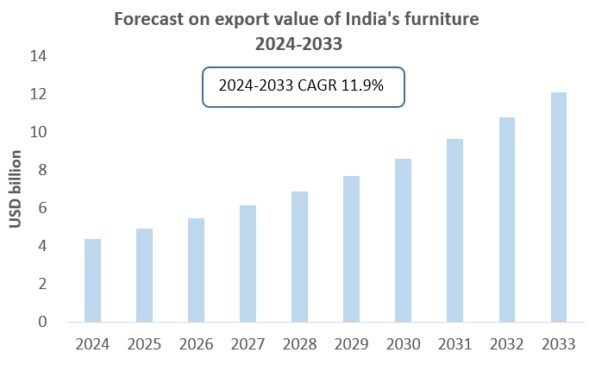

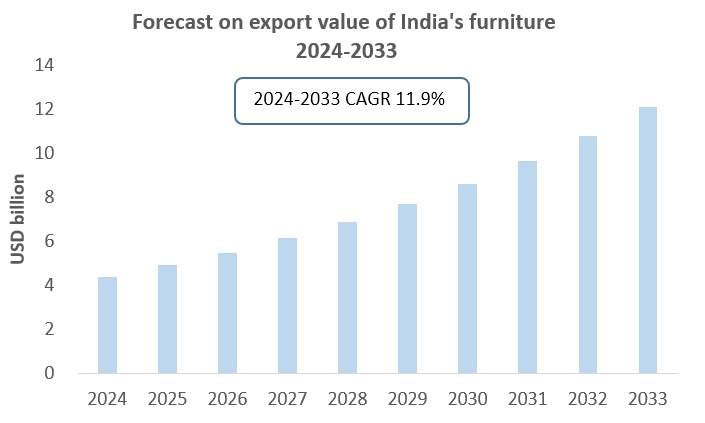

India is a very small global player when it comes to furniture, the export value of furniture in 2023 is only nearly US$ 3.5 billion, accounting for only 1.5 percent of global furniture exports. However, with future improvements in India’s infrastructure and dividends from its demographics, India is expected to become the new center of furniture manufacturing, gradually replacing China’s market position.

CRI forecasts that the export value of India’s furniture will continue to grow at a CAGR of 11.9% from 2024 to 2033, reaching US$ 12.09 billion in 2033.

Topics covered:

- India Furniture Industry Overview

- The economic and policy environment of India’s furniture industry

- India Furniture Industry Market Size, 2024-2033

- Analysis of the main India furniture production enterprises

- Key drivers and market opportunities for India’s furniture industry

- What are the key drivers, challenges and opportunities for India’s furniture industry during the forecast period 2024-2033?

- Which companies are the key players in the India furniture industry market and what are their competitive advantages?

- What is the expected revenue of India furniture industry market during the forecast period 2024-2033?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the India furniture industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the furniture industry in India?

Table of Contents

1 India at a Glance

1.1 Geographical situation

1.2 India’s Demographic Structure

1.3 India’s economic situation

1.4 Minimum Wage in India, 2014-2023

1.5 Impact of COVID-19 on the Furniture Industry in India

2. Overview of Indian Furniture Industry

2.1 History of Indian Furniture Industry Development

2.2 FDI in Indian Furniture Industry

2.3 Social Environment of Indian Furniture Industry

2.4 Policy Environment of Indian Furniture Industry

3. Indian Furniture Industry Supply and Demand Situation

3.1 Indian Furniture Industry Supply Situation

3.2 Indian Furniture Industry Demand Situation

4. Indian Furniture Industry Import and Export Situation

4.1 Indian Furniture Industry Import Situation

4.1.1 Import Volume and Import Value of Indian Furniture Industry

4.1.2 Main Import Sources of Indian Furniture

4.2 Indian Furniture Industry Export Situation

4.2.1 Export Volume and Import Value of Indian Furniture Industry

4.2.2 Main Export Destinations of Indian Furniture

5. Cost Analysis of the Indian Furniture Industry

5.1 Cost Analysis of Indian Furniture Industry

5.1.1 Labor costs

5.1.2 Cost of raw materials

5.1.3 Other costs

5.2 Price Analysis of Indian Furniture

6. Market Competition of Indian Furniture Industry

6.1 Barriers to entry in the Indian Furniture Industry

6.1.1 Brand Barriers

6.1.2 Quality Barriers

6.1.3 Capital Barriers

6.2 Competitive Structure of Indian Furniture Industry

6.2.1 Bargaining Power of Upstream Suppliers

6.2.2 Consumer Bargaining Power

6.2.3 Competition in Indian Furniture Industry

6.2.4 Threat of Potential Entrants

6.2.5 Threat of Substitutes

7. Analysis of Top 10 Furniture Brands in India, 2023

7.1 IKEA

7.1.1 Corporate Profile of IKEA

7.1.2 Operations of IKEA in India

7.2 WoodenStreet

7.2.1 Corporate Profile of WoodenStreet

7.2.2 Operations of WoodenStreet in India

7.3 HomeTown

7.3.1 Corporate Profile of HomeTown

7.3.2 Operations of HomeTown in India

7.4 Godrej Interio

7.4.1 Corporate Profile of Godrej Interio

7.4.2 Operations of Godrej Interio in India

7.5 Durian

7.5.1 Corporate Profile of Durian

7.5.2 Operations of Durian in India

7.6 Nilkamal

7.6.1 Corporate Profile of Nilkamal

7.6.2 Operations of Nilkamal in India

7.7 Natuzzi

7.7.1 Corporate Profile of Natuzzi

7.7.2 Operations of Natuzzi in India

7.8 Stanley

7.8.1 Corporate Profile of Stanley

7.8.2 Operations of Stanley in India

7.9 Savya Home

7.9.1 Corporate Profile of Savya Home

7.9.2 Operations of Savya Home in India

7.10 Bluwud

7.10.1 Corporate Profile of Bluwud

7.10.2 Operations of Bluwud in India

8. Indian Furniture Industry Outlook, 2024-2033

8.1 Analysis of Factors Influencing the Development of the Indian Furniture Industry

8.1.1 Drivers and Development Opportunities

8.1.2 Threats and Challenges

8.2 Supply Forecast of Indian Furniture Industry, 2024-2033

8.3 Demand Forecast of Indian Furniture Industry, 2024-2033

8.4 Import and Export Forecast of Indian Furniture Industry, 2024-2033

LIST OF CHARTS

Chart Total population of India 2008-2022

Chart GDP per capita in India 2013-2022

Chart Furniture Industry Related Policies Issued by the India Government 2018-2024

Chart Market size of furniture industry in India

Chart 2019-2023 India furniture industry imports

Chart 2019-2023 India furniture industry import amount

Chart 2019-2023 India furniture industry importers and import value

Chart 2019-2023 Export volume of India’s furniture industry

Chart 2019-2023 Export value of India’s furniture industry

Chart Exporting countries and export value of India’s furniture industry in 2019-2023

Chart 2024-2033 India furniture industry production forecast

Chart 2024-2033 India Furniture Market Size Forecast

Chart 2024-2033 India furniture industry import forecast

Chart 2024-2033 Export forecast for India’s furniture industry

Related reports:

Indonesia Furniture Industry Research Report 2024-2033

Mexico Furniture Industry Research Report 2024-2033

Philippines Furniture Industry Research Report 2024-2033

Vietnam Furniture Industry Research Report 2024-2033

Thailand Furniture Industry Research Report 2024-2033

Global Camping Furniture Market – Global Industry Analysis, Size, Share, Growth, Trends, And Forecast, 2022-2029

Research Report on Southeast Asia Furniture Industry 2023-2032

Research Report on Vietnam Wooden Furniture Industry 2022-2031

Hospital Furniture Market Forecast till 2027

Reviews

There are no reviews yet.