Description

Market Report Coverage – Electric & Hybrid-Electric Aircraft Propulsion System Market

Market Segmentation

• Propulsion Type: All-Electric Propulsion, Hybrid-Electric Propulsion

Regional Segmentation

• North America: U.S. and Canada

• South America

• Europe: U.K., Germany, France, Russia, Netherlands, and Rest-of-Europe

• Middle East and Africa

• Asia-Pacific: China, Japan, India, Australia, Singapore, and Rest-of-Asia-Pacific

Key Companies Profiled

3W International GmbH, Airbus S.A.S., Boeing, Cranfield Aerospace Solutions, General Electric Company, GKN Aerospace Services Limited, Honeywell International Inc., Israel Aerospace Industries Ltd., Lockheed Martin Corporation, MagniX, Rolls-Royce Holdings plc., Safran S.A., Siemens AG, Raytheon Technologies Corporation, Leonardo S.p.A

How This Report Can Add Value

This report will help with the following objectives:

• A dedicated section focusing on start-up and investment landscape

• Detailed analysis, which includes both value and volume of electric and hybrid-electric propulsion system used on all the aircraft types

• Major Programs of Electric & Hybrid-electric Aircraft Propulsion System Market

Market by Product: Analysis and Forecast: The product section will help the reader understand the different types of electric & hybrid-electric aircraft propulsion system used in several manned, unmanned and eVTOLs aircraft. The players operating in this market are developing innovative offerings and are highly focused on testing as well as demonstrating their propulsion system capabilities.

Key Questions Answered in the Report

• What are the major drivers, challenges, and opportunities behind the demand for the electric & hybrid-electric aircraft propulsion system market during the forecast period 2025-2035?

• Who are the key players in the electric & hybrid-electric aircraft propulsion system market, and what is the competitive benchmarking?

• What are the new strategies being adopted by the existing market players to make a mark in the industry?

• How is the electric & hybrid-electric aircraft propulsion system market expected to grow during the forecast period, and what is the anticipated revenue to be generated by the end of 2035?

• What are the trends in the electric & hybrid-electric aircraft propulsion system market across different countries? What are the revenue estimates for 2025 and 2035?

• Which country is expected to contribute the most to the electric & hybrid-electric aircraft propulsion system market during the forecast period?

Electric & Hybrid-Electric Aircraft Propulsion System

Electrically powered model aircraft and unmanned aerial vehicles (UAVs) have been flying since the 1970s. Although, in 1917, the first electrically powered manned tethered helicopter was developed. Moreover, the first ever electrically powered airplane, the MB-E1 was flown in October 1973. Along with this, many other electric-powered airplane prototypes are being developed and tested to enhance the air travel experience.

Hybrid-electric propulsion combines a conventional internal combustion engine system with an electric propulsion system. This type of propulsion system does not emit harmful components in the air, which reduces the total pollution levels raised due to air travel. Hybrid-electric propulsion can be classified into series- hybrid propulsion and parallel-hybrid propulsion.

Electric & Hybrid-Electric Aircraft Propulsion System Industry Overview

Governments are investing a significant amount of their resources in developing high-speed propulsion system designs such as ramjet and scramjet propulsion systems. High speed aircraft use air-breathing ramjet and scramjet engines that allow them to hover at extremely high speeds.

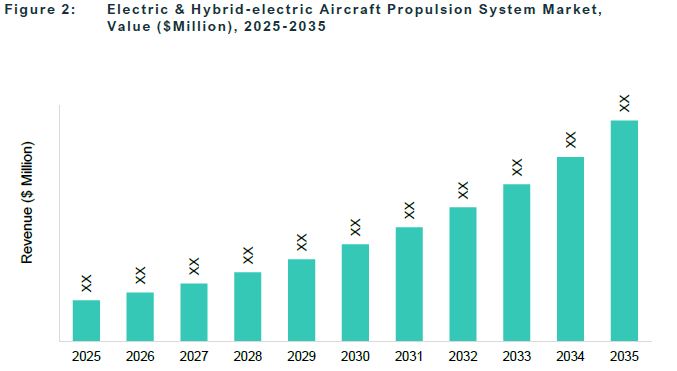

The global Electric & Hybrid-Electric Aircraft Propulsion System market is estimated to reach $74.90 billion in 2035, at a compound annual growth rate (CAGR) of 18.39% during the forecast period 2025-2035.

Market Segmentation

Electric & Hybrid-Electric Aircraft Propulsion System Market by Propulsion Type

Hybrid-Electric Propulsion segment is expected to dominate the global the electric & hybrid-electric aircraft propulsion system market, on account of high investments that are expected to be attained in the future due to the high adoption rate in the commercial aviation industry.

Electric & Hybrid-Electric Aircraft Propulsion System Market by Region

North America is expected to dominate the global electric & hybrid-electric aircraft propulsion system market during the forecast period. The research and development of next-gen aircraft in the region are growing at a significant pace, which in turn is expected to raise the demand for Electric & Hybrid-electric Aircraft Propulsion Systems in the coming years.

Key Market Players and Competition Synopsis

3W International GmbH, Airbus S.A.S., Boeing, Cranfield Aerospace Solutions, General Electric Company, GKN Aerospace Services Limited, Honeywell International Inc., Israel Aerospace Industries Ltd., Lockheed Martin Corporation, MagniX, Rolls-Royce Holdings plc., Safran S.A., Siemens AG, Raytheon Technologies Corporation, Leonardo S.p.A

The companies that are profiled in the report have been selected post undergoing in-depth interviews with experts and understanding details around companies such as product portfolio, annual revenues, market penetration, research and development initiatives, and domestic and international presence in the electric & hybrid-electric aircraft propulsion system market.

Accordingly, a structured approach is followed which include segmenting pool of players under three mutually exclusive and collectively exhaustive parts, holding a 100% pie of the market, as mentioned below:

Top Segment Players – These are leading original equipment manufacturers (OEMs), covering ~60% of the presence in the market.

Other Segment Players – These are component providers, covering ~40% of the presence in the market.

However, if a company is not part of the above pool, it has been well represented across different sections of the report (wherever applicable).