Description

China Polycarbonate Import

Polycarbonate (PC) is a colorless transparent, amorphous, thermoplastic polymer known for its clarity, heat resistance, impact resistance, and flame retardancy, maintaining good mechanical properties within normal operating temperatures. Polycarbonates are categorized into aliphatic, aromatic, and aliphatic-aromatic types; currently, aromatic polycarbonates, such as Bisphenol A polycarbonate, are the most widely used.

Polycarbonate is a high-performance thermoplastic extensively used across various industries due to its exceptional transparency, impact resistance, and ease of processing. According to CRI, it finds applications in consumer electronics, automotive components, medical devices, packaging materials, household goods, and optical industries. With the expansion of these industries and technological innovations, demand for polycarbonate is expected to increase.

In recent years, China’s polycarbonate production capacity has grown at an average annual rate of 30%. According to CRI, by the end of 2023, it is estimated that China’s annual polycarbonate production capacity has exceeded 4 million tons. Despite significant increases in domestic production capacity, the majority of domestically produced material is used for lower-end general-grade products such as sheets and films. High-end, high-value polycarbonates used in medical, electronics, automotive, and optical industries still require substantial imports.

In 2023, China imported approximately 1.04 million tons of polycarbonate, worth $2.463 billion. According to CRI, in 2023, China imported polycarbonate from over 60 countries and regions, with major sources including Taiwan, South Korea, Thailand, Japan, the United States, and Saudi Arabia, with Taiwan being the largest source.

In 2023, Mainland China imported 235,787 tons of polycarbonate from Taiwan, worth $563 million, accounting for 22.7% and 22.9% of the total imports for that year. According to the “Anti-Dumping Regulations of the People’s Republic of China,” on November 30, 2022, China’s Ministry of Commerce issued Announcement No. 35 of 2022, deciding to initiate an anti-dumping case investigation on imported polycarbonate originating from Taiwan.

On April 19, 2024, China’s Ministry of Commerce proposed to the State Council’s Tariff Policy Commission to impose anti-dumping duties, which, based on the Ministry’s recommendation, were decided to be implemented from April 20, 2024, for a period of five years. It is anticipated that imports and import values of polycarbonate from Taiwan will significantly decrease in the coming years.

Economic growth has driven higher consumption levels and increased demand for new products, directly promoting the need for high-performance materials. According to CRI, technological advancements have also fostered the development of new applications for materials beyond traditional areas, such as in sustainable energy and high-tech products.

For instance, in electric vehicles and renewable energy equipment, polycarbonate, due to its lightweight and durable properties, becomes an ideal choice for manufacturing components. It is expected that with the global emphasis on sustainable development and environmental awareness, developing and using environmentally friendly polycarbonate products will become a significant trend.

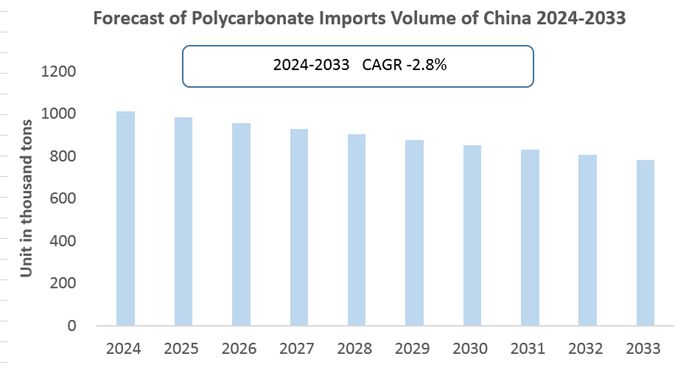

Therefore, it can be foreseen that in the coming years, both global and Chinese consumption of polycarbonate will continue to grow. According to CRI, with the ongoing increase in domestic production capacity and technological advancements, it is expected that the volume and value of polycarbonate imports into China will decline somewhat over the next few years. However, due to the short-term inability of domestic production to meet the demand for high-end polycarbonate products, the annual import volume of polycarbonate in China is expected to remain at several hundred thousand tons annually from 2024 to 2033.

Topics covered:

- Analysis of China’s Polycarbonate Import Policies

- Polycarbonate Imports in China from 2019-2023 and Main Sources

- Main Drivers and Market Opportunities for Polycarbonate Imports in China

- What are the main drivers, challenges, and opportunities for polycarbonate imports in China during the 2024-2033 forecast period?

- Who are the key players in China’s polycarbonate import market, and what are their competitive advantages?

- What is the expected revenue for the polycarbonate import market in China during the 2024-2033 forecast period?

- Polycarbonate Imports from Japan to China from 2019-2024

- Polycarbonate Imports from South Korea to China from 2019-2024

- Polycarbonate Imports from Thailand to China from 2019-2024

- Polycarbonate Imports from the United States to China from 2019-2024

- Polycarbonate Imports from Saudi Arabia to China from 2019-2024

- Monthly Status of Polycarbonate Imports in China from 2021-2024

- What strategies have major market players adopted to increase their market share in this industry?

- Which segment of China’s polycarbonate import market is expected to dominate by 2032?

- What are the competitive advantages of the main participants in China’s polycarbonate import market?

- What are the major limiting factors restraining the growth of polycarbonate imports in China?

Related Report:

Vietnam Polycarbonate Import Research Report 2024-2033

Table of Contents

1. China Polycarbonate Import Analysis 2019-2023

1.1. China polycarbonate import scale

1.1.1. china polycarbonate import volume

1.1.2. china polycarbonate import amount

1.1.3. China Polycarbonate Import Price

1.1.4 China Polycarbonate Apparent Consumption

1.1.5. China Polycarbonate Import Dependence

1.2. China Polycarbonate Main Import Sources

1.2.1 By Import Volume

1.2.2. by Import Value

2. 2019-2023 China Polycarbonate Main Import Sources Analysis

2.1. Taiwan

2.1.1 Import Volume Analysis

2.1.2 Import Value Analysis

2.1.3 Average Import Price Analysis

2.2 South Korea

2.2.1 Import Volume Analysis

2.2.2 Import Amount Analysis

2.2.3 Average Import Price Analysis

2.3. Thailand

2.3.1 Import Volume Analysis

2.3.2 Import Value Analysis

2.3.3 Average Import Price Analysis

2.4. United States

2.5. Japan

2.6. Saudi Arabia

3. China Polycarbonate Monthly Analysis 2021-2024

3.1 Monthly Analysis of Import Volume

3.2 Monthly Import Value Analysis

3.3 Monthly Average Import Price Forecast

4 Major Factors Affecting China’s Polycarbonate Imports Analysis

4.1 Policy factors

4.1.1 The current status of import policy

4.1.2 Trend forecast of import policy

4.2 Economic factors

4.2.1 Market price

4.2.2 Growth Trend of Polycarbonate Capacity in China

4.3 Technical Factors

5 China’s Polycarbonate Import Outlook, 2024-2033

5.1 China Polycarbonate Import Forecast 2024-2033

5.2 China’s Polycarbonate Import Value Forecast, 2024-2033

5.3 China’s Polycarbonate Average Import Price Forecast, 2024-2033

5.4 Forecast of Major Import Sources of Polycarbonate in China, 2024-2033

Table of selected charts

Chart China Polycarbonate Imports 2019-2023

Chart China Polycarbonate Import Value 2019-2023

Chart Average Price of Polycarbonate Imports in China 2019-2023

Chart China Polycarbonate Import Dependence 2019-2023

Chart Main Import Sources of Polycarbonate in China by Import Volume, 2019-2023

Chart Main Import Sources of Polycarbonate in China by Import Value, 2019-2023

Chart China’s Imports of Polycarbonate from Japan 2019-2023

Chart China Imports of Polycarbonate from Thailand 2019-2023

Chart Polycarbonate Quantity of Saudi Arabia Imported by China 2019-2023

Chart China Imports of South Korea Polycarbonate Quantity 2019-2023

Chart Forecast of Polycarbonate Imports from China 2024-2033

Chart Forecast of China’s Polycarbonate Import Amount, 2024-2033

Reviews

There are no reviews yet.